Interviewing for a consumer loan underwriter role? This pivotal position serves as the gatekeeper, meticulously analyzing loan applications to determine a borrower’s creditworthiness.

To ace your interview, you must demonstrate strong analytical skills, attention to detail, and expertise evaluating financial information. We compiled a list of 24 common consumer loan underwriter interview questions to help you prepare. Read on for tips to craft winning responses.

1. Walk Me Through Your Experience as a Consumer Loan Underwriter

Interviewers want to gauge your familiarity with industry regulations, ability to analyze financial data, and decision-making skills under pressure. Highlight your expertise assessing risk, reviewing credit reports, and determining applicants’ financial suitability for loans

Discuss your experience with various loan types like auto, personal, and home equity. Demonstrate proficiency with automated underwriting systems and knowledge of regulations like Fair Lending and ECOA. Emphasize your detail-oriented approach to thoroughly review documentation and identify any red flags.

2. How Do You Assess an Applicant’s Creditworthiness?

This question evaluates your approach, ability to analyze complex financial information, and judgment making prudent decisions. Explain how you examine the applicant’s credit score, income level, employment stability, and debt-to-income ratio.

Discuss how credit scores provide insight into past borrowing behaviors Stable income and employment indicate reliable repayment capacity A lower DTI means more disposable income to dedicate to the loan, Any available collateral also factors into the assessment,

3. What Methods Do You Use to Verify Information from Applicants?

Interviewers want to know you can identify discrepancies or fraudulent information to avoid bad loans and financial losses. Discuss using credit reports employment verification bank statements, tax returns, and background checks to validate applicant details.

Credit reports offer insight into credit history and debts. Employment verification confirms income stability. Bank statements reveal spending habits. Tax returns provide a financial snapshot for self-employed individuals. Background checks screen for potential fraud.

4. How Would You Handle a High-Risk Loan Application?

Balancing risk and reward is crucial. Discuss conducting thorough background and credit checks to assess the risk level. Explain how overly high-risk applications may need denying, while those with potential could be mitigated through requiring a co-signer or reducing the loan amount.

Emphasize the importance of clear communication with the applicant regarding the risks and terms. Your approach should combine careful assessment, risk mitigation, and transparent discussions.

5. What Factors Do You Consider When Underwriting Consumer Loans?

Interviewers want to confirm your knowledge evaluating a borrower’s creditworthiness. Discuss how the applicant’s credit history provides insight into repayment habits and risk levels. Explain how stable income and employment suggest better repayment capacity.

Note how debt-to-income ratios indicate if the borrower is overextended. Also discuss how collateral value is considered for secured loans to cover the amount if the borrower defaults.

6. Describe a Time You Had to Reject a Loan Application

Being able to tactfully deliver disappointing news while maintaining positive client relationships is key. Explain needing to reject an application due to insufficient credit history or poor scores. Note you communicated the rejection respectfully and objectively, focusing on facts from the credit report.

Discuss providing guidance to improve their creditworthiness, turning a negative experience into a constructive one. The aim is demonstrating empathy while making prudent decisions.

7. How Do You Stay Updated on Lending Regulations and Standards?

Employers want to know you’re proactive about constantly expanding your knowledge. Discuss regularly attending regulatory body webinars and workshops. Mention subscribing to newsletters from financial institutions and agencies.

Note how reading trade publications helps track market trends. Also discuss participating in networking events and continuing education courses to stay current.

8. Can You Describe Your Familiarity with Automated Underwriting Systems?

Interviewers want to confirm you can work efficiently and accurately with automated underwriting tools. Discuss your extensive experience with systems like Fannie Mae’s Desktop Underwriter and Freddie Mac’s Loan Prospector.

Explain how these tools assess eligibility, risk, and pricing. Note your ability to interpret the system findings to make informed decisions. Also emphasize still applying human judgement and expertise.

9. What Steps Do You Take to Ensure Compliance with Fair Lending Practices?

Employers want to evaluate your understanding of fair lending practices and commitment to an ethical environment. Discuss regularly reviewing the latest regulations and guidelines and attending training sessions.

Explain how you apply consistent criteria without discrimination based on race, gender, age, or marital status. Emphasize the importance of transparency through clear communication with applicants. Also note that regular audits help identify potential issues early.

10. How Do You Handle Pressure When Faced with Tight Underwriting Deadlines?

This question evaluates your time management abilities and capacity to remain calm under pressure. Discuss proactive planning and prioritizing tasks to effectively manage stress. Explain how focusing on one task at a time improves accuracy and efficiency in high-pressure situations.

Note that lifestyle factors like exercise, diet, and sleep help maintain energy and focus. Also emphasize that transparent communication with stakeholders is essential for collaborative solutions.

11. Could You Share an Example of a Complex Underwriting Scenario You Handled?

Interviewers want to assess your problem-solving skills and ability to make sound decisions. Describe a case involving an applicant with fluctuating self-employment income. Explain your approach of thoroughly analyzing their financial records over two years to determine average monthly income and identify patterns.

Discuss how you weighed other factors like credit score, debt-to-income ratio, and collateral value to make an informed recommendation that balanced risk.

12. How Do You Manage Your Pipeline to Ensure Timely Decisions?

This evaluates your organizational skills, time management, and grasp of task prioritization. Discuss categorizing applications based on urgency and complexity, tackling urgent, straightforward ones first. Explain allocating focused time for complex cases requiring deep attention.

Note using tools to track deadlines and progress. Emphasize regular communication with stakeholders to get updates on any changes or delays. Maintaining a buffer in your schedule allows flexibility for the unexpected.

13. Describe a Time You Made an Unpopular But Necessary Decision

Interviewers want to know you can make objective, compliant decisions even when met with dissatisfaction. Provide an example of denying a long-time client’s application due to their over-leveraged, high-risk financial status.

Explain standing by your decision despite potential backlash, because it protected the best interests of all parties and maintained underwriting integrity. Difficult decisions are inevitable, but principles and ethics must prevail.

14. How Would You Handle Disagreements with Stakeholders in the Underwriting Process?

This question assesses your ability to navigate conflict professionally. Discuss first seeking to understand the other party’s perspective by asking questions and listening actively. Then explain presenting your own viewpoint backed by data or policy guidelines.

Note that involving an unbiased third-party mediator could help reach an agreeable solution if disagreements persist. Emphasize that finding common ground should be the priority, with the client’s best interest in mind.

15. What Measures Do You Take to Protect Confidential Borrower Information?

Data protection is paramount, so interviewers want to confirm you have effective strategies to safeguard sensitive information. Discuss strictly adhering to privacy policies, only accessing necessary data for your role. Mention using encrypted systems for data transmission and storage.

Explain practices like password updates, two-factor authentication, and continuous learning about emerging threats and security best practices. Protecting confidentiality is crucial for legal compliance and maintaining trust.

16. How Do You Evaluate Collateral Value in Underwriting?

This assesses your analytical skills and grasp of collateral’s risk management role. Discuss initially reviewing the asset’s type, condition, and location. Explain obtaining a professional appraisal to establish fair market value for an unbiased estimate.

Note applying the loan-to-value ratio to determine maximum lending compared to the appraisal. A lower ratio means less risk. Thorough evaluation ensures collateral sufficiently covers the loan if the borrower defaults.

17. What Risk Management Strategies Do You Use in Underwriting?

Employers want to know you understand evaluating a borrower’s repayment capacity. Discuss using thorough credit checks to understand history and capacity. Mention utilizing predictive tools to forecast risks and default odds. Emphasize adhering to regulatory guidelines and internal policies to minimize legal complications.

Explain how regular portfolio reviews help identify repayment pattern changes to take proactive risk mitigation measures. A multi-pronged approach is key for prudent decisions.

18. How Do You Ensure Accuracy and Attention to Detail in Your Work?

Meticulousness and precision are crucial, so interviewers want to know your methods for maintaining them. Discuss how organization helps prioritize work to avoid rushed errors. Explain that checklists guide a systematic approach to ensure no steps are missed.

Note that continuous learning adapts your practices to evolving trends and regulations. Finally, emphasize that regular reviews help catch potential mistakes early. Underwriting demands a high level of accuracy

Interviewing as a UnderwriterNavigating the path to becoming an Underwriter involves a critical juncture: the interview process. Underwriters are the backbone of the insurance and financial industries, tasked with balancing risk and reward. Their interviews, therefore, are designed to probe not only their analytical prowess and attention to detail but also their decision-making process and ethical standards. In this guide, we’ll dissect the array of questions that Underwriters can anticipate facing. From dissecting case studies to demonstrating industry knowledge, we’ll cover the spectrum of technical, situational, and behavioral inquiries. We’ll provide insights into crafting responses that showcase your expertise, strategies for thorough preparation, and the traits that define a standout Underwriter candidate. With this guide, you’ll gain the tools and confidence to excel in your Underwriter interviews, positioning you to secure your role in this critical field.

- Learn as much as you can about the insurance company’s products, target markets, and the types of risks they cover. Learn about their underwriting philosophy and any market-specific advantages they may have.

- Know the Rules and Requirements of the Industry: Keep up with the latest rules and regulations in your industry, as well as compliance issues and the best ways to do things in underwriting. This will show that you are dedicated to upholding high standards and can easily adjust to changes in the law.

- Review Your Technical Knowledge: You should be ready to talk about underwriting principles, risk assessment methods, and how to use underwriting software. Review the financial statements, actuarial reports, and other data that you may need to look at for your job.

- To get ready for behavioral questions, think about situations from the past that show how you make decisions, handle risks, and solve problems. Prepare to talk about how you’ve worked with others or dealt with difficult underwriting cases.

- Practice Scenario-Based Questions: Anticipate questions that present hypothetical underwriting scenarios. Work on explaining how you would evaluate the risk, what other information you might need, and how you would choose the terms of coverage.

- Make a list of questions that show you’re interested in the company’s underwriting process, the problems they face, and what they expect from the person in this role. This shows that you have thought carefully about how you can help them succeed.

- Mock Interviews: Practice interviews with a teacher or coworker who can give you feedback on your answers and help you improve the way you talk to people. This will help you feel more at ease during the interview process and see where you can improve.

By following these steps, you will enter your underwriter interview with a solid foundation of knowledge and a clear demonstration of your skills and value. This preparation will not only help you answer questions confidently but also engage in a meaningful dialogue about how you can support the companys objectives and growth.

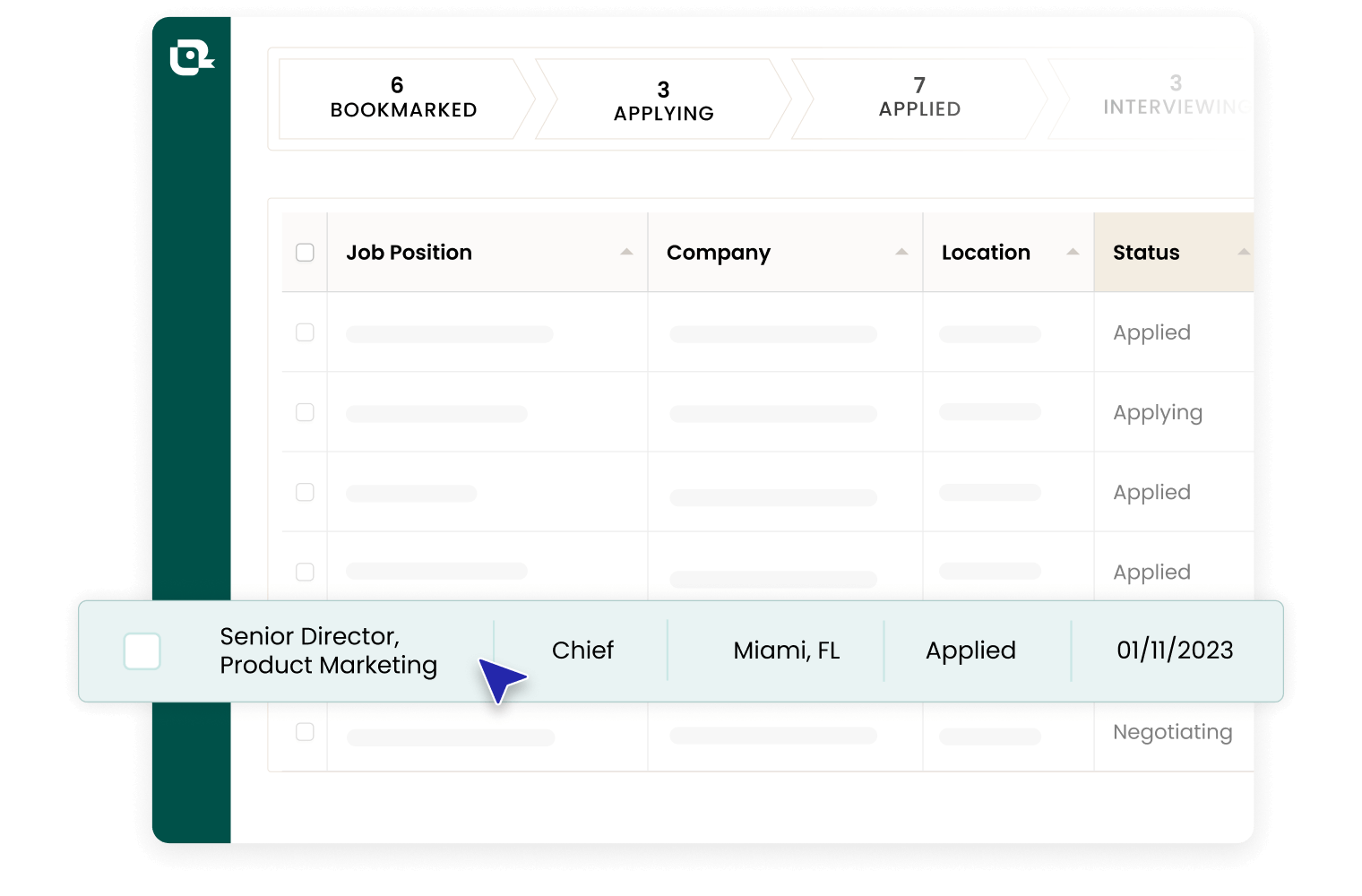

Stay Organized with Interview TrackingWorry less about scheduling and more on what really matters, nailing the interview. Simplify your process and prepare more effectively with Interview Tracking.

CONSUMER LOAN UNDERWRITER Interview Questions

FAQ

What does a consumer loan underwriter do?

How to nail an underwriting interview?

What kind of questions do underwriters ask?

What questions do underwriters ask?

During underwriter interviews, you can expect to be asked about your personality, qualifications, and experience. This article covers examples of various underwriter interview questions and sample answers to some of the most common questions, such as your experience in underwriting.

How should I prepare for an underwriter interview?

To prepare for your underwriter interview, consider practicing the STAR method: When answering situational questions that ask you to describe a ‘time when’, use the STAR method to respond efficiently. STAR refers to situation, task, action and result, all necessary parts of your answer.

What should an interviewer know about underwriting a loan?

An interviewer should know that when I underwrite a loan, I aim to maintain a calm and professional demeanor. It is important for them to understand my approach so they can determine if I am a good fit for their company.

What questions would an interviewer ask a mortgage underwriter?

An interviewer might ask a Mortgage Underwriter about a time when they had to work with another professional in the mortgage industry to complete an underwriting task. This question helps assess the Underwriter’s ability to collaborate effectively.