For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. He is the sole author of all the materials on AccountingCoach.com.

Office supplies are items used to carry out tasks in a company’s departments outside of manufacturing or shipping. Office supplies are likely to include paper, printer cartridges, pens, etc.

Shipping supplies are the cartons, tape, shrink wrap, etc. for preparing products that are being shipped to customers.

Manufacturing supplies are items used in the manufacturing facilities, but are not a direct material for the products manufactured. These will include a wide variety of items from cleaning supplies to machine lubricants.

If you’ve ever looked at an income statement, you’ve likely seen a line item for “supplies expense”. But what exactly does this represent? As an accounting term, supplies expense refers to the costs a company incurs for consumable items used in its operations during a reporting period. Let’s take a closer look at what comprises supplies expense and how it’s recorded in financial statements.

Overview of Supplies Expense

Supplies expense falls under the broader category of operating expenses. It includes costs related to:

- Office supplies like paper, pens, toner, etc.

- Factory supplies like lubricants, cleaning materials, small tools, etc.

- Any other consumable items used in a company’s daily activities.

These are items that are used up or worn out through normal business operations, across all departments Companies must continually purchase these items to keep their offices and facilities running smoothly.

Supplies expense is recognized on the income statement when the supplies are purchased or consumed. The goal is to match these costs to the period in which their economic benefits are realized.

Key Characteristics of Supplies Expense

There are a few important things to note about supplies expense in accounting

- Recorded when supplies are acquired or used, not when paid for. This matches expenses to usage.

- Usually charged to expense immediately since supplies are short-term assets.

- Immaterial costs like office supplies may be expensed immediately instead of tracking inventory.

- Factory supplies may be allocated to units produced as part of overhead costs.

- Presented as an operating expense on the income statement, below gross profit.

- Deducted from revenues when calculating profitability metrics like net income.

Properly recording supplies expense provides a more accurate picture of a company’s profitability in a given reporting period.

Examples of Supplies Expense

Supplies expense encompasses a wide variety of consumable items depending on the company. Here are some examples:

Office Supplies

- Paper, notebooks, pens, pencils, markers

- Toner, ink cartridges for printers

- Cleaning supplies for office kitchens, bathrooms

- Small appliances like coffee makers

Factory Supplies

- Lubricants, cleaning fluids, rags for machinery

- Janitorial supplies like mops, buckets, towels

- Work gloves, face masks, uniforms

- Solvents, adhesives, sealants

- Nuts, bolts, tools, spare parts

Other Supplies

- Medical supplies at a hospital

- Ingredients at a restaurant

- Gasoline for vehicles

- Lab chemicals at a research facility

As you can see, supplies expense encompasses a wide range of recurring costs essential for normal business activities.

Accounting Treatment of Supplies Expense

There are two main ways supplies expense is recorded in the accounting records:

1. Direct Expense Method

This simpler method expenses supplies as soon as they are purchased. Costs are directly charged to the supplies expense account. No inventory tracking is required.

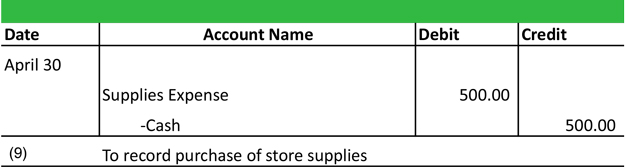

Example journal entry:

Supplies Expense $5,000 Accounts Payable $5,000Records $5,000 of various office supplies purchased on credit for immediate use. This directly increases expenses on the income statement.

2. Inventory Method

With this method, supplies are recorded in an asset account like Supplies Inventory when purchased. As supplies are actually used, this balance is reduced and supplies expense is increased. More complex but provides more accuracy.

Example journal entries:

Supplies Inventory $10,000 Accounts Payable $10,000Supplies Expense $3,000 Supplies Inventory $3,000 The first entry records a purchase of $10,000 of factory supplies. The second entry reduces the supplies inventory asset and records $3,000 of supplies expense as those items are consumed in production.

Presentation on Financial Statements

On the income statement, supplies expense is deducted as an operating expense when calculating gross profit and net income for a period. It’s listed with other costs like wages, utilities, etc. that are needed to operate the business.

The balance sheet may include a “Supplies Inventory” line item as a current asset if the company tracks supplies on hand. More commonly, supplies are immediately expensed and so do not appear on the balance sheet.

Impact on Financial Reporting

Properly recording supplies expense results in a more accurate income statement and matching of expenses to the period in which associated revenue is earned. However, companies can potentially manipulate reported profitability through supplies expense recognition policies.

For example, aggressively writing off supplies purchases as immediate expenses could temporarily decrease income. Conversely, delaying the recognition of supplies usage could defer expense recognition and increase current period profits.

As with all reporting, the goal is to accurately reflect the economic reality of purchasing and consuming supplies inventory during the normal course of operations. Following established accounting principles helps minimize manipulation.

Key Takeaways

- Supplies expense represents a company’s cost of consumable items used in its business during a reporting period.

- Common examples include office supplies, factory supplies, and other operating items that are used up.

- Supplies costs are recognized as expenses either when purchased or consumed, depending on inventory policy.

- Recognizing supplies expenses reduces net income and matches costs to revenues.

- Supplies expense is deducted as an operating expense on the income statement.

Accounting for Shipping Supplies

The cost of shipping supplies on hand will be reported as a current asset on the balance sheet and the shipping supplies used during the accounting period will be reported on the income statement as Shipping Supplies Expense.

Accounting for Office Supplies

The cost of office supplies on hand at the end of an accounting period should be the balance in a current asset account such as Supplies or Supplies on Hand. The cost of the office supplies used up during the accounting period should be recorded in the income statement account Supplies Expense. When supplies are purchased, the amount will be debited to Supplies. At the end of the accounting period, the balance in the account Supplies will be adjusted to be the amount on hand, and the amount of the adjustment will be recorded in Supplies Expense. (If the amount of supplies on hand is insignificant, a company may simply debit Supplies Expense when the supplies are purchased.)

Supplies and Supplies Expense What’s the difference

FAQ

What type of account is supplies expense?

|

Account

|

Type

|

Debit

|

|

STATE UNEMPLOYMENT TAX PAYABLE

|

Liability

|

Decrease

|

|

SUPPLIES

|

Asset

|

Increase

|

|

SUPPLIES EXPENSE

|

Expense

|

Increase

|

|

TRADING SECURITIES

|

Asset

|

Increase

|

What is supplies expense in accounting?

Supplies expense in accounting refers to the cost of a collection of goods that the company used during a specific reporting period to operate. Staff members may use these items regularly to complete their daily tasks. For example, an accountant might consider ink cartridges for the office printer as a supplies expense.

When is a Supply expense recorded in a company’s books?

Required: In the company’s books: 1. When supplies are purchased 2. When cost of supplies used is recorded as supplies expense Supplies expense for the period = $500 – $150 = $350 What is the purpose of adjusting entry at the end of accounting period?

How are supplies recorded in accounting?

Specifically, they are initially recorded as assets by debiting the office or store supplies account and crediting the cash account. At the end of the accounting period, the cost of supplies used during the period becomes an expense and an adjusting entry is made.

When cost of supplies used is recorded as supplies expense?

When cost of supplies used is recorded as supplies expense Supplies expense for the period = $500 – $150 = $350 What is the purpose of adjusting entry at the end of accounting period? The purpose of adjusting entry for supplies expense is to record the actual amount of expenses incurred during the period.