The statement of cash flows is one of the three key financial statements that provides invaluable insights into a company’s liquidity and solvency While companies can use either the direct or indirect method to prepare the cash flow statement, the indirect method is overwhelmingly preferred in practice

In this comprehensive guide, I will explain what the indirect method is, walk through an example, and provide tips on how to prepare an indirect cash flow statement. Whether you are an entrepreneur, financial analyst or accounting student, understanding this important accounting treatment will help strengthen your financial statement analysis skills.

What is the Indirect Method?

The indirect method is an accounting approach used to convert the accrual-basis net income into cash flows from operating activities. By starting with net income, it reverses out all the non-cash items and adjusts for changes in balance sheet accounts to arrive at the total cash generated from core business operations.

Under the indirect method, the operating activities section of the cash flow statement begins with net income from the income statement. Then, non-cash expenses like depreciation are added back, gains/losses are adjusted, and changes in current assets and liabilities are incorporated.

Why Use the Indirect Method?

There are two key reasons why the indirect method is favored by accountants and financial analysts

-

Simplicity Most companies already use accrual accounting to prepare their income statement and balance sheet The indirect method seamlessly integrates with these existing statements

-

Time Savings: Listing every individual cash inflow and outflow for the direct method is cumbersome and time-intensive. The indirect method is much faster.

While the direct method provides a detailed view of cash movements, the indirect method is easier to prepare and more commonly used. Let’s walk through an example to see it in action.

Indirect Method Example

Below is a sample income statement and comparative balance sheet for a fictional company. We will use these statements to demonstrate how to prepare an indirect method cash flow statement.

Income Statement

- Sales: $500,000

- COGS: $300,000

- Operating Expenses: $50,000

- Depreciation Expense: $10,000

- Net Income: $140,000

Balance Sheet

| 2021 | 2022 |

|-|-|-|

| Cash | $20,000 | $18,000 |

| Accounts Receivable | $40,000 | $60,000 |

| Inventory | $25,000 | $35,000 |

| Accounts Payable | $30,000 | $20,000 |

| Total Assets | $100,000 | $120,000 |

Now, let’s walk through the indirect cash flow statement line-by-line:

Operating Activities

- Net Income: $140,000

- Add back Depreciation Expense: +$10,000

- Increase in Accounts Receivable: -$20,000

- Increase in Inventory: -$10,000

- Decrease in Accounts Payable: -$10,000

- Cash from Operating Activities: $110,000

First, we start with the net income from the income statement. Next, we add back depreciation expense since it is a non-cash expense.

We then see from the balance sheet that accounts receivable and inventory increased from 2021 to 2022. These increases in assets mean that cash must have been used to finance them, so we subtract the increases from net income.

Finally, accounts payable decreased over the year. This decline in a liability account also reduces cash, so we subtract it as well.

After making all these adjustments, we arrive at $110,000 in cash flows from operating activities.

Key Steps to Prepare the Indirect Method

Follow these steps to accurately prepare an indirect cash flow statement:

-

Start with net income from the income statement

-

Add back non-cash expenses like depreciation and amortization

-

Subtract non-cash gains like asset sales

-

Review changes in current asset accounts:

-

Increase in assets = subtract from net income

-

Decrease in assets = add back to net income

-

-

Review changes in current liability accounts:

-

Increase in liabilities = add back to net income

-

Decrease in liabilities = subtract from net income

-

-

The result after adjustments is cash from operating activities

Mastering this sequence will allow you to seamlessly convert accrual net income into cash flows.

Helpful Tips for Indirect Method Prep

Keep these tips in mind when using the indirect method:

-

Focus on changes in current asset/liability accounts only. Long-term accounts are handled in investing/financing sections.

-

Watch out for non-cash gains/losses like mark-to-market adjustments or asset impairments. These need to be reversed.

-

Tie your adjustments back to the comparative balance sheet to verify accuracy.

-

Remember that increases in assets mean a deduction from net income, while increases in liabilities mean an addition.

-

For assets, think “more assets = less cash”. For liabilities, think “more liabilities = more cash”.

Properly applying these best practices will result in a high-quality, accurate cash flow statement prepared using the indirect method.

Why is the Indirect Method So Commonly Used?

There are several reasons why the indirect method dominates real-world financial reporting:

-

Less costly: Requires less time and manual effort than the direct method.

-

Use existing data: Can rely on data from income statement and balance sheet.

-

Provides reconciliation: Acts as its own reconciliation of accrual net income to cash basis.

-

Meets accounting rules: Complies with GAAP and IFRS which allow the indirect method.

While regulators express a preference for the direct method, the indirect method satisfies reporting rules while offering convenience and cost savings.

Is the Indirect Method Acceptable?

Yes, the indirect method meets accounting rules and standards. The Financial Accounting Standards Board (FASB) states that firms have the option to use either the direct or indirect method for the operating activities section.

Using the direct method exclusively would require companies to maintain a separate set of books on cash basis in addition to their standard accrual accounting. For this reason, regulators continue to permit the indirect method despite its shortcomings.

What are the Drawbacks of the Indirect Method?

A few potential limitations of relying on the indirect method include:

-

Less transparent: Obscures visibility into specific cash inflows/outflows from core operations.

-

Distorts operating cash flows: Lumps together cash and non-cash items in the operating section.

-

Higher risk of errors: Relies heavily on adjustments and reclassifications when preparing.

While the indirect method is widely accepted, some argue it masks true company performance and cash generation capabilities.

Key Takeaways on the Indirect Method

Preparing the statement of cash flows using the indirect method is a fundamental finance skill. Key points to remember include:

-

It starts with accrual-basis net income and adjusts to cash flow.

-

It is widely used for its simplicity and efficiency.

-

Non-cash items must be reversed and balance sheet changes incorporated.

-

It is permitted by accounting standards despite certain limitations.

Mastering the indirect method allows financial analysts to adeptly convert financial statements and evaluate liquidity.

What is the Cash Flow Statement Indirect Method?

The indirect method for the preparation of the statement of cash flows involves the adjustment of net income with changes in balance sheet accounts to arrive at the amount of cash generated by operating activities. The statement of cash flows is one of the components of a companys set of financial statements, and is used to reveal the sources and uses of cash by a business. It presents information about cash generated from operations and the effects of various changes in the balance sheet on a companys cash position.

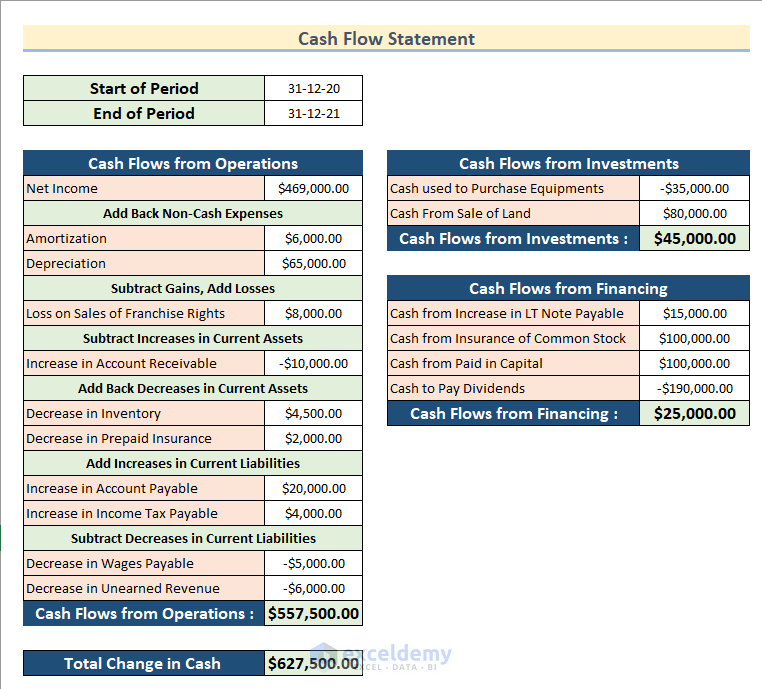

The format of the indirect method appears in the following example. In the presentation format, cash flows are divided into the following general classifications:

The indirect method of presentation is very popular, because the information required for it is relatively easily assembled from the accounts that a business normally maintains in its chart of accounts. The indirect method is less favored by the standard-setting bodies, since it does not give a clear view of how cash flows through a business. The alternative reporting method is the direct method.

Cash Flow Statement Indirect Method vs. Direct Method

Under the indirect method, the calculation of cash flows from operating activities begins with net income, which is then adjusted for changes in balance sheet accounts to arrive at the amount of cash generated or lost by operating activities. Under the direct method, actual cash flows are presented for items that affect cash flow. Examples of the items that are usually presented under this approach are cash collected from customers, interest and dividends received, cash paid to employees, cash paid to suppliers, interest paid, and income taxes paid. The difference between these methods lies in the presentation of information within the cash flows from operating activities section of the statement. There are no presentation differences between the methods in the other two sections of the statement, which are the cash flows from investing activities and cash flows from financing activities.

Prepare A Cash Flow Statement | Indirect Method

What is a cash flow statement indirect method?

The Cash Flow Statement Indirect method is used by most corporations, begins with a net income total and adjusts the total to reflect only cash received from operating activities. These adjustments include deducting realized gains and other adding back realized losses to the net income total. As a General Rule of Thumb-

How do you calculate cash flow from operations using indirect method?

Here’s a general rule of thumb when calculating the cash flow from Operations using the Cash Flow Statement Indirect Method. Asset account increases: subtract the amount from Net income Asset account decreases: add the amount to Net income How do Change in Current Liabilities effect Net Income?

What is indirect method in accounting?

The indirect method uses increases and decreases in balance sheet line items to modify the operating section of the cash flow statement from the accrual method to the cash method of accounting. The other option for completing a cash flow statement is the direct method, which lists actual cash inflows and outflows made during the reporting period.

What is the indirect method of financial analysis?

For many, the indirect method serves as a strategic tool for financial analysis. It gives a quick glimpse into operational efficiency. Net income forms the foundation of the cash flow statement in the indirect method. To understand a company’s cash flow, begin with the net income from the income statement.