Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and heres how we make money.

Modified adjusted gross income, or MAGI, is an important number for taxpayers to know Calculating your MAGI can help determine your eligibility for certain tax deductions, credits, and government programs While it may seem complicated at first, breaking down the calculation into a few simple steps can make finding your MAGI much easier.

What is Modified Adjusted Gross Income (MAGI)?

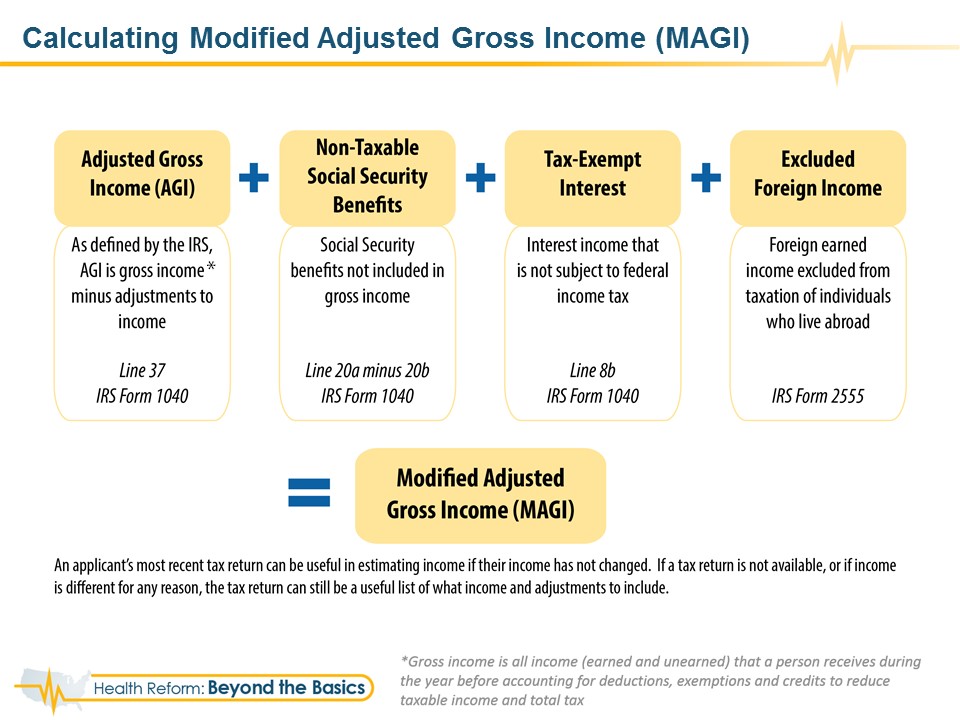

Modified adjusted gross income is your adjusted gross income (AGI) plus certain amounts that were deducted to arrive at your AGI Essentially, you start with your AGI and add back in certain deductions to find your MAGI.

Some key facts about MAGI

- MAGI is usually close to your AGI but may differ by certain deductions.

- MAGI is used to determine eligibility for certain tax deductions, credits, government programs, and more.

- MAGI calculation methods can vary slightly depending on the deduction or credit.

- Generally, you start with AGI and add back certain deductions.

Knowing your MAGI can help you maximize tax deductions you qualify for. Read on to learn how to calculate it.

How is MAGI Different from AGI?

AGI and MAGI are similar numbers but have some key differences:

- AGI is your total income minus certain adjustments like IRA contributions, student loan interest, and more.

- MAGI takes your AGI and adds back some deductions like IRA contributions to arrive at a new number.

For many taxpayers, AGI and MAGI are the same. However, they differ when you deduct certain amounts to calculate your AGI, which then get added back to determine MAGI.

Some common deductions that differ between AGI and MAGI include:

- Traditional IRA contributions

- Student loan interest

- Tuition and fees

- Foreign earned income & housing exclusions

So your AGI subtracts these, while your MAGI adds them back. Again, for some taxpayers, AGI and MAGI are identical. But when they differ, it’s important to calculate MAGI correctly to determine eligibility for deductions.

What is MAGI Used For?

The main uses of MAGI are determining eligibility for:

- IRA Contribution Deductions: MAGI determines your eligibility to deduct traditional IRA contributions.

- Roth IRA Contributions: Your MAGI affects contribution limits for Roth IRAs.

- Premium Tax Credits: Eligibility for premium tax credits for health insurance depends on your MAGI.

- Other Tax Credits & Deductions: Education, retirement savings, and other credits use MAGI to determine eligibility.

So properly calculating your MAGI is important to maximize tax deductions you qualify for.

How to Calculate Modified Adjusted Gross Income (MAGI)

Here are the steps to calculate your modified adjusted gross income:

1. Calculate Your Gross Income

Add up all sources of income you received during the year:

- Wages, salaries, tips

- Interest and dividends

- Capital gains

- Business income

- Retirement distributions

- Unemployment

- Social Security benefits

- Any other income

2. Subtract Adjustments to Get Your AGI

Take your gross income and subtract any adjustments to arrive at AGI:

- IRA contributions

- Student loan interest

- Self-employment taxes

- Health savings account contributions

- Educator expenses

- And more

This AGI number goes on line 8b of your Form 1040.

3. Add Back Certain Deductions to Get MAGI

From your AGI, add back certain deductions:

- Traditional IRA contributions

- Student loan interest deduction

- Tuition and fees deduction

- Foreign earned income & housing exclusions

- Foreign housing deductions

- Exclusion of savings bond interest

- Exclusion for adoption expenses

- And more

This final MAGI number is what you’ll use to determine eligibility for certain deductions and credits.

MAGI Calculation Examples

Here are a few examples of how MAGI can differ from AGI:

Example 1:

Gross Income: $75,000

Adjustments:

- $3,000 Traditional IRA contribution

- $2,500 Student loan interest deduction

AGI: $75,000 – $3,000 – $2,500 = $69,500

MAGI: $69,500 + $3,000 (IRA contribution) + $2,500 (student loan interest) = $75,000

In this case, the AGI and MAGI are equal since we added back all the deductions.

Example 2:

Gross Income: $95,000

Adjustments:

- $5,000 Traditional IRA contribution

- $5,000 Foreign earned income exclusion

AGI: $95,000 – $5,000 = $90,000

MAGI: $90,000 + $5,000 (IRA contribution) = $95,000

Here the MAGI doesn’t add back the foreign earned income exclusion, so it differs from the AGI.

How to Use MAGI to Maximize Deductions

The main benefit of finding your MAGI is to maximize tax deductions you’re eligible for based on your income. Here are some key ways to use it:

- See if you can deduct traditional IRA contributions based on your MAGI and filing status.

- Determine your eligibility and limits for contributing to a Roth IRA.

- Calculate if you qualify for premium tax credits for health insurance plans.

- Check income thresholds for education credits like the American Opportunity Credit.

For example, you can deduct the full $6,000 traditional IRA contribution if your MAGI as a single filer is below $78,000 in 2023. For education credits, the phaseout range starts at a MAGI of $80,000.

So calculating your MAGI accurately lets you qualify for more valuable tax breaks!

Frequently Asked Questions

How is MAGI calculated for a traditional IRA deduction?

For traditional IRA deductions, calculate your MAGI by taking your AGI and adding back deductions like student loan interest, foreign earned income & housing exclusions, foreign housing deductions, excluded savings bond interest, and excluded employer adoption benefits.

What is considered income when calculating MAGI?

All sources of gross income are included when first calculating your MAGI. This includes wages, capital gains, retirement income, Social Security benefits, interest/dividends, and other income sources.

Can I deduct my traditional IRA with a high MAGI?

If your MAGI exceeds certain thresholds based on your filing status, you may not be able to deduct your traditional IRA contribution or can only deduct a portion of it. The IRA deduction is phased out at higher MAGI levels.

Does MAGI include Social Security benefits?

No, Social Security benefits are not included in your MAGI calculation. Your gross income will include any taxable Social Security benefits, but the full amount is not used for MAGI.

How do I calculate MAGI for Roth IRA contribution limits?

For Roth IRA contributions, calculate your MAGI by taking your AGI and adding back any foreign earned income exclusion, foreign housing exclusion/deduction, and income from bona fide residents of Puerto Rico or American Samoa that you excluded.

The Bottom Line

Calculating your modified adjusted gross income involves starting with your AGI, then adding back certain deductions not included in AGI. It’s worth taking the time to accurately calculate your MAGI since it can determine your eligibility for valuable tax deductions and credits. Use the step-by-step guide provided to figure out your MAGI and maximize tax breaks you qualify for.

MAGI vs. AGI: What’s the difference?

Your AGI, adjusted gross income, is your total income minus any eligible deductionsInternal Revenue Service . https://www.irs.gov/e-file-providers/definition-of-adjusted-gross-income. Accessed Feb 28, 2024.View all sources. Your MAGI, modified adjusted gross income, is just your AGI with certain deductions added back, such as student loan interest, foreign-earned income and housing exclusions, and employer adoption benefits, among other things.

The numbers may be close, and they may even be the same in some cases.

Premium tax credit eligibility

Another thing MAGI is used for is to determine eligibility for the premium tax creditHealthCare.gov . Modified Adjusted Gross Income (MAGI). Accessed Feb 28, 2024.View all sources. The premium tax credit is a refundable tax credit available to taxpayers who have purchased a health insurance plan from the health insurance marketplace.