The most common methods that investors use to analyze the benefits and risks associated with long-term investments in the stock market include fundamental analysis, technical analysis, and quantitative analysis. Long-term investors look for investments that offer a greater probability of maximizing their returns over a longer period of time.

Generally, this means at least one year, although many financial experts suggest time frames of five to ten years or longer. One of the benefits of being a long-term investor is the ability to save and invest for big goals that require significant time to achieve the highest rewards, such as retirement.

By understanding the differences between fundamental, technical, and quantitative analysis, long-term investors give themselves access to three valuable stock-picking strategies they can use for making profitable investment decisions.

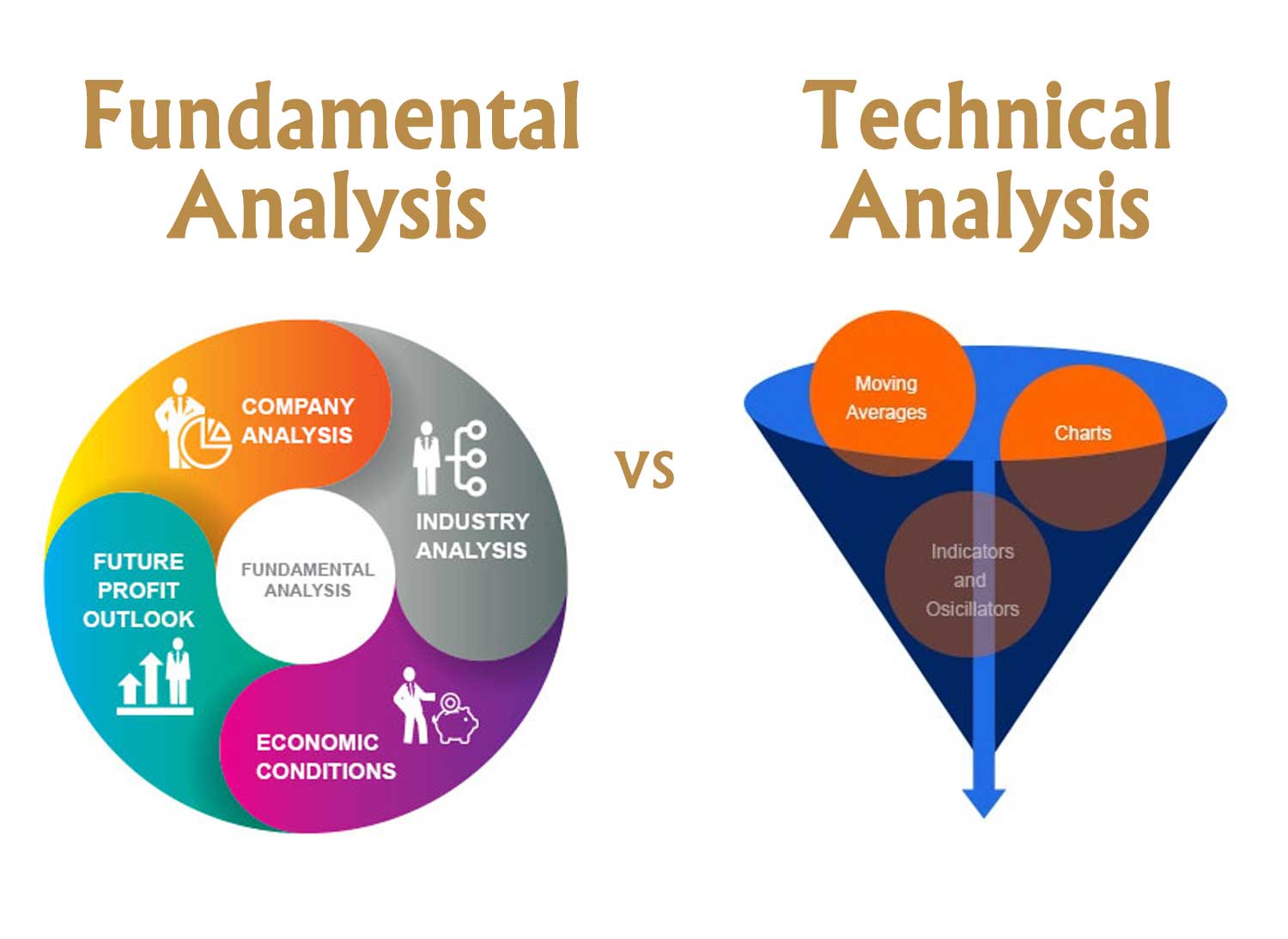

Investing in stocks can be an intimidating endeavor, especially for beginners. With thousands of stocks to choose from, how do you know which ones are worth investing in? This is where stock analysis comes in. Stock analysis helps investors evaluate stocks to determine their potential value and expected returns. The two most common methods of stock analysis are technical analysis and fundamental analysis. But which method is better for picking winning stocks?

In this article, we will compare technical analysis vs fundamental analysis, outlining the key differences and the pros and cons of each approach We will also provide examples of how each method is applied in practice By the end, you’ll have a solid understanding of both types of stock analysis so you can determine which is better suited to your investing style and goals.

What is Technical Analysis?

Technical analysis involves analyzing historical stock price charts, volume, and other market data to identify patterns and trends The core assumption of technical analysis is that all known information about a stock is already reflected in its share price

Some key principles of technical analysis include:

- Price trends tend to persist and recur over time

- Supply and demand drive prices

- Price movements are not purely random and tend to follow trends

Technical analysts use various indicators and charts to analyze and predict future price movements. Some popular technical indicators include moving averages, Bollinger Bands, relative strength index (RSI), and MACD.

Pros of Technical Analysis

- Provides objective analysis based on quantifiable data

- Useful for short-term trading and identifying momentum

- Helps set entry and exit points for trades

Cons of Technical Analysis

- Focus on price action ignores fundamentals

- Susceptible to false signals and confirmation bias

- Limited usefulness for long-term investing

What is Fundamental Analysis?

In contrast to technical analysis, fundamental analysis involves analyzing a company’s financial statements, management, competitive advantages, and industry conditions to estimate its intrinsic value. The goal is to identify undervalued stocks that can be expected to increase in price when the market corrects the mispricing.

Fundamental analysis considers both qualitative factors like management expertise and quantitative factors like revenue, profit margins, debt levels, and cash flows. Analysts use valuation models like discounted cash flow analysis and ratio analysis to calculate a stock’s fair value.

Pros of Fundamental Analysis

- Provides in-depth understanding of a company’s financial health

- Useful for long-term value investing

- Helps identify undervalued stocks

Cons of Fundamental Analysis

- Time-consuming process requiring deep research

- Delayed reaction to new information

- Less useful for short-term trading

Now that we’ve defined both terms, let’s dig into the key differences between technical analysis and fundamental analysis.

Key Differences Between Technical and Fundamental Analysis

Here are some of the main ways technical analysis and fundamental analysis differ:

-

Focus – Technical analysis focuses on studying market data and price trends while fundamental analysis focuses on a company’s financials and competitive advantages.

-

Data used – Technical analysis relies on price and volume data. Fundamental analysis examines financial statements, company assets, management expertise, and more.

-

Time horizon – Technical analysis aims to predict short-term price movements. Fundamental analysis has a long-term outlook on a stock’s value.

-

Trading strategy – Technical analysis helps time exactly when to buy or sell a stock. Fundamental analysis identifies undervalued stocks but does not indicate entry/exit points.

-

Information advantage – Technical analysis assumes all known information is already reflected in the share price. Fundamental analysis assumes insider knowledge can lead to a pricing edge.

-

Accuracy – Technical analysis is prone to false signals. Fundamental analysis has more ambiguity in valuation models.

Technical Analysis vs Fundamental Analysis in Practice

To better understand how each approach works in practice, let’s walk through some examples.

Technical Analysis Example

Mark is performing technical analysis on the stock of XYZ Company. He pulls up a stock chart over the last year and adds a 50-day and 200-day moving average. He sees that the 50-day MA just crossed below the 200-day MA, a bearish signal known as the “death cross.”

Looking at momentum indicators, Mark also notices that the RSI is showing XYZ stock as oversold at around 30. However, volume has been declining as the stock has drifted lower. This divergence between price and volume suggests waning downside momentum.

Given the oversold conditions combined with the loss of downside momentum, Mark uses technical analysis to conclude that a short-term upside bounce is likely. So he buys shares of XYZ Company.

Fundamental Analysis Example

Mary is performing fundamental analysis on ABC Company. She thoroughly reviews the company’s financial statements, including the balance sheet, income statement, and cash flow statement.

She calculates key ratios like the P/E, debt-to-equity, profit margins, and interest coverage ratio. She also researches the company’s management team, business model, competitive advantages, and threats.

After building a detailed financial model and estimating ABC’s intrinsic value at $20 per share, Mary concludes the current stock price of $15 is undervalued. The stock’s 25% upside to fair value makes it a good long-term buy.

So Mary uses fundamental analysis to determine that ABC stock is currently underpriced, even if the technical chart doesn’t show it yet.

As you can see from these examples, technical and fundamental analysis differ significantly in how they analyze stocks and arrive at investment decisions.

Which Stock Analysis Method is Better?

So which stock analysis method is better – technical or fundamental? Here are some key points:

-

For long-term investing based on a stock’s underlying value, fundamental analysis has the edge. It provides a thorough understanding of the business.

-

For short-term trading and identifying momentum shifts, technical analysis is preferable. Charts quickly show when momentum shifts.

-

Serious investors should learn both methods. Combining technical and fundamental analysis provides valuable complementary insights.

-

No method will be perfect or work in all markets. Even the best analysis involves making assumptions and estimates.

Ultimately there is no one “better” method of stock analysis. Each has its own purpose, strengths, and limitations. Learning to combine both technical and fundamental analysis is ideal to become a well-rounded investor able to make smart trades aligned with long-term valuations.

Here are the key takeaways when comparing technical analysis and fundamental analysis:

-

Technical analysis focuses on studying price trends and patterns through historical charts and market data. Fundamental analysis focuses on determining a stock’s intrinsic value through financial statements.

-

Technical analysis is better for short-term trading and identifying momentum shifts. Fundamental analysis has more efficacy for long-term value investing.

-

Both methods involve making assumptions and estimates. Using them together provides more complete insights.

-

Technical analysis provides entry and exit signals but ignores fundamentals. Fundamental analysis assesses value but doesn’t indicate timing.

-

For beginners, technical analysis is faster to learn but has more risk of false signals. Fundamental analysis takes more time to learn properly but provides a framework for assessing value.

Technical Analysis

The process of evaluating securities through statistics is known as technical analysis. Analysts and investors use data on market activity such as historical returns, stock prices, and volume of trades to chart patterns in securities movement. While fundamental analysis attempts to show the intrinsic value of a security or specific market, technical data is meant to provide insight into the future activity of securities or the market as a whole. Investors and analysts who use technical analysis feel strongly that future performance can be determined by reviewing patterns based on past performance data.

Technical analysis uses data from short periods of time to develop the patterns used to predict securities or market movement, while fundamental analysis relies on information that spans years. Because of the short duration of data collection in technical analysis, investors tend to use this method more in short-term trading. However, technical analysis can be a beneficial tool to evaluate long-term investments when combined with fundamental analysis.

Fundamental Analysis

The majority of investors who want to evaluate long-term investment decisions start with a fundamental analysis of a company, an individual stock, or the market as a whole. Fundamental analysis is the process of measuring a securitys intrinsic value by evaluating all aspects of a business or market. Tangible assets, including the land, equipment, or buildings that a company owns, are reviewed in combination with intangible assets such as trademarks, patents, branding, or intellectual property.

To perform fundamental analysis, youll want to review a companys financial statements, historical data, investor conference calls, press releases, analyst reports, and analyst estimates.

When evaluating the broader scope of the stock market, investors use fundamental analysis to review economic factors, including the overall strength of the economy and specific industry sector conditions.

Fundamental analysis results in a value assigned to the security in review that is compared to the securitys current price. Investors use the comparison to determine whether a long-term investment is worth buying because it is undervalued or if it is worth selling because it is overvalued.

Investopedia Video: Fundamental vs Technical Analysis

What is the difference between technical analysis and fundamental analysis?

Fundamental analysis considers both past and presented data about a stock, whereas technical analysis considers only past data. Fundamental analysis is useful for long-term investors. In contrast, technical analysis is useful for day traders and short-term traders who wish to earn profits by selling the stock over a shorter period.

What is technical analysis?

Technical analysis is an investment approach that analyzes market data, such as price and volume charts, to identify trends and make investment decisions. Technical analysis aims to identify patterns and trends that can be used to predict future price movements.

What is the difference between technical analysis and financial analysis?

It involves scrutinizing company financials, industry conditions, economic indicators, and management quality, akin to evaluating a business or economy’s health and prospects. Technical Analysis: In stark contrast, this approach ignores fundamental factors, concentrating exclusively on market price movements and trading volumes.

Can fundamental and technical analysis be combined?

Yes, fundamental and technical analysis can be effectively combined to make more informed investment decisions. By integrating these methods, investors can gain insights into both the intrinsic value of an asset (through fundamental analysis) and the market trends and timing (via technical analysis).