Interviewing for a real estate loan officer role? You can expect to be asked a range of questions designed to assess your skills experience and fit for the position. Going in prepared will help ensure you make a great impression and land the job.

In this comprehensive guide, we’ll overview the key real estate loan officer interview questions you’re likely to encounter along with tips for crafting winning responses.

Why Do You Want to Work Here?

This is one of the most common interview questions you’ll face. The hiring manager wants to gauge your interest in and enthusiasm for the company.

When responding:

-

Show that you know and care about the company by naming specific things that interest you (e.g. g. their reputation, values, training, career development opportunities, etc).

-

Explain why those factors make the company attractive and align with your own career goals and interests.

-

Convey sincere excitement about the prospect of bringing your skills and experience to advance their mission

Tell Me About Yourself

This open-ended request is often used early in interviews to get the conversation rolling. The key is to focus on highlights specifically relevant to the loan officer role.

Structure your answer as a short elevator pitch highlighting:

-

Your number of years experience in mortgage lending.

-

Your key lending skills and areas of expertise (e.g. purchase loans, refinances, loan analysis)

-

1-2 standout accomplishments that demonstrate success as a loan officer.

-

What motivates you in your work.

-

Why you’re an excellent fit for the position.

This allows you to shape the narrative and emphasize the factors that make you the ideal candidate.

Why Do You Think You’re a Good Fit?

This is a great chance to talk more about why your background makes you the best person for the job.

Emphasize factors like:

-

Years of directly relevant experience in mortgage lending.

-

Specific skills and knowledge in their top required areas (credit analysis, underwriting, sales, etc).

-

Track record of high achievement in previous loan officer roles.

-

Strong work ethic and commitment to professional development and continuous improvement.

-

Personality traits and soft skills that equip you to excel (e.g. communication, relationship-building, persistence).

Cite examples that vividly demonstrate these strengths whenever possible. This will reinforce that your value aligns perfectly with their needs.

What Motivates You?

Hiring managers want to understand what gets you excited and inspired around mortgage lending.

Good options to mention include:

-

Helping people achieve homeownership and financial goals. Talk about how rewarding it is to guide borrowers through the process.

-

Building relationships with new clients and partners. You love cultivating networks and connecting people strategically.

-

Ongoing learning. The ever-changing mortgage industry keeps you engaged and drives you to continuously improve.

-

Being a trusted advisor. Few things are more gratifying than advising clients and seeing them succeed.

-

Competition. You thrive on the competitive nature of sales and are motivated to be a top producer.

Convey genuine passion for the work. This helps show you’ll bring strong motivation and commitment to excelling in the role.

Where Do You See Yourself in Five Years?

Hiring managers want to gauge if you’ll stick around. Emphasize a vision focused on growing your career there. For example:

-

You see yourself becoming one of their top producing loan officers as you build an expanded book of business.

-

You hope to build deep expertise and become a go-to person in a key lending area like commercial financing or VA loans.

-

You aim to earn additional professional certifications through their training program to broaden your capabilities.

-

You envision moving into leadership roles like mentoring junior loan officers, leading special projects or initiatives, or helping shape products and services.

This reassures them that investing in you is worthwhile, as you’re planning for long-term growth and advancement with the company.

What’s Your Biggest Strength?

This gives you a prime chance to highlight a top skill that makes you stand out. For loan officers, good options include:

-

Tenacity and work ethic. Describe how you’ve become known as someone who will put in the work needed and persist to close loans. Give an example like pursuing 100 leads to get 10 loans.

-

Communication and relationship building. Share how your interpersonal skills help you establish trust and rapport with diverse clients to understand their needs.

-

Loan analysis expertise. Detail your sharp analytical abilities that allow you to guide clients to financing solutions tailored to their situation. Provide an example deal you structured.

-

Calming, reassuring demeanor. Note how you excel at keeping clients at ease through a complex process and instilling confidence each step.

Reinforce with a specific story demonstrating the strength powerfully impacting your effectiveness as a loan officer. This level of detail can be compelling and memorable.

Other Common Questions

-

Why did you choose mortgage lending as a career? Focus on sincere passions and motivations that got you into the field.

-

What do you think are the most important skills for a loan officer to have? Emphasize must-haves like analytical thinking, communication, persistence, and organization.

-

How do you stay up-to-date on mortgage industry trends? Mention reading industry newsletters, taking continuing education courses, attending conferences, and networking.

-

Why did you leave your last job? Keep your answer positive – emphasize seeking growth opportunities or new challenges.

-

How do you handle stress or deal with difficult clients? Share your best strategies for remaining calm and professional in high pressure situations.

-

Where do you see the mortgage industry going in the next 5 years? Demonstrate your industry insight and perspective on trends like rising rates, shrinking margins, and digital disruption.

-

What are your biggest weaknesses? Ensure you pick legitimate areas for improvement – then highlight what you’re doing to address them.

How to Prepare

-

Research the company so you can speak knowledgably about their products, mission and culture.

-

Review the job description closely so you can connect your background directly to their stated needs.

-

Reflect on your skills and achievements so you can articulate your value and fit.

-

Prepare illustrative stories that spotlight your successes and strengths. This makes your capabilities real and memorable.

-

Practice aloud with someone so you can polish your responses.

-

Get a good night’s rest beforehand so you’re focused and sharp.

Preparation is key to nailing loan officer interviews. By following these tips, you’ll showcase your value and land the perfect mortgage lending role. Good luck!

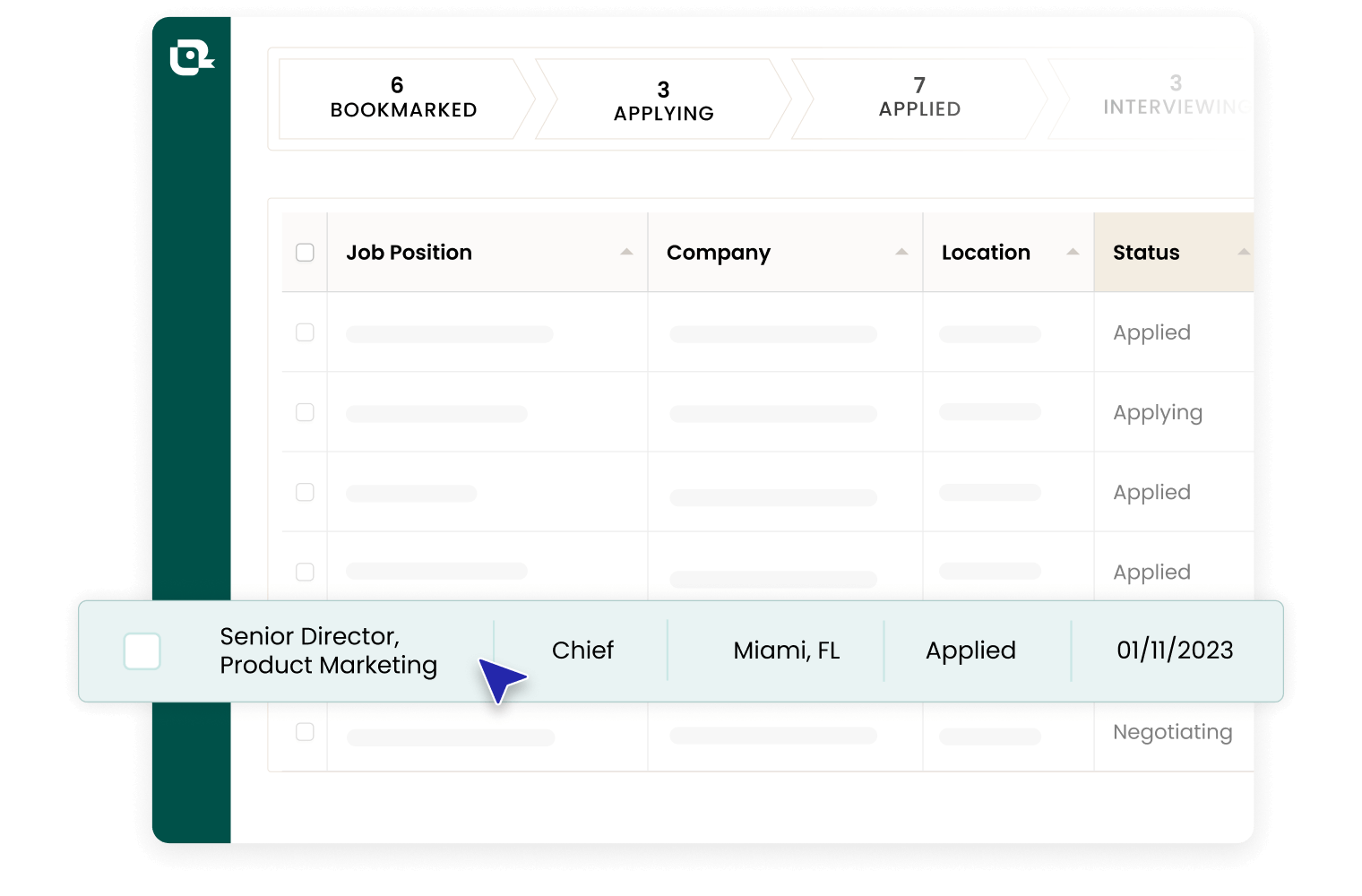

Stay Organized with Interview TrackingWorry less about scheduling and more on what really matters, nailing the interview. Simplify your process and prepare more effectively with Interview Tracking.

Interviewing as a Loan OfficerNavigating the path to becoming a Loan Officer involves a critical juncture: the interview. This is where your financial acumen, interpersonal skills, and ethical standards are put to the test. Loan Officers are the linchpins in the lending process, requiring not only a deep understanding of financial products but also the ability to build trust with clients and adhere to regulatory standards. In this guide, we’ll dissect the array of questions that you, as a Loan Officer candidate, should anticipate. We’ll break down the significance of each question type, from probing your technical knowledge to assessing your customer service prowess. We’ll provide insights into crafting impactful responses, preparing effectively for the interview, and identifying the traits that epitomize a top-tier Loan Officer. Armed with this knowledge, you’ll be poised to make a compelling impression in your interviews, paving the way for a successful career in the financial sector.

- Learn About the Lending Institution: Look into the history, loan products, target customers, and market niche of the lending institution. If you know where the company stands in the financial world, you can make sure that your answers fit with their values and goals.

- Review Financial Products and Regulations: Learn about the different types of loans, like mortgages, personal loans, and business loans. Also, get to know the latest financial rules and regulations. This information is very important for doing the job well and showing off your skills in the interview.

- Get ready for behavioral questions by thinking about your past work in customer service, sales, or finance and being ready to talk about how you dealt with tough situations like dealing with difficult customers or figuring out complicated financial situations.

- Brush up on your analytical skills. Loan officers need to be able to analyze loan applications and financial data with ease. Go over important financial numbers again and practice reading credit reports and financial statements.

- Prepare Insightful Questions About the Role and the Institution: Think of questions that show you are interested in the specifics of the Loan Officer position and the practices of the institution. For example, you could ask about their underwriting process or how they get new customers.

- Do Mock Interviews: Practice with a mentor or a peer, focusing on how to explain what you know about how loans work and how you can help the institution succeed. The feedback you get from these sessions can help you improve how you do interviews.

By following these steps, you will be able to demonstrate a comprehensive understanding of the Loan Officer role and how it fits within the broader context of the financial services industry. Your preparation will show potential employers that you are not only knowledgeable but also genuinely interested in contributing to their teams success.