The Financial Modeling & Valuation Analyst is the premiere certification offered by the Corporate Finance Institute. With over 100,000+ student enrolments each year from 170 countries, it is certainly witnessing a surge in popularity. The FMVA is a relatively new certification, but it has still managed to outpace most of its competitors in generating interest from the industry. Part of that popularity has to do with their unique modular content structure which makes it suitable for a LOT of finance and banking roles.

But just how much will the FMVA help your career? Is it worth the time commitment and the cost? How does it compare with other popular certifications? These are question that you should be asking before you commit to any course or certification.

The Financial Modeling and Valuation Analyst (FMVA) certification has been gaining popularity over the last few years. But is it really worth investing your time and money into?

In this extensive 2023 review, we’ll dive deep into the FMVA program to help you decide if it’s right for your career goals.

What is the FMVA Certification?

The FMVA certification is an online training program offered by the Corporate Finance Institute (CFI). It teaches financial modeling, valuation, accounting, financial analysis, and other in-demand skills for finance careers.

The certification consists of:

- Preparatory courses reviewing accounting, finance, Excel, and math fundamentals

- 14 core courses teaching modeling, valuation, forecasting, and presentation skills

- Elective courses on advanced topics like M&A, real estate, ecommerce valuation, and more

- A final exam requiring 70% to pass

Once completed, you can list FMVA certification on your resume and LinkedIn profile. Over 1 million students worldwide have taken CFI courses since the institute was founded in 2016.

The Pros of FMVA Certification

Career Advancement

The modeling and valuation skills taught in the FMVA program are highly desirable in finance Recruiters and hiring managers see FMVA certification as a sign you can hit the ground running

Statistics from CFI show FMVA students earn an average salary of $121,000 per year. The knowledge gained can open doors to investment banking, private equity, venture capital, equity research, FP&A, and other lucrative roles.

Real-World Skills

Unlike conceptual finance programs, FMVA focuses on practical skills like building models in Excel. The course uses real-world examples and case studies, so what you learn mirrors on-the-job tasks.

Flexible and Self-Paced

FMVA lets you learn at your own pace. The online format means you can study anytime, anywhere. Plus you get lifetime access to program materials with a CFI membership.

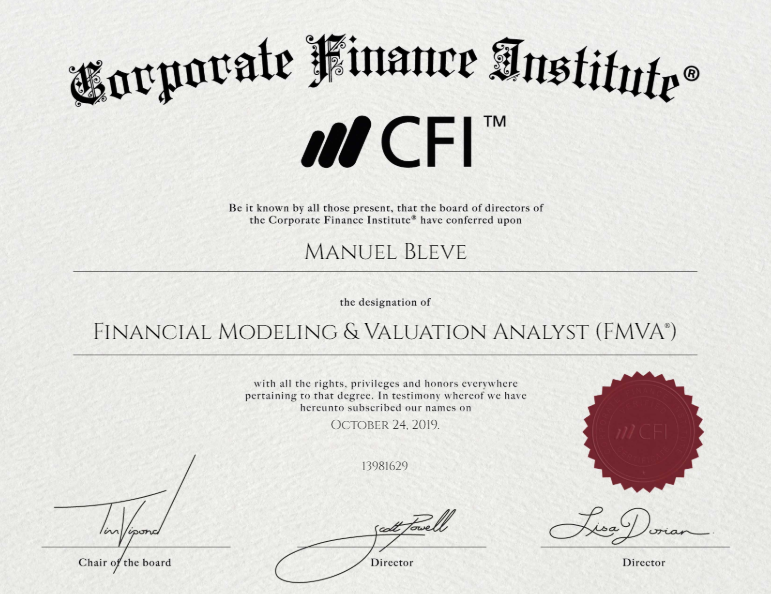

Shareable Certificate

Upon completing FMVA, you get a certificate to showcase on your CV, resume, LinkedIn, and other profiles. It’s a tangible way to demonstrate your financial modeling abilities.

Drawbacks of the FMVA Certification

No Prestige or Brand Recognition

While useful for skills, FMVA lacks the prestige of “gold standard” designations like the CFA. It’s simply not as well known or respected among finance professionals.

Easy Exams

FMVA exam questions are multiple choice and can be retaken unlimited times. This has led some to criticize FMVA as less rigorous than comparable programs with difficult proctored exams.

No Community

Unlike some online courses, FMVA doesn’t offer networking with fellow students. There’s no community forum to engage with peers and instructors.

Who Should Get FMVA Certified?

The FMVA curriculum lends itself well to certain professionals. It’s a great fit if you:

-

Work in accounting, FP&A, credit analysis, or other finance roles and want to transition to higher-paying positions in investment banking or corporate finance

-

Studied finance, accounting, economics but need to bolster your modeling skills before starting your career

-

Didn’t major in finance but want to break into the field. FMVA lets you gain finance skills without going back for another degree

-

Are unsure which finance career path to pursue and want to keep your options open

Essentially if you want to become a world-class financial modeler and business valuer, FMVA is a smart choice. While not required for finance roles, it can give your resume a competitive edge.

Who Shouldn’t Get FMVA?

FMVA makes less sense if you:

-

Only want a resume booster and are fine skipping the coursework. The FMVA credential lacks prestige, so it won’t impress recruiters on its own.

-

Don’t plan to use modeling/valuation skills. The program won’t benefit general management, marketing, or other non-finance professionals.

-

Want to interact with professors and peers. FMVA is 100% self-guided without a student community.

-

Are already a CFA charterholder. CFA trumps FMVA when it comes to reputation and rigor.

How Much Does FMVA Certification Cost?

FMVA certification is only available by enrolling in CFI’s membership program. Their self-study membership costs $497 per year and includes:

- Access to the FMVA certification curriculum

- 120+ finance courses

- 5,000+ video lessons

- Downloadable templates and models

- Certificate upon completing FMVA

The full-immersion membership is $847/year. It adds advanced analytical tools, 1:1 coaching calls, resume reviews, and more benefits.

While pricey upfront, CFI lets you take unlimited courses during your membership. The more certifications you complete, the more affordable it becomes.

Is the Time Commitment Worth It?

FMVA requires a meaningful time investment. It takes 4-6 months to complete the certification at a normal pace.

That said, the skills gain can last a career. Time invested upfront in modeling proficiency will save you exponentially more time in the future.

Think of FMVA as an intensive period of training to set yourself up for higher-level finance positions. The program also lets you work on your schedule, so you can balance it with existing commitments.

Final Recommendation – Worth It for the Right Person

For those serious about reaching the top of the finance field, FMVA is absolutely worth the time and money required. The modeling, analysis, and presentation abilities you develop are rewarded with lucrative career opportunities.

However, FMVA isn’t a fit for everyone. Make sure your career goals align with the curriculum before enrolling. If you won’t actually use financial modeling skills, the program likely isn’t worthwhile.

Bottom line – for aspiring investment bankers, private equity analysts, venture capital associates, and other elite finance professionals, FMVA is a smart investment in your future.

Flexible scheduling & fully online

Most finance certifications have a chicken and egg problem. You need those certifications to land your dream role, but because of fixed exam dates, it can takes years to earn them which might be too late. Which is one of the main problems that the FMVA solves. You can take it as per your own convenience/ schedule and don’t have to wait around for years.

The course is also fully online, including the tests. This might just be a minor convenience for some, but for others it can be a big deal. Either way, it means you can earn this certification from the comfort of your home at your own pace, without having to worry about deadlines. You can take the exams as per your own schedule.

I went through quite a few Corporates Finance books back in college, and while they were all great, there was a major flaw. Books are written from an academic perspective by academicians. They often lack the jargon used in the industry and are also light on real world applications of theoretical concepts.

The FMVA is especially helpful in this regard. You learn the lingo and little nuances that interviewers tend to pick up on subconsciously during an interview or other discussion. There are very few courses that focus on this, but the FMVA videos naturally use this Street/ City lingo. It might seem like a minor thing, but it can establish you as an industry insider during the hiring process or networking chats.

A certification is only as valuable as the reputation of the provider. The Corporates Finance Institute has become one of the better names in the world of finance and is poised for strong growth based my analysis. With over 100,000 enrolments each year, they have been creating a lot of buzz in the industry which has a ripple effect far and wide.

I had the same experience with some other certifications that I took over 10 years ago and some of them have become synonymous with their particular disciplines. I fully expect the FMVA to become that ubiquitous for corporate finance and related roles. So you are investing not just in your present, but in your future as well.

Special Offer for BankersByDay: Get 10% off the FMVA!

I don’t really consider the FMVA and CFA as direct competitors because they have different focus areas with marginal overlap. Still, as the CFA is the benchmark for finance certifications, it makes sense to make a quick comparison from the perspective of a finance practitioner.

The CFA curriculum is more focused towards portfolio management, security analysis, investments and other market related roles. Whereas the FMVA is more about valuations and financial modelling. This makes the FMVA more suited for investment banking or financial analyst roles while the CFA is preferable for investment management roles like portfolio and asset management.

That being said, curriculum is just part of the equation. Good certifications also reflect positively on your commitment, ability, intelligence and other positive attributes that employers look for. For example, if I was interviewing a candidate who has a project management certification that is not relevant to the finance role they are applying for, I would still view it in a positive light.

The FMVA can be completed in a few months. Most students require 100-150 hours of prep time depending on skill level. If you are already a finance student, it will be even less. This is also the biggest drawback of some of these other certifications like the CFA. It will take you years to clear the exams and you will also have to meet the rather lengthy work experience requirements. Which sort of defeats the purpose of such a certification in my opinion. You need the careers boost now. Not when you are already 4-5 years into your career.

The FMVA has the cost advantage here by a fair margin. Not only is the CFA several times more expensive to take, you will probably spend something extra on the prep resources as well. Personally, I still think the CFA is worth if you are targeting an investment role. But for everything else, stick with the FMVA.

I am assuming you are a finance student/ professional, and as a finance student you have probably figured out the opportunity cost equation here already. With the FMVA you will be ready and certified in a matter of months (assuming you clear the exams). That gives you a 4+ year head start compared to most other professional certifications.

The CFA is obviously one of the most recognized certifications since it’s been around for decades. But other certifications like the FRM and FMVA have been growing rapidly. The fact is they are not even in direct competition. CFA is for investments, FRM is for risk management and FMVA is financial analysts.

The FMVA is enrolling over 100,000+ students per year which is likely to increase its recognition as well. A certification is only as good as the reputation of its provider and from what I can tell, CFI is really committed to creating a similar quality brand and has already come a long way on that front.

Here is a summary:

| FMVA® | CFA® | |

| Focus Areas | Financial Modeling, Valuation | Investment/ Portfolio Management |

| Study Time (Estimate) | ~100 hours | ~600 hours |

| Time to Complete | <1 year | 3-5 years |

| Work Experience | Not required | 4 years |

| Exams | Online, anytime | On site, fixed dates |

FMVA Review (Financial Modeling and Valuation Analyst)

Is FMVA a good course?

While the quality of the material in the FMVA program is great, the online exam format will never render the same merit as a closed-book in-person exam like the CFA (Chartered Financial Analyst). No access to all reviews: Unlike Coursera for example, or a website like Amazon, you can’t see real reviews on the courses’ pages.

Is the FMVA worth it?

Not when you are already 4-5 years into your career. The FMVA has the cost advantage here by a fair margin. Not only is the CFA several times more expensive to take, you will probably spend something extra on the prep resources as well. Personally, I still think the CFA is worth if you are targeting an investment role.

How popular is the FMVA certification?

With over 100,000+ student enrolments each year from 170 countries, it is certainly witnessing a surge in popularity. The FMVA is a relatively new certification, but it has still managed to outpace most of its competitors in generating interest from the industry.

How do I get the FMVA certification?

What has the most impact is a high GPA, a top university, relevant internships, and soft skills. Now that we’ve got that out of the way, here’s how to access the FMVA program: You cannot purchase access to the FMVA certification by itself. Instead, you can only buy a CFI membership plan.