So, you’ve earned—or are about earn—a bachelor’s or master’s degree in finance or a related field, and you’ve decided to sell securities. Or, you’ve decided to add securities to your financial services or insurance repertoire. Now that you have charted your path, the next step is earning the licenses you need to practice your profession.

A financial securities license is an essential certification for individuals who want to have a career in the securities industry This license demonstrates to employers and clients that you have the qualifications and competencies to perform securities transactions responsibly

But what exactly are securities licenses, who needs them, and how do you go about getting one? As someone interested in entering the financial services sector, these are important questions to have answered.

In this comprehensive guide I will explain in simple terms everything you need to know about financial securities licenses. We will cover

- What are securities licenses

- Why you need a securities license

- Who requires securities licenses

- The main types of securities licenses

- How to obtain a securities license

- The costs involved

- Frequently asked questions

Let’s get right into it!

What Are Securities Licenses

A securities license is a certification legally required by the Financial Industry Regulatory Authority (FINRA) to conduct business in the securities industry.

Securities refer to tradable financial assets like stocks, bonds, exchange traded funds, and options. Conducting transactions involving securities requires registration with FINRA.

The licenses certify that individuals have met competency standards and have an adequate understanding of securities regulations This ensures ethical business practices and protects investors

These licenses are mandatory for securities brokers, traders, financial advisors, and other professionals who deal with securities as part of their work. Each license has permission for specific activities.

Having securities licenses promotes trust, credibility, and business for license holders. It shows prospective employers and clients that an individual is qualified to handle securities responsibly.

Why You Need a Securities License

There are several important reasons why financial professionals need to acquire securities licenses:

Legal Requirement

A securities license is a legal prerequisite mandated by FINRA to conduct securities business. It is illegal to participate in activities like securities trading and financial advising without appropriate licenses. Violators can face stiff penalties or even jail time.

Access to Securities Exchanges

With a securities license, you gain entry into stock exchanges and get trading privileges. You are legally certified to buy and sell securities for clients. Without licenses, exchanges will bar you from conducting securities transactions.

Client Trust and Confidence

Possessing securities licenses inspires confidence and trust from prospective clients. They feel secure knowing they are dealing with vetted, certified professionals who meet FINRA qualifications.

Career Advancement

Securities licenses open doors to lucrative job opportunities and career advancement in the securities sector. Positions like investment advisor and fund manager usually require applicants to hold relevant licenses.

Higher Salaries

Licensed professionals attract higher remuneration packages compared to unlicensed individuals. Employers offer premium pay for licensed staff given the trust and skills they bring.

Who Requires Securities Licenses

While not exhaustive, the following professionals are required to acquire relevant securities licenses for their work:

- Investment advisors

- Stockbrokers

- Financial advisors

- Fund managers

- Insurance agents selling securities-based insurance products

- Commodity traders

- Account executives

- Compliance officers

Even established veterans moving into management roles dealing with securities need to be licensed. Firms also need licenses for their entities. Unlicensed individuals are restricted to only administrative functions.

Main Types of Securities Licenses

There are different license types issued by FINRA and NASAA catering to specific securities activities:

FINRA-Administered Licenses

Series 6 – For investment company and variable contracts representatives. Permits mutual funds and variable annuities sales.

Series 7 – The most comprehensive license covering diverse securities like stocks, ETFs, options, bonds etc. For general securities representatives.

Series 22 – For direct participation programs representatives dealing with partnerships, REITs and LLCs.

Series 79 – For investment banking roles underwriting corporate securities. Needed with Series 7.

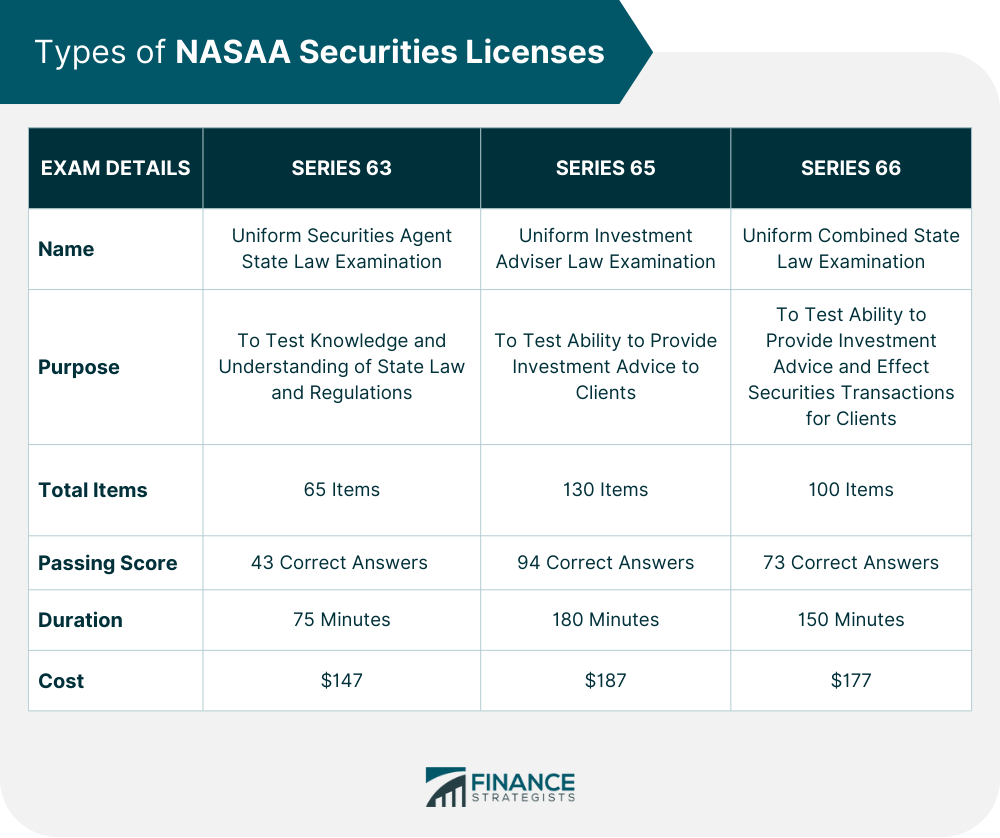

NASAA-Administered Licenses

Series 63 – Covers state laws for securities advisors. Required in most states together with Series 6 or 7.

Series 65 – For fee-only investment advisors. Covers advising and portfolio management.

Series 66 – Combines Series 63 and Series 65 content. The unified advisor law exam.

There are also licenses like Series 24, Series 27, Series 53, Series 82 etc. for supervisory roles. The required license depends on your specific financial services career path.

Most professionals start with the generalized Series 7 or Series 6 before adding on specialized licenses. Some licenses also require prerequisites.

How to Obtain a Securities License

Follow these key steps to get licensed:

1. Pass the Securities Industry Essentials (SIE) Exam

The SIE exam tests basic securities industry knowledge. Passing it is compulsory for subsequent FINRA exams like Series 6 and 7.

2. Pass Desired Qualification Exams

Based on your intended role, pass the relevant qualification exam e.g. Series 7, Series 66 etc. Each has its own focus area, content and passing score.

3. Register with CRD

Apply for FINRA registration on the Central Registration Depository (CRD) within two years of passing exams. This grants your license.

4. Pass Any State Requirements

Meet additional requirements for states you wish to conduct business in e.g. exams, experience, fees.

5. Maintain Your Licenses

Undertake the required continuing education courses annually to maintain your licenses. Report any disclosures also.

Passing the exams requires extensive studying and preparation. It is recommended to enroll in exam prep courses. These guide you on information covered, test format, study resources and offer practice exams.

Costs Involved in Getting Licensed

You should budget both time and money when planning to get licensed. Key costs involved include:

- Enrollment fees for exam prep courses – $200 to $1000

- Registration fees for exams – $40 to $305 per exam

- Required qualifying exams – At least 2, maybe more

- CRD registration fees – $100 to $110 initially, $45 annually

- State registration and renewal fees – Varies across states ($30 to $300)

- Continuing education courses – About $100 annually

Overall, budget $1000 to $3000 for prep materials, exams and registrations. This excludes travel costs if taking exams at designated centers.

Also set aside at least 6 weeks of thorough preparation for exams. It may take 3 to 6 months to complete all requirements.

Frequently Asked Questions

Which is the most important securities license?

The Series 7 license is the foundation license allowing for the broadest range of securities activities. Many specialized licenses require it as a prerequisite.

What securities license is needed to be a financial advisor?

Most financial advisor roles require the Series 65 license at a minimum. Advisors recommending specific securities investments also need Series 7.

How long are securities licenses valid?

Licenses are valid for 2 to 4 years before needing renewal. You must also complete annual continuing education courses to stay current.

Can someone with a criminal record get securities licensed?

Yes, it is possible if the offense was not financial services related. However, full disclosure is required during background checks. Some applications may be denied based on past misconduct.

What is the pass rate for securities license exams?

Pass rates range from 70% to 92% depending on the specific exam. The 6 hour long Series 7 exam has a 92% pass rate. Shorter exams tend to have lower pass rates.

Final Thoughts

A securities license is mandatory for conducting securities transactions and advising services legally. They validate skills and promote trust in license holders.

While certainly no walk in the park, licensing exams can be passed with diligent preparation over 6 to 12 weeks. Study materials, determinations and patience is key.

The costs may seem high initially, but they pay for themselves quickly given the lucrative opportunities that open up.

If you aspire towards a career dealing with securities, then proper licenses are absolutely essential. They get your foot through the door and elevate your standing as a finance sector professional.

Step 3: Determine Which Securities License or Licenses You’ll Need

You can’t sell securities at a brokerage firm without being licensed. The types of licenses you’ll need depend on the brokerage that’s hiring or sponsoring you. Most of those who hire or train new advisors will have a mandatory licensing program included in their training package, and almost all firms mandate which securities licenses must be obtained to sell the companys products and services. If you intend to be a Registered Investment Advisor or an independent broker-dealer, you’ll also need to be licensed.

Most Common FINRA and NASAA Securities Licenses

- Series 6: If you want to sell mutual funds, variable annuities, and other investment packages, you’ll need this license. Administered by FINRA and known as the limited-investment securities license, the Series 6 license enables you to sell what are known as packaged investment products. If you’re an insurance agent who wants to sell variable products, you’ll also need this license.

- Series 7: If you’d like to be a stockbroker, this is the license for you. Administered by FINRA and known as the general securities representative license, the Series 7 license authorizes you to sell virtually any type of individual security, such as preferred stocks, options, bonds, and other individual fixed income investments—plus all forms of packaged products. Basically, this license enables you to sell everything except commodities futures, real estate, and life insurance.

- Series 3: If you want to sell commodity futures contracts, you need the Series 3 license, also administered by FINRA.

- Series 31: If you want to sell managed futures, which are pooled groups of commodities futures, you’ll need the Series 31 license, an offshoot of the Series 3 license.

- Series 63: If you have a Series 6 license or a Series 7 license, and you want to do business as a stockbroker or sell mutual funds in any state, you need this license. Administered by NASAA, Series 63 is known as the Uniform Securities Agent license.

- Series 65: If you want to be a financial planner or advisor who works for an hourly fee rather than a commission, or you want to be a stockbroker or other financial representative who deals with managed-money accounts, you’ll need this license. It’s also administered by NASAA.

- Series 66: If you have a Series 7 license, you have already answered a good portion of the Series 65 exam, so instead of earning Series 63 and Series 65 separately, you can choose to hold this license instead.

- Series 79: If you want to offer advice or facilitate debt or equity offerings (public or private), mergers or acquisitions, tender offers, final restructuring, asset sales, and divestitures or corporate reorganizations, you’ll need this license.

- Series 99: If you plan to be a senior manager or a supervisor in operations or will have the authority to materially commit capital in various back office functions, you need this license.

These are the most common securities licenses. You can find a more comprehensive list at the FINRA and NASAA websites. Keep in mind that to earn some of these licenses, like the Series 6 and Series 7, you will need to be sponsored by or work for a broker-dealer.

If you work for a company, take advantage of financial education and training programs offered by them, which make include Securities Licensing exam prep. According to a recent College for Financial Planning report, 79% of financial professionals say financial education and training programs offered by their company is important as they are developing their careers.*