Outsourcing management and administrative functions can save your business money and increase efficiency. Be sure you understand the management services agreement before you take this step for your company.

Edward A. Haman is a freelance writer, who is the author of numerous self-help legal books. He has practiced law in H…

There can be many benefits to hiring an outside management company for your business. To help ensure things go smoothly, such an arrangement should be formalized with a management services agreement. This also may be called an administrative services agreement.

In today’s complex and competitive business landscape, companies are constantly looking for ways to reduce costs, increase efficiency, and focus on their core competencies. One popular strategy is outsourcing certain business functions to external management services providers. But before you can reap the benefits of outsourcing, you need a solid management services agreement (MSA) in place.

In this comprehensive guide, we’ll break down exactly what an MSA is, the key components you need to include, and some best practices for making the agreement work effectively. Let’s get started!

What is a Management Services Agreement?

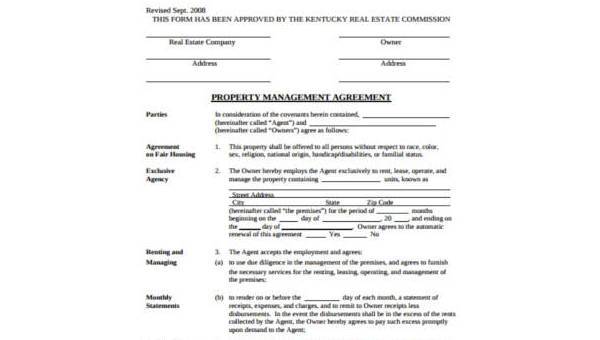

A management services agreement (MSA) is a legally binding contract between a business and an external management services provider. Under an MSA, the management services provider handles specific business functions and responsibilities on an ongoing basis

Common business functions that get outsourced under an MSA include:

- Accounting and bookkeeping

- Payroll administration

- HR and benefits management

- IT services and support

- Facilities management

- Marketing and advertising

- Legal and compliance

The goal of outsourcing these functions via an MSA is for the business to save money, benefit from the provider’s specialized expertise, and focus their internal resources on core business goals.

Key Components of a Management Services Agreement

A strong MSA will clearly define the scope of work, expectations, terms, and other details to prevent misunderstandings down the line. Here are some key components to include:

Services to be provided – Detail the specific tasks and responsibilities the provider will handle under the agreement. The more granular here, the better.

Performance standards – Lay out service levels, key performance indicators (KPIs), reporting requirements, etc. so expectations are clear.

Term and termination – State the length of the agreement and conditions for terminating early if performance issues arise.

Payment terms – Specify provider fees, payment frequency, invoicing procedures, late fees, and other financial details.

Indemnification – Establish responsibilities if third party claims or lawsuits arise from the provider’s services.

Insurance requirements – Mandate the types and minimum levels of insurance the provider must carry.

Confidentiality – Require confidential treatment of your company’s proprietary information.

Dispute resolution – Specify procedures like arbitration to handle any disagreements about the MSA’s terms.

Liability limitations – Limit the provider’s legal liability for damages unless willful misconduct caused them.

Record maintenance – State rules for maintaining and providing access to records related to the services rendered.

Best Practices for Management Services Agreements

Here are some key tips for making sure your MSA sets the outsourcing relationship up for success:

Conduct due diligence on the provider – Vet their expertise, track record, and ability to deliver on the agreement.

Define the scope clearly – Leave no room for interpretation on the provider’s responsibilities.

Set performance metrics – Tie provider fees to meeting key metrics like service levels, quality, budget, etc.

Maintain visibility – Require regular reports from the provider so you can monitor performance.

Build in flexibility – Allow for adjusting the scope and fees as needs evolve over time.

Watch for compliance issues – Avoid MSA terms that could limit your legal, regulatory, or compliance obligations.

Review insurance carefully – Inadequate coverage poses significant risk if claims arise.

Have legal review the agreement – An experienced attorney can help craft a balanced MSA protecting all parties.

Management Services Agreement vs. Professional Services Agreement

Management services agreements are frequently confused with professional services agreements (PSAs). While related, these two contract types have distinct differences:

-

Scope – An MSA is for ongoing, recurring services while a PSA is typically for a defined project or one-time service.

-

Duration – MSAs tend to be longer-term (1-5 years) while PSAs are shorter-term (weeks to months).

-

Payment terms – MSAs often have fixed recurring fees while PSAs have one-time project fees.

-

Exclusivity – PSAs are usually non-exclusive. MSAs can be exclusive or non-exclusive depending on the context.

The distinctions largely come down to the nature of the services – ongoing versus project-based.

Final Thoughts

Management services agreements allow businesses to strategically outsource non-core functions so they can stay lean and focused. Defining the terms upfront in a detailed MSA helps ensure an effective partnership. With clear expectations set, outsourcing via an MSA can provide tremendous value. Just make sure to involve your legal counsel to look out for your interests when drafting the agreement.

Using Outside Management Services

Many businesses hire an outside company to perform various management and administrative functions. The hired manager may be a corporation, limited liability company (LLC), partnership, or other type of business entity, or an individual operating as a sole proprietorship.

Compared with using in-house employees for management functions, contracting with an outside manager has the potential to reduce costs and increase efficiency. In addition to saving the costs associated with employees, your company also may be able to avoid the costs of equipment and office space associated with such employees.

A management services agreement can include many responsibilities, such as handling your employee payroll, developing and managing employee benefit programs, bookkeeping and accounting, maintaining company records, processing accounts payable and receivable, securing insurance for the company, and providing advice and consulting services for any number of needs.

If the management company is only hired for a specific project, the document may be called a project management consultancy agreement, or something similar.

Independent contractor vs. employee status

An important issue that arises with hiring any outside party is assuring the status of the outside party as an independent contractor. The Internal Revenue Service (IRS) has complex rules for determining whether someone will be classified as an employee or as an independent contractor. This also can be an issue under state law.

The management services agreement should be carefully written to establish, as clearly as possible, independent contractor status for the manager and its employees. IRS rules and state laws for determining independent contractor status are too complex for a comprehensive discussion here. However, consideration will be given to the degree of control the company has over the manager, and the degree of control the manager has over the company. A company may hire an independent contractor to do a certain job, but if the company gets too involved in dictating how the job is done, the relationship may be determined to be that of employer-employee.

MSO (Management Services Organization) Basics

What is a management services agreement?

A management services agreement is a contract between an external management or administrative professional and a company. The contract specifies the details of the relationship and when the professional relationship ends. It’s an important document that helps consultants and companies optimize the benefits they receive from the engagement.

What is a management services agreement (MSA)?

Learn about the purposes and goals of MSAs and how they apply to private practice ownership. What is a Management Services Agreement? A management services agreement (MSA) is a contract that facilitates the business relationship between two business entities, most often a non-physician-owned business entity and a physician-owned medical practice.

How to choose a management services agreement?

A suitable agreement is a better starting point to answer questions about work parameters, responsibilities, payment terms, business operations, and services provided. You can even specify what and how often the manager offers reports on the business and more with a management services agreement.

How do I create a management services agreement?

Creating your own Management Services Agreement is easy to do with Rocket Lawyer. To start the process, you can tap or click on the “Make document” button. You will then be guided through several questions about your situation to build your custom contract.