Most small businesses sell to their customers on credit. That is, they deliver the goods and services immediately, send an invoice, then get paid a few weeks later. Businesses keep track of all the money their customers owe them using an account in their books called accounts receivable.Whats Bench?Online bookkeeping and tax filing powered by real humans.

Here weâll go over how accounts receivable works, how itâs different from accounts payable, and how properly managing your accounts receivable can get you paid faster.

Accounts receivable and revenue are two common accounting terms that are often confused. However, it’s important to understand that accounts receivable is an asset, while revenue is an income statement account.

In this article, we’ll clarify the difference between accounts receivable and revenue, providing a clear explanation of their unique functions in accounting and financial reporting. We’ll also look at how to analyze and manage accounts receivable to maximize cash flow for your small business or startup.

Accounts Receivable Basics

First, let’s define accounts receivable. Accounts receivable (AR) is the balance of money owed to a company by its customers for goods or services delivered on credit.

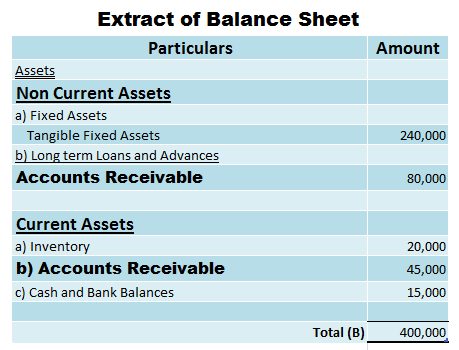

AR represents an asset because it entails a legal right to receive cash in the future when customers pay their bills. As an asset account, accounts receivable appears on the balance sheet under current assets.

Accounts receivable is made up of:

- Unpaid customer invoices from sales made on credit terms

- Outstanding balances from both current and prior billing periods

Common examples of accounts receivable include

- Products shipped to retailers but not yet paid for

- Services rendered to clients that are due net 30 days

- Software subscriptions billed quarterly in advance

Revenue Defined

In contrast to accounts receivable, revenue represents income earned by making sales of products or services. Revenue is an income statement account, not a balance sheet account.

Revenue is recognized when a sale is made This occurs either when

- Cash is received at the point of sale (cash basis)

- Goods are delivered or services rendered on credit (accrual basis)

Under accrual accounting, you book revenue when a credit sale is made, even though cash is not received until later when the AR is paid.

Key Differences Between AR and Revenue

While related accounts receivable and revenue play distinct roles

Accounts Receivable

- Balance sheet asset account

- Unpaid customer balances from credit sales

- Includes current + prior period sales

- Represents future cash to be collected

Revenue

- Income statement account

- Sales made during current period

- Recognized at point of sale

- Closed out each accounting period

Analyzing Accounts Receivable Trends

Accounts receivable analysis involves monitoring patterns in the AR balance over time. Trends to watch for include:

- Growing AR in relation to sales – Could signal loose credit policies or collection problems

- Increasing days sales outstanding – Indicates customers taking longer to pay

Compare AR to net credit sales monthly and year-over-year to catch issues early. Use AR aging reports to see which customers owe balances and how long they’ve been outstanding.

Steps to Optimize Accounts Receivable

To maximize cash flow, work to optimize your accounts receivable by:

- Establishing clear credit policies on amounts and terms

- Vetting new customers carefully before extending credit

- Sending invoices promptly and following up on past due accounts

- Offering discounts for early payment

- Accepting credit cards to enable faster payment

With diligent AR monitoring and management, you can minimize bad debts and keep cash flowing smoothly.

Key Takeaways on AR vs Revenue

-

Accounts receivable represents an unpaid credit sale that is owed to the company, while revenue is the income earned from the sale.

-

AR is an asset, as it entails a future economic benefit. Revenue is an income statement account closed out each period.

-

AR includes unpaid balances from current and past periods. Revenue reflects only sales in the current period.

-

Analyzing AR trends helps gauge credit policies and collection efficacy to enhance cash flow.

Give customers more ways to pay

If you only offer limited payment options, customers may be more inclined to drag their feet when the invoice due date rolls around. There are fees associated with accepting credit card payments, but allowing customers to pay using their credit cards is usually win-win: youâll get paid faster and they can rack up points.

What is an accounts receivable aging schedule?

Keeping track of exactly whoâs behind on which payments can get tricky if you have many different customers. Some businesses will create an accounts receivable aging schedule to solve this problem.

Hereâs an example of an accounts receivable aging schedule for the fictional company XYZ Inc.

Accounts Receivable Aging Schedule

XYZ Inc., as of July 22, 2021

| Customer Name | 1-30 days | 30-60 days | 60+ days | Total |

|---|---|---|---|---|

| Keithâs Furniture Inc. | $500 | $1,000 | $500 | $2,000 |

| Joes Fencing | $500 | $100 | $100 | $700 |

| ABC Paint Supply | $1,000 | $200 | $0 | $1,200 |

| Learner Farms | $1,000 | $0 | $100 | $1,100 |

| Ninas Pizza | $2,000 | $50 | $0 | $2,050 |

| Total | $5,000 | $1,350 | $700 | $7,050 |

A quick glance at this schedule can tell us whoâs on track to pay within 30 days, whoâs behind schedule, and whoâs really behind.

For example, you can immediately see that Keithâs Furniture Inc. is having problems paying its bills on time. You might want to give them a call and talk to them about getting their payments back on track.

Accrued Revenue vs Accounts Receivable – What is the Difference?

Is accounts receivable an asset?

When a company extends a credit for goods and services provided to their customer, the amount owed to the seller is known as accounts receivable. Since this amount is convertible to cash on a future date, accounts receivable is considered an asset.

Is accounts receivable a revenue account?

Accounts receivable is an asset account, not a revenue account. However, under accrual accounting, you record revenue at the same time that you record an account receivable. Let’s say you send your friend Keith’s business, Keith’s Furniture Inc., an invoice for $500 in exchange for a logo you designed for them.

What does accounts receivable mean?

Accounts receivable represents money customers owe you for goods or services you already delivered but have yet to get paid for. Accounts receivable are listed on the balance sheet of a company as a current asset. Accounts receivable may sometimes be referred to as “AR”.

What is accounts receivable (AR)?

Accounts receivable (AR) is the balance of money due to a firm for goods or services delivered or used but not yet paid for by customers. Accounts receivable is listed on the balance sheet as a current asset. Any amount of money owed by customers for purchases made on credit is AR.