The cash flow statement is crucial for a company’s finances and for understanding the overall health of the business. Creating a cash flow statement involves using either the direct or indirect cash flow method and setting up the right processes.

In this article we will guide you through the process and help you understand the details and differences between the direct and indirect cash flow method.

Understanding a company’s cash flow is crucial for gaining insights into financial health and performance. There are two primary methods for reporting cash flow – direct and indirect While both have the same end goal of showing how cash enters and leaves a business, the approaches differ

Learning the key distinctions between direct and indirect cash flow enables smarter analysis of financial statements. Read on for an in-depth look at how these methods vary.

What is the Direct Cash Flow Method?

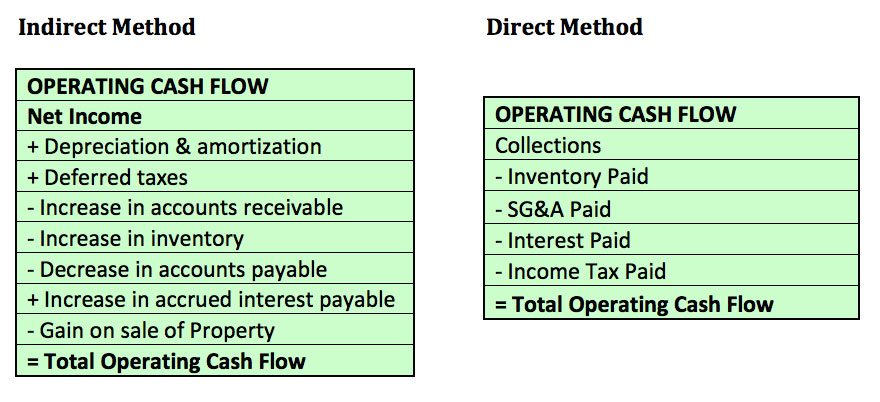

The direct method reports major cash inflows and outflows by disclosing the specific cash received and cash paid Some typical line items shown include

- Cash collected from customers

- Cash paid to suppliers

- Cash paid for salaries

- Cash received from interest

- Cash paid for taxes

By listing the primary sources and uses of cash, investors and creditors can clearly see how much actual cash the company generated and where it was spent.

The direct cash flow method aligns with the basic goal of the statement of cash flows – showing the exchange of cash between a company and the outside world. It provides a transparent view of how cash enters and exits the core business operations.

What is the Indirect Cash Flow Method?

Rather than listing cash transactions, the indirect method starts with net income on the income statement. It then adjusts net income for non-cash items like depreciation. Finally, changes in balance sheet accounts like accounts receivable are factored in to calculate the cash impact.

For example, if accounts receivable decreased over the period, this means cash collections were higher than sales revenue. The logic is that while sales may have been made on account, the decrease in AR indicates more cash was received from customers.

Additional adjustments are made for changes in inventory, accounts payable, accrued liabilities and other non-cash accounts to indirectly compute cash flow. Think of it as backing into the amount of cash generated from net income.

Key Differences Between the Methods

There are some important distinctions between these two approaches:

Data Source

- The direct method lists actual cash transactions found on the company’s T-accounts or general ledger.

- The indirect method relies on accrual-based amounts from the income statement and balance sheet.

Calculation Process

- Direct cash flow sums up cash inflows and outflows for the major activities.

- Indirect cash flow adjusts net income for non-cash items to derive the cash amount.

Level of Detail

- The direct method provides more granular visibility into each operating cash activity.

- Indirect cash flow gives less visibility by lumping operating activities into one line.

Ease of Preparation

- The indirect method is easier to prepare using existing accounting reports.

- The direct method requires gathering details on cash transactions by activity.

Clarity for Investors

- Direct cash flow more clearly shows how cash entered and exited the business.

- Indirect cash flow requires more analysis to understand the operating cash flows.

Direct Cash Flow Example

Here is an abridged example of what a direct method cash flow statement might look like:

Direct Method Cash Flow Statement

| |

|-|:-|

| Cash from Operating Activities: |

| Cash received from customers | $1,500,000 |

| Cash paid for inventory | $(650,000) |

| Cash paid for wages | $(220,000) |

| Cash paid for utilities | $(60,000) |

| Cash paid for taxes | $(100,000) |

| Net cash from operating | $470,000 |

This shows the major operating cash inflows and outflows for core activities like sales, inventory, payroll and taxes. Stakeholders can clearly see the company generated $470,000 in net cash from operating activities based on these direct cash transactions.

Indirect Cash Flow Example

The same company would report operating cash flows indirectly as follows:

Indirect Method Cash Flow Statement

| |

|-|:-|

| Net Income | $500,000 |

| Adjustments to net income: | |

| Depreciation | $50,000 |

| Decrease in Accounts Receivable | $100,000 |

| Increase in Inventory | $(80,000) |

| Increase in Accounts Payable | $60,000 |

| Net Cash from Operations | $630,000 |

Rather than listing cash transactions, this approach starts with net income then adjusts for non-cash amounts like depreciation and changes in balance sheet accounts to derive the cash flow amount.

Which Method is Better?

The direct cash flow method is typically viewed as providing more transparency for investors, lenders and analysts. By clearly listing where cash came from and where it was spent, they can better understand how the business operates and where cash is generated.

However, the indirect method is much more widely used in practice. It is simpler to prepare since it relies on existing accounting data. Most accounting software can automatically generate an indirect cash flow statement. The direct method requires gathering details on actual cash transactions across the general ledger accounts.

When it comes to analyzing cash flow, both methods arrive at the same total amount of operating cash flow. But the direct method provides extra visibility that allows for deeper insights into the underlying drivers and trends behind that cash flow.

Tips for Assessing Cash Flow

When reviewing cash flow statements, keep these tips in mind:

-

Compare current cash flow to previous periods to spot trends over time. Is cash from operations increasing or decreasing?

-

Look for steady or improving operating cash flow. This shows the core business is generating sufficient cash.

-

Check that cash flow and net income are aligned over time. Diverging amounts may signal problems.

-

Look for heavy investment outflows that can depress current cash flow but fuel growth later.

-

Make sure financing cash isn’t relied on too heavily to fund operating shortfalls.

Whether using the direct or indirect method, cash flow statements contain vital insights into a company’s financial fitness. Taking the time to properly analyze current and historical cash flow leads to better informed decisions and mitigates risk. While the approaches differ, both play an important role in illuminating how well a business manages its cash lifeline.

Direct vs. Indirect Cashflow: What’s the Difference?

What sets apart direct and indirect methods in calculating net cash flow from operating activities?

The key difference lies in their starting points and the kinds of calculations they involve.

With the indirect method, you start with your net income.

With the direct method you begin with the actual cash your business received and paid out.

Both methods use distinct calculations to reach the same end result, but they use different details during the process.

Let’s explore each method separately.

Benefits and Drawbacks of Indirect Cash Flow

The indirect method is commonly used by both small and large companies to comply with International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP) requirements. Publicly traded companies must use this method, even if they use the direct method internally.

Many accountants prefer the indirect method because it’s easier to prepare. It uses information from existing financial statements, saving time and effort compared to the direct method.

Unlike the direct method, the indirect method provides less detailed information about specific cash flow activities. It doesn’t offer a deep understanding of what contributes to the company’s net cash flows.

The indirect method might not accurately represent the company’s current cash position. It indirectly calculates net cash flow from other financial statements, meaning the numbers might not be up to date if the previous financial statements aren’t accurate or updated. This could lead to misleading information about the company’s cash situation.

Direct vs. Indirect Method Statement of Cash Flows

What is the difference between direct and indirect cash flow?

These methods differ by the transactions used to determine your cash flow statements. Indirect cash flow takes the net income and uses it as the base. It then adjusts as needed. In contrast, you can use direct cash flow for income tax, interest, and other variables. It takes the cash transactions and ignores the non-cash transactions.

Which cash flow method is more accurate?

Most accountants and analysts believe the direct method of cash flow presentation is the most accurate. While this may be true, calculating cash flow under the direct approach is much more complicated than under the indirect method. Complexities arise since each source of cash inflows and outflows must be appropriately identified.

Which method is better for preparing a cash flow statement?

Public companies and organizations with regular audits prefer the indirect method of preparation of cash flow. Since the indirect method utilizes information directly from the income statement and balance sheet, auditors and analysts can quickly perform calculations to determine if the information is accurate.