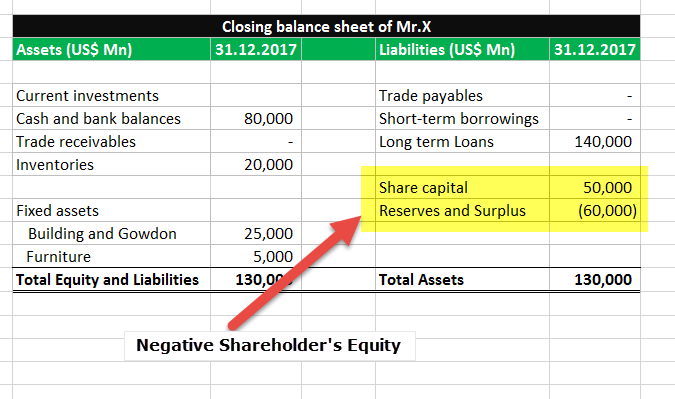

Negative shareholder equity occurs when a company’s liabilities exceed its assets resulting in a negative balance on the shareholder equity line of the balance sheet. This happens when a company accumulates substantial losses over time or takes on excessive debt obligations. While negative equity can signal financial troubles it does not necessarily mean a company is headed for bankruptcy. Understanding the causes and implications of negative equity provides insight into a company’s financial health.

What Causes Negative Shareholder Equity?

Several factors can cause negative equity:

-

Accumulated Losses – If a company operates at a loss over multiple years, retaining those losses can result in negative retained earnings and equity. This is common with startups and companies trying to expand into new markets.

-

Debt Overhang – Taking on too much debt can push liabilities above assets Interest expenses can also contribute to losses and negative equity

-

Dividends and Buybacks – Paying substantial dividends or repurchasing stock can reduce equity, especially if done when profitability is low.

-

Write-downs – Writing down overvalued assets reduces the asset side of the balance sheet and equity along with it.

-

Acquisition Accounting – In a merger, the deal value above the target’s book value gets treated as goodwill, an intangible asset. If goodwill later gets written down, equity takes a hit.

Examples of Companies with Negative Equity

Several major companies have maintained negative shareholder equity due to losses, debt, dividends, buybacks, or impairments:

-

Revlon – The cosmetics company has run losses leading to negative equity. Total liabilities of $3.6 billion exceed assets of $3 billion.

-

Colgate-Palmolive – Despite profitability, Colgate has negative equity due to treasury stock acquisitions and other comprehensive losses.

-

HP – One-time charges from corporate restructuring and dividends drove HP’s equity negative.

-

Sprint – High debt obligations and losses in the competitive telecom industry led to negative shareholder equity for Sprint.

Implications of Negative Equity

Negative equity can signal financial instability or restrictions on financing:

-

Equity Financing – With negative book value, issuing new equity shares becomes very dilutive and unattractive.

-

Debt Financing – Negative equity and high existing leverage could restrict additional borrowing.

-

Vendor Financing – Suppliers may require quicker payment or not offer credit terms.

-

Fire Sales – Assets may need to be sold below book value to pay off liabilities if liquidity dries up.

-

Distressed Restructuring – Without financing options, the company may need to restructure debt agreements.

-

Bankruptcy – If operating losses continue with negative equity, bankruptcy can result. Equity holders often get wiped out.

Does Negative Equity Equal Zero Value?

Despite negative book value, equity shares can still have positive market value for several reasons:

-

Cash Flows – Share prices depend on profits and cash flow potential rather than just book value.

-

Asset Value – Asset liquidation could yield more than book value. Brands and patents not on the books have value.

-

Turnaround Potential – Investors may see long-term recovery potential not captured in equity.

-

Acquisition Value – Negative book value companies can still be acquisition targets. Deal price exceeds book value.

So negative equity does not guarantee worthless shares. But it does suggest financial instability that warrants caution from creditors and investors.

Can Negative Equity Reverse?

Negative equity is not always a death knell. Companies can potentially reverse it through:

-

Returning to Profitability – Earning income over time can gradually eliminate losses and offset negative equity.

-

Reducing Debt – Paying down debt improves the financial leverage and risk profile.

-

Cutting Costs – Lowering operating costs and expenses helps achieve profitability.

-

Raising Equity – Issuing new shares boosts the equity side, though at a cost of dilution.

-

Selling Assets – Divesting underperforming assets generates cash to pay off debt.

-

Restructuring – Renegotiating debt agreements can ease liquidity and reduce interest costs.

However, turning around negative equity often requires drastic measures. Preventing negative equity through prudent financing and operational decisions is ideal.

Key Takeaways on Negative Shareholder Equity

-

Negative shareholder equity occurs when liabilities exceed assets, usually from accumulated losses or excessive debt.

-

It signals financial risk but does not necessarily imply worthless shares or bankruptcy.

-

Causes include losses, debt, dividends, buybacks, acquisitions, and asset impairments.

-

Consequences can include loss of financing, fire sales of assets, and financial restructuring.

-

Market value depends on future profit potential, not just negative book value.

-

Returning to profitability, cutting costs, raising equity, and reducing debt can reverse negative equity.

Understanding the root causes and nuanced implications of negative equity provides a more complete picture of a company’s financial health and value. While negative equity indicates problems, management still has opportunities to stabilize the business and recover shareholder value.

What Is Shareholder Equity (SE)?

Shareholder equity (SE) is a companys net worth and it is equal to the total dollar amount that would be returned to the shareholders if the company must be liquidated and all its debts are paid off. Thus, shareholder equity is equal to a companys total assets minus its total liabilities.

SE is a number that stock investors and analysts look at when theyre evaluating a companys overall financial health. It helps them to judge the quality of the companys financial ratios, providing them with the tools to make better investment decisions.

Retained earnings are part of shareholder equity as is any capital invested in the company.

- Shareholder equity is the dollar worth of a company to its owners after subtracting all of its liabilities from its assets.

- You can calculate shareholder equity by adding together the numbers on a companys balance sheet for assets and liabilities.

- Positive shareholder equity means the company has at least enough assets to cover its liabilities.

- The number for retained earnings is part of shareholder equity. This is the percentage of net earnings that is not paid to shareholders as dividends.

- Shareholder equity gives analysts and investors a clearer picture of the financial health of a company.

:max_bytes(150000):strip_icc()/ShareholderEquitySE_V1-def750af6b7d42b78c60369d49f6e68f.jpg)

Examples of Shareholder Equity

Heres a hypothetical example to show how shareholder equity works. Lets assume that ABC Company has total assets of $2.6 million and total liabilities of $920,000. In this case, ABC Companys shareholder equity is $1.68 million.

Can Stockholders’ Equity be Negative?

What is a negative shareholders’ equity?

Shareholders’ equity determines the returns generated by a business compared to the total amount invested in the company. The shareholders’ equity can either be negative or positive. A negative shareholders’ equity means that shareholders will have nothing left when assets are liquidated and used to pay all debts owed.

What does a positive shareholder’s equity mean?

If shareholders’ equity is positive, a company has enough assets to pay its liabilities; if it’s negative, a company’s liabilities exceed its assets. A look at shareholders’ equity helps investors assess the worth of a company and its long-term sustainability.

What happens if a company reports negative stockholders’ equity?

If a company reporting negative stockholders’ equity were to liquidate, its stockholders would probably receive nothing in exchange for their original investments in the company’s stock, though this depends on how much the company can earn by selling its remaining assets and settling any remaining liabilities.

Why does a company have negative equity?

It can happen because of a number of other reasons too. However, the following are the major reasons for negative equity. The company is over-leveraged, which means that there is a huge amount of debt. When a company incurs losses, this results in cash outflow. So, the company generally borrows to stay and operate.