For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. He is the sole author of all the materials on AccountingCoach.com.

Factory overhead also known as manufacturing overhead, refers to all indirect costs incurred during the manufacturing process. Unlike direct costs like raw materials and labor, factory overhead costs cannot be easily traced to specific units of production. Instead these costs are allocated across all units produced.

Factory overhead typically accounts for 20-40% of total product cost, Careful management of overhead costs is critical for maintaining healthy profit margins This article will examine the most common examples of factory overhead to help business owners better understand and control these expenses,

Depreciation

One of the largest components of factory overhead is depreciation on fixed assets like buildings, machinery, and equipment. As these assets are used over time, they lose value and must be expensed. Methods like straight-line depreciation allocate depreciation evenly over the asset’s useful life.

Proper asset maintenance and strategic asset purchases can help minimize depreciation costs. Business owners should also periodically review depreciation schedules to ensure they align with actual asset lifespan.

Rent and Utilities

Ongoing costs like rent, property taxes, insurance, electricity, gas, water, and waste removal keep the factory running day-to-day. While variable costs like energy usage may fluctuate with production volume, other expenses like rent remain fixed.

Business owners can negotiate better rental rates or purchase factory facilities outright to reduce costs. Energy-efficient equipment, lighting, and optimized production scheduling also help control utility expenses.

Equipment Maintenance and Repairs

Regular maintenance and repairs are needed to keep equipment in good working order. This includes costs for maintenance payroll, spare parts, supplies, and external repair services. Preventative maintenance helps minimize repair frequencies.

Factory Supervision and Support Labor

Salaries for factory department supervisors, quality management staff, inventory clerks, and other indirect laborers are factory overhead costs. Efficient organization and lean staffing help control labor overhead.

Taxes, Insurance and Fringe Benefits

Payroll taxes, health insurance contributions, retirement plans, and other employee fringe benefits for factory staff are included in manufacturing overhead. Careful workforce planning and benefit program design help optimize these costs.

Factory Supplies and Expenses

Indirect materials like lubricants, cleaning chemicals, office supplies, small spare parts, and other items not incorporated into finished goods are overhead costs. Judicious use, bulk purchasing, and inventory controls can reduce supply expenses.

Quality Control and Inspection

The costs of finished goods inspections, lab testing, production monitoring, quality record-keeping, and rework of defects add to factory overhead. Robust quality control procedures minimize inspection overhead over the long-term.

Inventory Management Expenses

Purchasing, receiving, storage, internal transfers, and related inventory management activities require labor and supplies, which contribute to overhead costs. Efficient warehouse layouts, material handling procedures, and inventory turnover help curb these expenses.

Safety and Environmental Compliance

Safety training, protective gear, emissions monitoring, and hazardous waste handling contribute to the overhead burden. However, these costs pale in comparison to the danger and risks of non-compliance.

Factory Security

Security guards, access control systems, fencing, outdoor lighting, and surveillance cameras help protect assets from theft and vandalism.prudent security measures end up paying for themselves over time.

Internal Material Handling

The costs of in-plant conveyance like forklifts, carts, packaging materials, and related activities add to manufacturing overhead. Optimized factory layout and material flow keep material handling costs in check.

Production Scheduling and Logistics

Coordinating complex manufacturing operations requires production scheduling labor and systems. The costs of planning, scheduling, dispatching, and tracking work orders are factory overhead. Lean workflow and integrated IT systems help minimize scheduling overheads.

Obsolescence Allowances and Scrap

Production processes generate material waste and obsolete parts that carry overhead costs for disposal and replacement. Improving production efficiency and material yields reduces scrap rates and obsolescence.

Royalties, Licenses and Patents

Ongoing fees for intellectual property like proprietary technology and patented processes contribute to overhead expenses. However, the competitive advantages provided by protected IP usually outweigh the costs.

Factory Administrative Costs

Management, clerical, IT support, legal, accounting, and other back-office staff working at the factory represent overhead labor costs. While essential, office headcounts should be right-sized for operational needs.

Safety Stock and Excess Inventory

Carrying extra raw material and finished goods inventory to buffer against stock-outs and meet unexpected demand adds holding and storage costs to overhead. Lean inventory management balances availability and overhead.

Proper categorization, allocation, monitoring, and controlling of overhead costs is an important responsibility for manufacturing managers. While individual overhead expenses may seem minor, they add up significantly across the production scale. By understanding the key drivers and implementing overhead cost reduction strategies, manufacturers can effectively manage this major portion of total costs.

Definition of Manufacturing Overhead

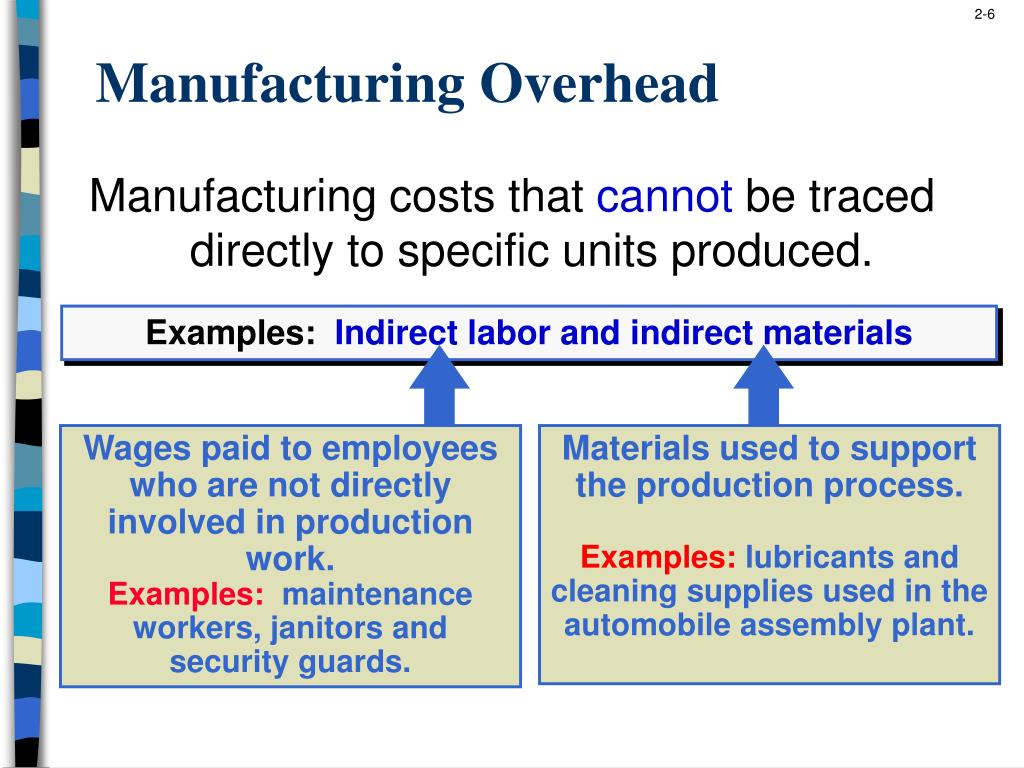

Manufacturing overhead (also known as factory overhead, factory burden, production overhead) involves a company’s manufacturing operations. It includes the costs incurred in the manufacturing facilities other than the costs of direct materials and direct labor. Hence, manufacturing overhead is referred to as an indirect cost.

Generally accepted accounting principles require that a manufacturer’s inventory and the cost of goods sold shall consist of:

- the cost of direct materials

- the cost of direct labor

- the cost of manufacturing overhead

Note: Expenses that are outside of the manufacturing facilities, such as selling, general and administrative expenses, are not product costs and are not inventoriable. They are reported as expenses on the income statement in the accounting period in which they occur.

Manufacturing Overhead

FAQ

What is considered factory overhead?

What does factory overhead not include?

What is not included in manufacturing overhead?

What is counted as manufacturing overhead?

What is factory overhead?

Factory overhead represents the costs incurred by an organization when manufacturing a product, except the costs of direct labor and materials. Also called manufacturing overhead, it comprises these major parts: Indirect labor: This refers to all the costs for employees not directly involved in the manufacturing of a product.

What is manufacturing overhead?

Manufacturing overhead (also known as factory overhead, factory burden, production overhead) involves a company’s manufacturing operations. It includes the costs incurred in the manufacturing facilities other than the costs of direct materials and direct labor. Hence, manufacturing overhead is referred to as an indirect cost.

What costs are included in manufacturing overhead?

Examples of costs that are included in the manufacturing overhead category are as follows: Since direct materials and direct labor are usually considered to be the only costs that directly apply to a unit of production, manufacturing overhead is (by default) all of the indirect costs of a factory. What is Not Included in Manufacturing Overhead?

What is included in factory overhead?

They comprise fixed costs like rent, insurance, utilities, maintenance, depreciation and others that aren’t directly linked to production and variable costs like the ones for indirect materials and utilities that vary according to the number of units produced. What does factory overhead include?