Learn how to view, download, print, or request by mail your annual 1099-R tax form that reports how much income you earned from your annuity.

It’s tax season again, which means it’s time to start gathering all those pesky 1099 forms that report income you received outside of your regular paychecks. As an independent contractor or someone who earns interest, dividends, rents, royalties or other types of miscellaneous income, chances are you will receive one or more 1099 forms. But what are these forms, why are they important, and where do you get them? Keep reading to find out everything you need to know about 1099 forms and how to use them when filing your taxes.

What is a 1099 Form?

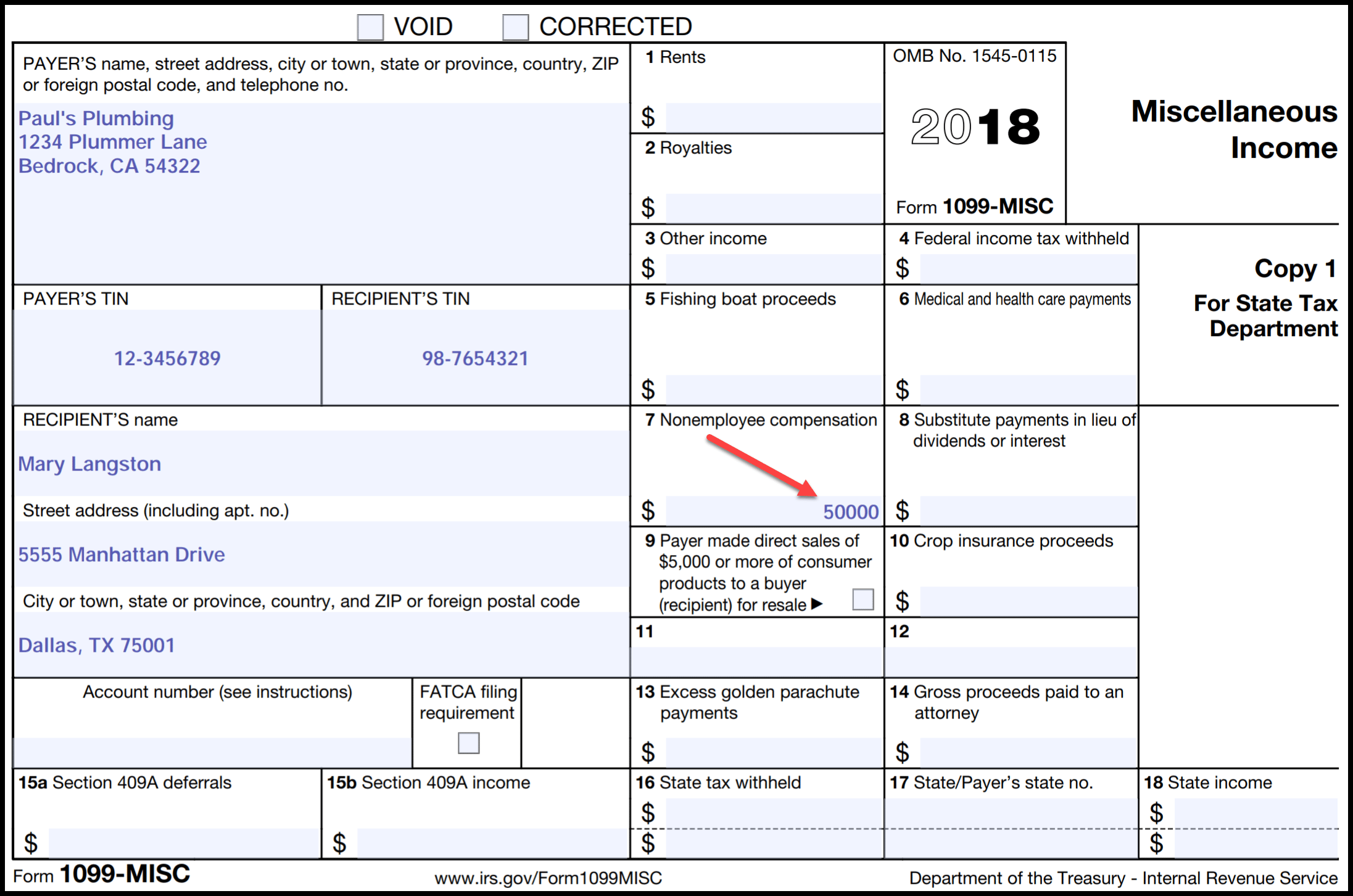

A 1099 form is an information return that is used to report various types of income other than wages, salaries, and tips (which are reported on a W-2 form) 1099 forms are filled out by the payer who distributes the funds, such as a bank that pays interest or an employer who pays an independent contractor. As the recipient, you will receive a copy of the 1099 form for your records so you can report the income on your tax return.

There are several different types of 1099 forms, each used to report a specific category of income

-

1099-INT – Reports interest income from sources like bank accounts, CDs, bonds, etc.

-

1099-DIV – Reports dividend income from investments

-

1099-MISC – Reports miscellaneous non-employee income like freelance/contract work, rent payments, royalties, etc. This is one of the most common 1099 forms.

-

1099-NEC – Similar to 1099-MISC but specifically for nonemployee compensation like independent contractor payments.

-

1099-R – Reports distributions from retirement accounts like 401(k)s and IRAs.

-

1099-G – Reports unemployment compensation and state/local tax refunds.

-

1099-K – Reports payment card and third party network transactions.

-

1099-S – Reports proceeds from real estate transactions.

-

1099-C – Reports canceled debt.

When Will I Receive My 1099 Forms?

By law, 1099 forms must be mailed out by January 31st for the previous tax year. However, many companies send them out earlier, so you may start receiving 1099s as early as mid-January.

If you have not received an expected 1099 form by early February, it is your responsibility to reach out to the payer and request it to make sure it wasn’t lost in the mail. The deadline to furnish 1099 forms to recipients is January 31, but they do not have to be filed with the IRS until the end of February (or the end of March if filing electronically).

Why are 1099 Forms Important?

It is crucial that you report all 1099 income on your tax return. The IRS receives copies of all 1099 forms issued to you, so they will be cross-checking to make sure you correctly reported the income. If you fail to report 1099 income, you could face penalties, interest, and potential audit risks.

When filing your return, you will need to enter the amounts exactly as shown on each 1099 form you received in order to match the IRS records. So be sure to keep all your 1099s organized and accessible when it’s time to file.

What Do I Need to Do With My 1099s?

Save each 1099 form you receive, as you will need to reference them when filing your tax return. Here are some tips for organizing and using your 1099s:

-

Review for accuracy – Give each one a quick look over to make sure the amount paid to you is correct. Contact the payer immediately if you find any errors.

-

Compare with your records – Double check that the amounts align with the income recorded in your books or financial records.

-

File chronologically – Keep all 1099 forms together in a safe place, filed chronologically by date or by type. This will make it easy to find later.

-

Enter info carefully – When filing your tax return, transcribe the information like recipient name, income amount, federal withholding, etc. accurately from each form.

-

Report all income – Be sure to report all 1099 income on the appropriate lines of your tax return, just as it appears on the form.

-

Attach if required – Some forms like 1099-MISC may need to be physically attached to your return when filing on paper. Check the instructions for each form.

-

Keep copies – Make photocopies of each 1099 form for your personal records in case you need them later. Also keep copies of any 1099s you send to contractors if you run a business.

Where Can I Get a 1099 Form?

If you are the payer responsible for issuing 1099s, you need to complete and distribute them to your recipients by the January 31st deadline. Here are some options for getting blank 1099 forms:

-

IRS website – You can download, print, and fill out current year IRS forms 1099-INT, 1099-DIV, 1099-MISC, 1099-NEC, and more at irs.gov.

-

Tax software – Many popular tax prep software programs like TurboTax and TaxAct allow you to prepare 1099 forms.

-

Office supply stores – During tax season, many office stores like Staples or Office Depot stock blank 1099 forms for purchase.

-

Online retailers – You can buy blank 1099 forms in packs from online retailers like Amazon or Ebay.

-

Print service providers – Companies like PDFfiller and 1099FIRE let you fill out digital 1099 forms online and then print and mail them for you.

No matter where you get them, make sure you are using the current year’s version of each form. Forms often update from year to year.

How Do I Fill Out a 1099 Form?

If you are issuing 1099s to contractors, employees, vendors or other payees, you will need to know how to properly complete these forms. Here are some tips:

-

Accurately enter payee information like name, address, and tax ID number.

-

Make sure the payment amounts you report match your business records. Double check your math.

-

For 1099-MISC forms, select the appropriate box to categorize the type of payment being reported.

-

Provide additional details if required, like withholding amounts or state tax information.

-

Triple check the recipient’s tax ID number to avoid an IRS notice.

-

Use the official IRS form that applies to the current tax year. Don’t use outdated forms.

-

Print clearly in black or blue ink if filling out by hand.

-

Make a copy for your records before distributing to payee by January 31.

For detailed steps on completing forms 1099-INT, 1099-DIV, 1099-MISC, 1099-NEC and others, download the IRS instructions for each form. Be sure you are familiar with all reporting requirements.

Can I File 1099 Forms Electronically?

While recipients will receive 1099s by mail in paper form, payers can also file them electronically with the IRS which is more efficient. Electronically filed 1099 forms are due by March 31st whereas paper filing is due by February 28th. To file 1099s online, you typically need filing software that supports IRS e-file. Options include:

-

Using 1099 software like 1099 Pro or Tax1099 that submits your forms electronically.

-

Generating 1099 e-file files through payroll providers like SurePayroll or QuickBooks Payroll.

-

Filing through an online tax preparation program like TurboTax.

-

Submitting 1099 XML files through the IRS FIRE system if you are a large volume filer.

No matter how you file, be sure to follow the IRS instructions for electronic filing. Notify payees that they will receive paper copies.

Penalties for Filing or Reporting 1099s Late or Inaccurately

It is important to take 1099 reporting seriously and avoid mistakes that could lead to IRS penalties. Potential penalties include:

-

A penalty of up to $270 per information return for late filing if filed 30+ days past the due date.

-

A penalty of $270 per information return if you fail to file entirely by the deadline.

-

A penalty of $530 per return for intentional disregard of filing requirements.

-

A penalty of $530 for filing a return with false or incorrect information.

-

A penalty of $270 per information return for failing to provide a copy to the payee.

Always be sure to file 1099 forms on time and double-check all entered information to avoid potentially steep IRS fines. Reach out to a tax professional if you need help.

Key Takeaways on 1099 Forms

-

A 1099 is used to report various types of non-wage income to the IRS.

-

Keep all 1099s received in a safe place and accurately enter amounts onto your tax return.

-

If you run a business,

How to access your 1099-R tax form

-

Sign in to your online account

Go to OPM Retirement Services Online

-

Click 1099-R Tax Form in the menu to view your most recent tax form

-

Select a year from the dropdown menu to view tax forms from other years

We make the last 5 years available to you online.

-

Click the save or print icon to download or print your tax form

How to request your 1099-R tax form by mail

Sign in to your account, click on Documents in the menu, and then click the 1099-R tile. Well send your tax form to the address we have on file. You can verify or change your mailing address by clicking on Profile in the menu and then clicking on the Communication tab.

Where can I get 1099 forms for free?

Where can I find information about Form 1099-MISC?

For the latest information about developments related to Form 1099-MISC and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form1099MISC. Free File Program. Go to www.irs.gov/FreeFile to see if you qualify for no-cost online federal tax preparation, e-filing, and direct deposit or payment options.

How do I send a 1099-nec to a contractor?

When you produce a 1099-NEC, you provide copies of the form to different recipients: Submit Copy A to the IRS with Form 1096, which reports all 1099 forms issued to contractors, and the total dollar amount of payments. Send Copy 1 to your state’s Department of Revenue. Provide Copy B to the recipient (the contractor).

How do I file a 1099 int?

When preparing your income tax return, the following 1099-INT information will be helpful: Box 1: Interest income — Enter this amount on Form 1040 or on Schedule B (if required). It’s taxable as ordinary income. Box 2: Early withdrawal penalty — This amount is charged when you withdraw a time investment, like a CD, early.

How do I file a 1099-MISC?

Enter the name and TIN of the payment recipient on Form 1099-MISC. For example, if the recipient is an individual beneficiary, enter the name and social security number of the individual; if the recipient is the estate, enter the name and employer identification number of the estate. The general backup withholding rules apply to this payment.