The statement of retained earnings is used to summarize retained earnings activity for a specific period of time.

Known by a variety of names, including the statement of owner’s equity, statement of equity, or a detailed earnings statement, the statement of retained earnings can be prepared as a separate statement or as part of your business balance sheet or income statement.

The statement of retained earnings is a key financial statement that summarizes changes in retained earnings for a company over a specified period This statement reconciles the beginning and ending retained earnings balances for the period. Preparing this statement is an important accounting process for tracking earnings that are not paid out as dividends

This guide explains what a statement of retained earnings is, the key steps to prepare it, and tips for proper statement preparation

What is a Statement of Retained Earnings?

The statement of retained earnings, also called the statement of owner’s equity, reports changes in retained earnings during an accounting period. Retained earnings refers to the cumulative net income or profit of a company after paying dividends. The statement shows:

- Beginning retained earnings balance

- Net income for the period

- Dividends paid to shareholders

- Ending retained earnings balance

This statement is important because it allows investors and creditors to analyze dividend payment practices and evaluate the profitability and financial health of a company.

Key Steps to Prepare a Statement of Retained Earnings

Follow these main steps to prepare a statement of retained earnings:

1. Identify the beginning retained earnings balance

- Obtain the ending retained earnings balance from the prior year’s statement

- This number should match the beginning balance for the current year

2. Record net income for the current period

- Find the net income amount from the income statement

- Net income increases retained earnings

3. Note cash dividend payments to shareholders

- Dividends are distributed from retained earnings

- Determine the total dividends paid during the period

4. Calculate the ending retained earnings balance

- Beginning balance

- Plus: Net income for the period

- Less: Total dividends

- Equals: Ending retained earnings balance

5. Format the statement

- Organize the numbers into a statement format

- Include a title, column headings, numbers, and total

Tips for Preparing a Good Statement of Retained Earnings

Follow these tips when preparing a statement of retained earnings:

-

Reconcile numbers – The beginning balance must match prior year’s ending balance. The statement should flow logically from beginning to end.

-

Include supporting documents – Reference documents used such as the income statement and balance sheet.

-

Note date ranges – Cover the same period as the other financial statements.

-

Check calculations – Accurately add and subtract all numbers. Perform checks to verify totals are correct.

-

Disclose dividend details – Separately disclose dividends for preferred and common stock.

-

Watch outstanding shares – If the number of outstanding shares changes, retained earnings per share will also change.

-

Analyze material discrepancies – Research and explain any significant discrepancies between beginning and ending balances.

-

Use standard formatting – Follow common statement formatting like using columns and including a header and title.

-

Disclose uncommon items – If anything unusual impacts retained earnings, like correcting an error, disclose it.

-

State any restrictions – Note any restrictions on retained earnings, such as limits on dividends.

-

Match other statements – The numbers should align with the balance sheet and income statement.

-

Be consistent – Use the same presentation format from period to period.

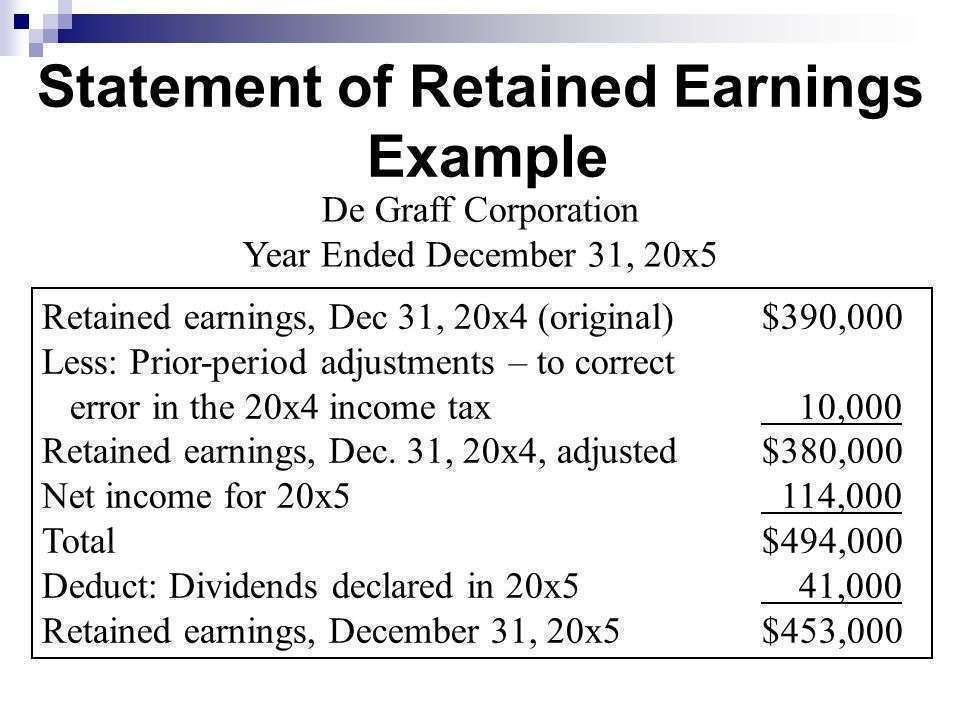

Sample Statement of Retained Earnings

Below is an example statement of retained earnings prepared in standard format:

Company ABC

Statement of Retained Earnings

For the Year Ended December 31, 20X1

| Beginning retained earnings, January 1, 20X1 | $100,000 |

| Net income for 20X1 | 25,000 |

| Less: Dividends paid, 20X1 | (5,000) |

| Ending retained earnings, Dec 31, 20X1 | $120,000 |

This simple statement starts with the prior year’s ending retained earnings balance, adds net income, subtracts dividends, and ends with the current period’s ending retained earnings amount. It covers one year, matching the balance sheet and income statement.

Additional line items could be added such as common and preferred stock dividend amounts paid. The amounts are formatted in columns with appropriate header rows to clearly present the information.

Uses of the Statement of Retained Earnings

The statement of retained earnings is useful for:

- Evaluating dividend payment practices

- Assessing income and profitability trends

- Analyzing changes in retained earnings

- Understanding effects of dividends on financial position

- Providing equity information to investors

- Making financial modeling decisions

Careful preparation of this statement ensures accuracy of a company’s reported retained earnings changes and balance. It helps inform sound business decisions and analysis for owners, managers, and interested third parties.

The statement of retained earnings is a crucial financial statement that summarizes movements in retained earnings balances based on net income, dividends and prior period retained earnings. Following the key steps and tips outlined above helps produce an accurate and clear statement. Proper statement preparation provides vital insight into profitability and equity for making informed financial decisions and planning future strategy. Taking time to carefully prepare this statement leads to improved understandability and utility of the information reported.

More informed decision-making

Preparing a statement of retained earnings can help business owners make better decisions when it comes to their business, including whether to reinvest funds back into the business, distribute earnings to shareholders, or a combination of the two.

How to prepare a statement of retained earnings

Creating a retained earnings statement is a simple process using the retained earnings formula:

Beginning Retained Earnings + Net Income/Loss – Dividends Paid = Retained Earnings

The statement of retained earnings is formatted simply:

Your Company Name

Statement of Retained Earnings

For the Year Ended December 31, 2019

| Retained earnings at the beginning of the period | $114,000 |

| Add net income or subtract net loss | $ 55,000 |

| Less dividends paid | $ -47,000 |

| Retained earnings at end of period | $ 122,000 |

The first example shows an increase in retained earnings, while the second example shows a decrease.

Your Company Name

Statement of Retained Earnings

For the Year Ended December 31, 2019

| Retained earnings at the beginning of the period | $114,000 |

| Add net income or subtract net loss | $ -7,000 |

| Less dividends paid | $- 21,000 |

| Retained earnings at end of period | $ 86,000 |

A decrease in retained earnings is not necessarily cause for alarm, as any time you invest money back into your business, your retained earnings will likely decrease.

If you’re ready to create a statement or retained earnings, just follow these simple steps:

The Statement of Retained Earnings

How do I prepare a statement of retained earnings?

Here’s how to prepare a statement of retained earnings for your business. Companies typically calculate the change in retained earnings over one year, but you could also calculate a statement of retained earnings for a month or a quarter if you want. Your beginning retained earnings are simply the previous period’s ending retained earnings.

What is the formula for a statement of retained earnings?

The formula for the statement of retained earnings is: Beginning retained earnings + net income – dividends = ending retained earnings Here’s how to prepare a statement of retained earnings for your business.

What is the starting balance of retained earnings?

If this is your first statement of retained earnings, your starting balance is zero. Let’s say your retained earnings last year was $12,000. This is what the first line would look like: Beginning Retained Earnings Balance: $12,000 3. Add net income. Find net income on your income statement.

What is a beginning retained earnings statement?

Let’s say you’re preparing a statement of retained earnings for 2021. Your beginning retained earnings are the retained earnings on the balance sheet at the end of 2020 ($200,000, for example). If your business recorded a net profit of, say, $50,000 for 2021, add it to your beginning retained earnings.