As a business owner, you likely pay wages to employees. But when it comes to paying yourself, what do you do?

Depending on your type of business structure, you might be able to pay yourself an owner’s draw. But, what is an owner’s draw?

Demystifying Owner’s Draws in Accounting: A Comprehensive Guide

As a business owner, determining how to pay yourself can be a confusing task. You may have heard the term “owner’s draw” thrown around, but what exactly does it mean? In this comprehensive guide, I’ll explain everything you need to know about owner’s draws in accounting.

What is an Owner’s Draw?

An owner’s draw, also known as just a draw, refers to the amount of money a business owner withdraws from their company for personal use. Rather than taking an official salary, owners can opt to pay themselves through draws. The funds for these draws come directly from the owner’s equity account.

Owner’s equity represents the owner’s financial stake in the business It includes investments they’ve made into the company, as well as their share of any profits or losses. By taking draws, owners are essentially drawing upon these funds for their personal benefit

Some key characteristics of owner’s draws:

- Provides a way for owners to pay themselves instead of a salary

- Withdrawn directly from the owner’s equity account

- Used for personal expenses and needs

- Amount and frequency can vary based on company cash flow

Now let’s look at what types of businesses commonly use owner’s draws

Businesses That Take Owner’s Draws

Owner’s draws are generally only taken by certain types of business structures:

-

Sole proprietorships – The owner can withdraw funds as they see fit.

-

Partnerships – Partners can take draws, often outlined in the partnership agreement.

-

Limited liability companies (LLCs) – Members of an LLC can take draws.

Meanwhile, incorporated entities like S-corps and C-corps typically cannot directly take owner’s draws. Shareholder-owners of these corporations receive salaries and dividends instead.

Here’s a quick summary of which entities can utilize owner’s draws:

- Sole proprietorships – Yes

- LLCs – Yes

- Partnerships – Yes

- S-corps – No

- C-corps – No

Taking draws provides business owners flexibility in how they receive compensation from their company. But how exactly are they taxed?

Tax Implications of Owner’s Draws

When it comes to taxes, owner’s draws have different implications versus being paid a salary. Unlike salaries, draws are not deductible business expenses. The draws are not taxed on the business’s income statement.

However, owners must pay income tax on the draw amounts personally. Owners who take draws typically need to pay estimated quarterly taxes and self-employment taxes on the draw income.

Some owners decide to take a small salary to cover employment taxes, then take additional draws as needed. With a salary, payroll taxes are withheld directly. But draws require manually handling all tax obligations.

Determining Draw Amounts

When deciding how much to take as an owner’s draw, here are some important factors to consider:

-

Cash flow – Don’t withdraw more than your business can afford based on current cash on hand. Monitor bank balances and projections.

-

Seasonal changes – Draws may need to be lower during slower income months.

-

Upcoming expenses – Ensure sufficient funds remain to cover upcoming operating expenses.

The ideal draw amount depends on the company’s financial circumstances. Owners should be wary of withdrawing too much through draws without leaving enough operating capital for the business.

Dangers of Excessive Draws

Taking very large owner’s draws can be risky:

- May leave inadequate operating funds to cover expenses

- Can limit growth by reducing reinvestment capital

- Impacts owner’s equity and company valuation

- Increases tax burden on owner

Before significantly increasing draw amounts, owners should carefully assess potential downsides. Establish a reasonable maximum draw threshold and exercise discipline to avoid exceeding it. Monitoring cash flow and projections helps prevent excessive draws.

Recording Owner’s Draws in Accounting

Properly recording owner’s draws is important for accurate financial reporting. Here are some key steps:

-

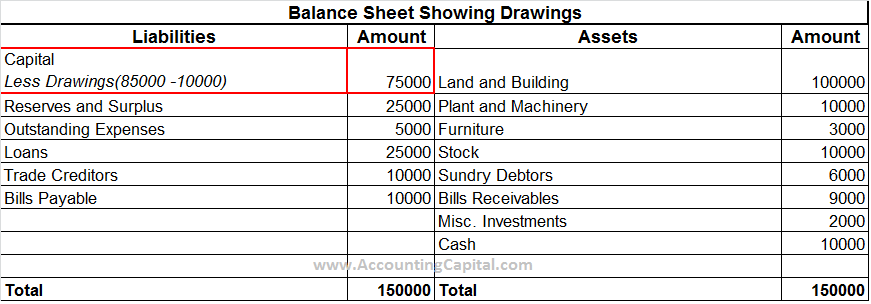

Establish an “Owner’s Draw” account under Owner’s Equity section of balance sheet

-

When draws are taken, debit the Owner’s Draw account and credit cash

-

At end of period, subtract total draws from Owner’s Equity amount

-

Report draw amounts on owner’s personal tax returns

Using accounting software can simplify tracking draws. The right technology automates recording draw transactions.

Key Takeaways

- Owner’s draws allow owners to take money from their business for personal use

- Sole proprietorships, LLCs, and partnerships commonly utilize draws

- Draws come directly from the owner’s equity account

- Owners must pay income and self-employment tax on draw amounts

- Excessive draws can be risky if they deplete operating capital

- Draw transactions should be accurately recorded for financial reporting

Businesses that take owner’s draws

Again, certain business structures can take owner’s draws. These structures include:

- Sole proprietorships

- Partnerships

- Limited liability companies (LLC)

In most cases, you must be a sole proprietor, member of an LLC, or a partner in a partnership to take owner’s draws.

Typically, corporations, like an S Corp, can’t take owner’s withdrawals. However, corporations might be able to take similar profits, such as distributions or dividends.

Take a look at our handy list below to see where your business falls:

- Sole proprietorship: Can take owner’s draws

- LLC: Can take owner’s draws

- Partnership: Can take owner’s draws

- S Corp: Cannot take owner’s draws

- C Corp: Cannot take owner’s draws

Are owner’s draws taxable?

Do you have to pay taxes on owner’s draw? An owner’s draw is not taxable on the business’s income. However, a draw is taxable as income on the owner’s personal tax return.

Business owners who take draws typically must pay estimated taxes and self-employment taxes.

Some business owners might opt to pay themselves a salary instead of an owner’s draw. When it comes to salary, you don’t have to worry about estimated or self-employment taxes.

How do I Enter the Owner’s Draw in QuickBooks Online?

What is an owner’s draw in accounting?

In accounting, an owner’s draw is when an accountant withdraws funds from a drawing account to provide the business owner with personal income. Accountants may help business owners take an owner’s draw as compensation. These draws can be in the form of cash or other assets, such as bonds.

What is owner’s draw (owner’s withdrawal) in accounting?

What is Owner’s Draw (Owner’s Withdrawal) in Accounting? Owner’s Draw or Owner’s Withdrawal is an account used to track when funds are taken out of the business by the business owner for personal use. Business owners may use an owner’s draw rather than taking a salary from the business.

What is a business owner’s draw?

Business owners might use a draw for compensation versus paying themselves a salary. Owner’s draws are usually taken from your owner’s equity account. Owner’s equity is made up of different funds, including money you’ve invested into your business.

Can a business take owner’s draws?

Owner’s draws are usually taken from your owner’s equity account. Owner’s equity is made up of different funds, including money you’ve invested into your business. Business owners can withdraw profits earned by the company. Or, the owner can take out funds they contributed. Again, certain business structures can take owner’s draws.