Revenue cycle management (RCM) is the process healthcare organizations use to manage financial operations related to billing and collecting revenue for medical services. RCM begins when a patient schedules an appointment and ends when the account balance is resolved through reconciliation of insurance payments, contractual adjustments, write offs, or patient payments.

RCM helps strengthen revenue by minimizing claim denials, reducing days in accounts receivable, and increasing collections. As a result, healthcare providers receive correct and timely payments and optimize financial performance. Effective RCM also can help healthcare organizations comply with regulatory requirements and improve patient satisfaction.

Revenue cycle management (RCM) is a critical yet often misunderstood process in the healthcare industry. As a healthcare provider, effectively managing your revenue cycle can significantly impact your bottom line and organizational success. In this comprehensive guide, we’ll demystify revenue cycle management so you can optimize this process and achieve financial stability.

What Exactly is Revenue Cycle Management?

Revenue cycle management refers to the financial process that healthcare providers use to manage clinical and administrative functions related to payments, It covers everything from patient appointment scheduling and registration to final payment collection,

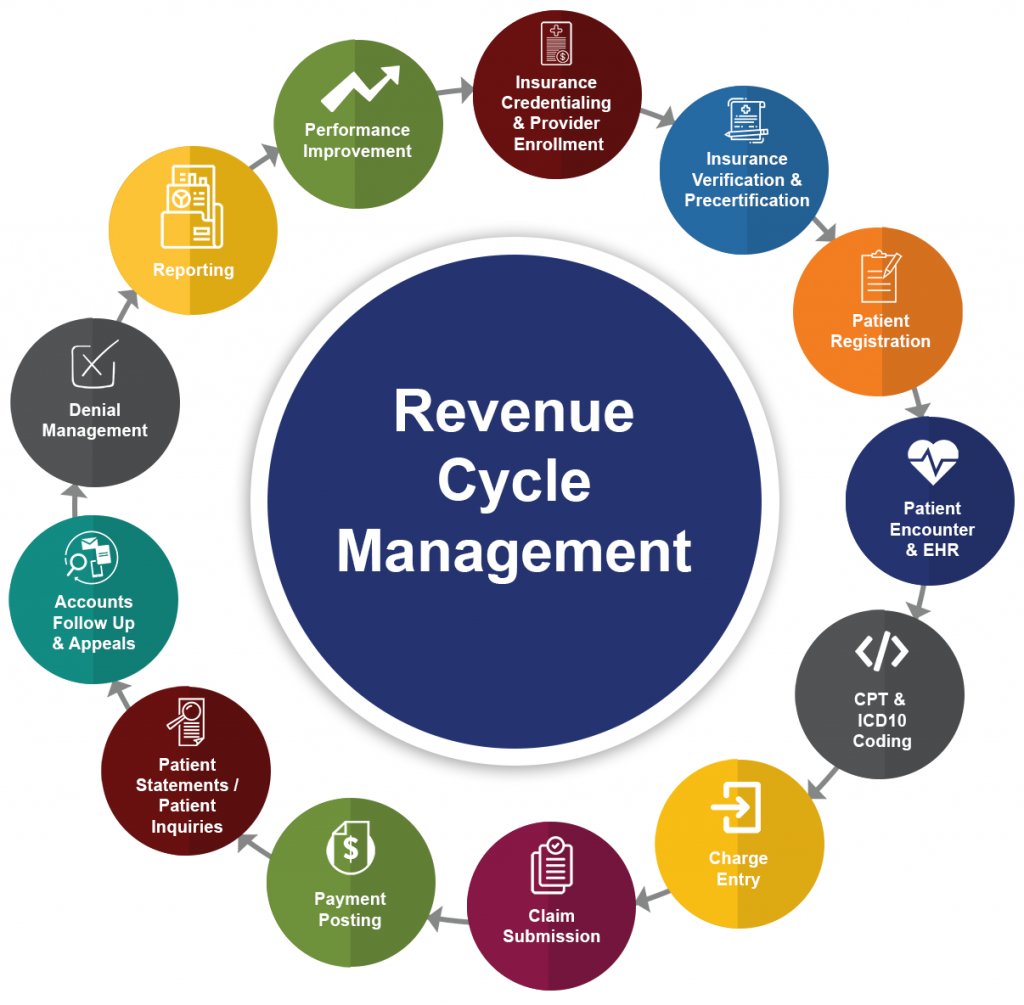

The revenue cycle begins when a patient first contacts the provider to schedule an appointment. It ends when the healthcare provider has received the appropriate reimbursement for the services rendered. This cycle involves many steps, including:

- Patient scheduling and registration

- Verifying insurance eligibility and benefits

- Managing pre-authorizations and referrals

- Coding and documentation

- Billing and insurance claims processing

- Payment posting

- Resolving denied claims and accounts receivable follow-up

- Collecting payments from patients and third-party payers

The primary goal of revenue cycle management is to accelerate cash flow and maximize reimbursement while reducing costs and minimizing claims errors. An optimized revenue cycle means providers get paid faster for the services they provide.

Why is Revenue Cycle Management Important?

Effective revenue cycle management is critical for the financial health and sustainability of healthcare organizations. Here are some of the key reasons it matters:

-

Maximizes reimbursement: With efficient RCM, providers can accelerate reimbursement, reduce denial rates, and improve collections. This boosts overall revenue.

-

Reduces operating costs: Automating parts of the revenue cycle improves efficiency. This decreases labor costs associated with manual claims processing and follow-up.

-

Enhances financial performance: Smooth and steady cash flow enables providers to meet payroll, cover expenses, and invest in growth.

-

Improves regulatory compliance: Proactive RCM identifies issues early so providers can take corrective action, preventing fines or penalties.

-

Boosts patient satisfaction: Fewer billing errors and faster payment resolution improves the patient experience and satisfaction scores.

In short, RCM has a huge impact on an organization’s fiscal health and success. It’s the engine that keeps the business running efficiently.

Key Components of the Revenue Cycle

Now that we’ve covered the basics, let’s look at the key steps in the revenue cycle workflow:

Patient Registration

This first step starts with the patient making an appointment. The registration team collects crucial data including:

- Demographics like name, date of birth, address, phone, email

- Insurance details

- Copays and estimates of out-of-pocket costs

Accurate patient registration is crucial for smooth claims processing later in the cycle. Data entry errors can easily cause denied claims and lost revenue down the road.

Verifying Insurance Eligibility

The next vital step is verifying the patient’s insurance coverage and benefits eligibility. Confirming active coverage and benefit levels prevents unexpected costs for patients and denials for providers.

This verification process typically involves checking details like:

- If the insurer covers the required services

- Copay, deductible, and coinsurance amounts

- Any need for referrals or authorizations

Managing Authorizations and Referrals

For some services, providers must obtain prior authorizations or referrals before delivering care. The revenue cycle team handles submitting and tracking these requests to ensure approval is in place before the visit.

Missing authorizations are a common reason for post-visit claim denials. Staying on top of this administrative work prevents revenue loss.

Delivering Patient Care

The clinical team provides necessary medical services and care to patients. Thorough procedure documentation is essential for accurate coding and billing later in the revenue cycle.

Coding and Billing

After the visit, certified medical coders assign standard codes to diagnose and procedures performed based on the provider’s documentation. These codes get submitted to insurance companies for claims processing and reimbursement.

Accurate coding is imperative. Incorrect codes often lead to denied claims and payment delays or underpayment.

Adjudicating Claims

Insurers receive the claim and adjudicate it, determining the payment amount they will remit to the provider. The provider receives an explanation of benefits (EOB) outlining the payment decision.

Resolving Denied Claims

Unfortunately, claims are commonly denied initially for various reasons like missing information, improper coding, untimely filing, etc. The denial management team reviews the EOB, corrects any issues, and quickly resubmits denied claims.

Timely follow-up on denials is key to maximizing reimbursement. Complex denials may require appealing to the payer.

Payment Posting

As payments from insurers arrive, the team posts them to the correct patient accounts. For unpaid balances, billing statements go out to patients.

Patient Collections

The revenue cycle team reaches out to patients to collect any outstanding balances – copays, deductibles, coinsurance amounts. Effective collection efforts improve cash flow.

This full cycle from scheduling to final payment collection optimizes revenue realization. Bottlenecks anywhere along the workflow can slow down cash and cause problems.

Benefits of Revenue Cycle Management Software

Given the complexity of the healthcare revenue cycle, specialty software provides major advantages for smooth end-to-end workflow management. Some top benefits include:

-

Streamlines workflows: Automates manual tasks like insurance verification and coding audits.

-

Provides visibility: Dashboards monitor KPIs and keep teams on the same page.

-

Enhances reporting: Robust analytics identify bottlenecks and improvement opportunities.

-

Reduces claim errors: Logic checks and scrubbers catch mistakes before submission.

-

Increases collections: Tools like online patient billing portals expedite payments.

-

Facilitates compliance: Built-in rules ensure accurate claim submission and reporting.

Bottom line, RCM software saves significant time and effort while reducing costly claim errors and payment delays. The efficiency gains impact both staff and the bottom line.

Key Revenue Cycle Management Metrics and KPIs

To assess the effectiveness of their RCM program, providers should monitor key performance indicators (KPIs). Some top metrics include:

-

Days in accounts receivable (AR): Lower is better. Benchmark is below 30 days.

-

Denial rate: Lower is better. Benchmark is under 5%. Highlights coding and billing issues.

-

First-pass payment rate: Higher is better. Benchmark is over 90%. Indicates clean claims submitted.

-

Net collection rate: Higher is better. Benchmark is over 95%. Measures collections vs. total charges.

-

Patient payments within 30/60/90 days: Higher is better. Tracks patient collection rates.

These quantitative measures pinpoint opportunities for revenue cycle improvement. The benchmarks provide goals to work toward.

Revenue Cycle Management Challenges and How to Overcome Them

While efficient RCM is crucial, it’s not without challenges. Here are some common obstacles providers encounter:

Increasing complexity of insurance rules: Plans have intricate policies spanning authorizations, reimbursement levels, covered services, etc. Staying current takes significant effort. Leverage payer policy databases and verification tools to streamline the administrative workload.

Manual processes: Handling phone calls, faxes, data entry, and paper mail slows staff and leads to errors. Go digital to automate workflows.

Disconnected systems: Poor system integration between electronic medical records (EMR) software, practice management systems, and billing systems hampers visibility and workflows. APIs and interfaces can connect platforms.

Changing regulations: Frequent regulatory updates around coding, documentation, billing, etc. makes compliance difficult. Perform regular audits and stay tuned to news from regulatory bodies.

High staff turnover: Revenue cycle roles like coders and billers have notoriously high turnover. Cross-train staff and provide engaging training to retain talent.

Targeted solutions and process improvements address these common challenges. And leveraging RCM technology is key to digitizing workflows.

Best Practices for Revenue Cycle Management

While every healthcare organization is unique, there are some universal best practices that promote revenue cycle optimization:

-

Verify insurance eligibility upfront – Saves time and prevents surprise claim denials.

-

Obtain authorizations before service delivery – Confirms services are covered and medically necessary.

-

Review documentation and coding– Ensures accuracy which smooths claims processing and reimbursement.

-

Automate workflows– Eliminates tedious manual processes prone to human error.

-

Act on denials quickly– Speedy correction and resubmission prevents revenue loss.

-

Monitor KPIs– Identifies issues and opportunities for improvement.

-

Educate patients on financial responsibility– Sets expectations and improves collections.

-

Cross-train staff– Creates versatility and continuity when team members leave.

While every healthcare provider aims for an optimized revenue cycle, it takes diligence and partnership between clinical and administrative teams to achieve peak performance. Following best practices moves organizations in the right direction.

The Takeaway

In today’s complex healthcare landscape, revenue cycle optimization is a priority for organizational success and sustainability.

RCM Challenge 1: Coding Precisely and Billing Accurately

For smooth cash flow, healthcare organizations must have precise medical coding and accurate billing. These are separate processes, but both are crucial to receiving payment for services performed. Medical coding involves extracting billable information from the medical record and clinical documentation, while medical billing uses those codes to create insurance claims and bills for patients.

The coding and billing processes must be effective and carried out with extreme caution, owing to the complexity involved. Errors and improper knowledge result in leaking revenue. Denials resulting from medical coding errors equate to lost time and lost revenue because additional office staff time is needed to correct and resubmit follow-up claims. Also consider the added costs for items such as postage for mailed claims, paper, and envelopes.

The coding and billing process in healthcare can differ from organization to organization. Some practices use one staff member as the biller and the coder. Other practices have billing separate from coding. Outsourcing medical coding and billing services to a trusted company is another option for ensuring that providers have well-qualified specialists working to obtain accurate payment. In any case, the coder researches and determines which medical codes are appropriate to assign after reviewing the documentation. The relationship between medical records documentation and billing is an essential one. To support reporting the most accurate ICD-10-CM,  CPT®, and HCPCS Level II codes, documentation should be clear, precise, and thorough. When reviewing documentation, coders should ask themselves, âDoes the documentation support the coding?â Once the codes are assigned, the biller will then perform charge entry and bill the charges to the payer. Charge entry includes ensuring that a patientâs correct insurance and demographic information is entered into the billing system. The coder also verifies that the assigned procedure and diagnosis codes correspond to the correct physician on the date of service.

Both medical coding and billing require specialized knowledge of coding guidelines, payer preferences, and more, and the rules change frequently. Organizations should administer assessment tests for medical coders and billers prior to their hire, and may conduct drug screenings to ensure that staff members do not perform duties under the influence. Organizations also should provide their coders and billers with training sessions to keep knowledge and processes up to date.

Steps for an Effective Revenue Cycle Include:

- Appointment scheduling: Determining the need for services, along with collecting patient name, contact information, and insurance coverage details

- Registration: Completing patient intake, including insurance verification, front-desk collections, and collecting patient demographics

- Charge capture for services: Assigning medical procedure and diagnosis codes for the encounter

- Billing: Creating clean claims to receive reimbursement from insurers and provide bills for patients

- Denial management: Regularly reviewing denial reason codes to determine why a claim was denied and making corrections to prevent denials in the future

- Accounts receivable (A/R) follow-up: Identifying and following up on unpaid charges

There are a variety of tasks within each step and possible variations, as well. For instance, some patient services may require prior authorization, which usually applies to surgical procedures or other high-cost ancillary services where insurance payers require the provider to obtain authorization prior to performing the service.