I keep trying to prove the old adage, “You get what you pay for,” is wrong. I want to pay little, yet get a lot. This a question of cost versus value. By nature we seemed wired to focus on the cost of a product or service. By changing your focus to value instead, you will make better decisions, get better results, and even save money in the end. Here’s how.

I recently grappled with the cost versus value equation regarding my exercise. Over the years, I’ve joined various gyms, bought home equipment, and downloaded exercise apps. My results were always mixed. I would do well for a period of time and then it would drop off.

Two years ago, I heard all the fuss about the Peloton bike and classes. I thought it would be the same as the other exercise plans I’d tried. So, I did nothing.

A year ago, after hearing even more people rave about their Peloton results, we bought one. It wasn’t cheap and it came with a monthly fee for the online classes.

From March (when it was delivered) to December 2021, I worked out 175 days. (Update: In 2022 I worked out 217 days.) These results make the Peloton the cost effective workouts of anything I’ve tried, even though it was the most expensive service.

Here’s the lesson: value is the results you get divided by the cost. Value is what works, not how cheap it is.

Understanding the nuances between value cost and price is essential both as a consumer and business owner. However, these fundamental economic concepts are often conflated or poorly defined. In this comprehensive guide, I’ll clarify the distinctions between value, cost, and price with definitions and illustrative examples.

By the end, you’ll have an intuitive grasp of how these interrelated terms differ. With this knowledge, you can make smarter purchasing decisions and strategically price your own products or services.

Defining Value, Cost, and Price

Let’s start with clear definitions of each term:

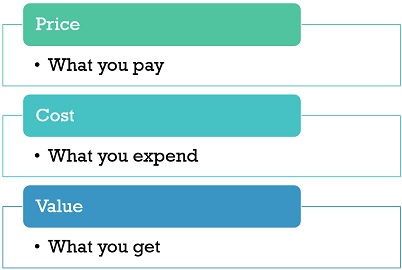

Value – The worth, importance, or usefulness that something provides. It’s subjective based on the benefits perceived by consumers.

Cost – The amount of money, time, materials, and other resources required to produce or obtain something. Costs are inputs for businesses.

Price – The amount of money being charged for a product or service. Prices can be set independently by the seller.

Value is inherent in the thing being exchanged. Cost refers to what it takes to supply that thing. Price represents what is asked of the buyer in the transaction.

These core concepts seem straightforward. But distinguishing them in real market scenarios can be tricky…

Illustrating the Differences

Hypothetical examples help crystallize how value, cost, and price interact while maintaining their distinct meanings:

Scenario 1 – Producing Furniture

John is an entrepreneur who builds chairs. Let’s break down value, cost, and price from both his producer perspective and the consumer view:

John’s Costs:

- Materials = $20 for wood, fabric, nails

- Labor = 5 hours at $15/hour wage = $75

- Overhead = $10 for rent, utilities, equipment wear

- Total Cost = $20 + $75 + $10 = $105

John’s Price:

- John prices the chair at $150 to make a profit

Customer Value:

- Jane needs a chair for her apartment dining table

- The chair John produced is sturdy and comfortable when Jane tries it

- Jane values the chair’s usefulness at $200

For John, the cost to produce the chair is $105. He then sets the price at $150 when selling to customers. Jane perceives the chair’s value as $200 because of its utility to her.

Jane is receiving surplus value by only paying $150 for something she appraises as worth $200. This scenario demonstrates how cost, price, and value differ from each producer and consumer perspectives.

Scenario 2 – Selling Concert Tickets

Let’s examine another common transaction around event tickets:

Promoter’s Costs:

- Performer Fee: $50,000

- Venue Rental: $10,000

- Marketing: $5,000

- Total Costs: $65,000

Face Value Ticket Price:

- 1,000 tickets at $100 each to cover costs and make a profit

Perceived Ticket Value:

- Fans of the performer may value front row seats at $500 given the experience

- Some may only value nosebleed seats at $50

The promoter incurring the show’s costs prices tickets at a certain price to make a profit. But the value varies greatly for each fan based on seat location and devotion to that artist. Sacrificing more money equates to higher value from their perspective.

This example again demonstrates the fluidity of value versus the more defined costs and prices.

Why Understanding These Differences Matters

You may be wondering, why does any of this abstract theory matter in the real world?

For consumers, recognizing the gaps between value, cost, and price allows you to make optimal decisions. You want to pay prices below your perceived value threshold.

Business owners need to price above costs to be profitable. But setting prices too high when customers don’t perceive adequate value leads to losses. Managing this balance requires separating these concepts.

Let’s explore some specific applications:

Pricing Strategically

Savvy entrepreneurs don’t merely factor costs and then attach some profit margin to set prices. They deeply understand their customers’ perceived value and willingness-to-pay for differentiated product experiences.

With this knowledge, you can strategically price different versions of your offering to capture surplus value. Airlines master this with first-class seating at premium prices for elevated service. The budget coach seats still cover costs while making air travel affordable for the masses.

Recognizing True Costs

Consumers often focus only on sticker prices rather than full costs. Calculate your real total cost of ownership when purchasing big-ticket items:

- Cars – The purchase price, insurance, gas, maintenance and repairs

- Homes – Mortgage payments, property taxes, utilities, upkeep

Thinking holistically helps avoid buying things you can’t actually afford long-term even if the upfront price seems reasonable.

Maximizing Consumer Surplus

As a buyer, your goal is to maximize consumer surplus – getting the most value possible relative to price paid.

Comparison shopping, negotiating prices lower, and waiting for sales are common tactics to increase the value differential. Patience and flexibility allow you to better align personal value perceptions with market prices.

Key Takeaways on Value, Costs, and Prices

-

Value is the worth or usefulness derived by the consumer. Cost reflects resources used by the producer to create and market offerings. Price is what the seller asks in exchange.

-

Value is subjective and varies across different consumers even for the same product. Costs and prices are more objective and defined.

-

Understanding these core distinctions is essential for producers in pricing strategically and buyers in recognizing true costs and maximizing surplus value.

-

Producers must price above costs but below customer value levels to succeed. Buyers aim to pay prices as far below personal value thresholds as possible.

In today’s world full of choices and new business models, properly differentiating between value, cost, and price is an economic must-have. Keep these foundational concepts in mind and you’ll make smarter decisions benefiting both sides of transactions.

Examples of Cost Versus Value

Here’s a couple more examples of cost versus value:

The Coaching Mastery Certificate Program requires an investment of time and money and has a tremendous value in terms of participant results. It produces extremely valuable shifts of mindsets and behaviors. Participants learn communication and leadership skills that can be immediately used in work, ministry, and everyday relationships. The price tag for these results is less than most other training programs out there of its length and type, and yet, more effective. That’s value.

A coaching engagement might feel expensive, but produces value beyond other types of assistance. Think of all the unused self-study courses and books you’ve purchased. The information they hold is valuable, but the value to you is only in the results from your application. It you don’t consistently apply it, there’s no value, regardless of how inexpensive it is. Coaching produces valuable insights while supporting you to apply those insights. The value of coaching is the results you see in your relationships, work, and life.

One more example: relationships. Consider the effort (cost) to maintain a good relationship and the happiness and fulfillment (value) it produces. The low-cost relationship is shallow or fleeting. When a person does something that offends us, we move on to someone else. But how satisfying are those relationships? When we put effort into a relationship by working through conflict, listening, making known and adjusting our expectations, compromising, forgiving and being forgiven, we grow as a person. Our relationship has history and progress. It goes deeper to more emotional levels. As humans, we find greater satisfaction in this type of relationship, and thus, are happier and more fulfilled. The cost in terms of the work to grow that kind of relationship is higher, but the value to us is also higher.