We give an accrued revenue definition to explain the meaning and examples of accrued revenue. Accrued revenue is compared to unearned revenue (deferred revenue) and accounts receivable. The journal entry is made for accrued revenue as an asset and income statement revenue before billing and receiving cash from customers for proper revenue recognition in accounting.

Accrued revenue can be confusing for many small business owners I want to explain exactly what accrued revenue is, why it’s important, and walk through the steps to record it properly

What is Accrued Revenue?

Accrued revenue refers to revenue that has been earned but the cash has not yet been received,

For example, let’s say you are a graphic designer and you invoice a client $1,000 for a logo design. You finish the work in January, but the client isn’t scheduled to pay until February. In this case, you have $1,000 of accrued revenue in January that has not yet been paid.

The key things to note about accrued revenue are

- It has been earned through work performed or services provided.

- Cash has not yet been received.

- It should be recorded as revenue on the income statement.

- It should be recorded as a receivable on the balance sheet.

Accrued revenue allows you to match revenue with expenses properly, meaning your financial statements will be more accurate. It provides a better representation of actual economic events during a period.

Why Accrued Revenue is Important

There are a few key reasons why properly recording accrued revenue is important:

Match Revenues and Expenses

As mentioned above, accrued revenue allows you to match revenues with related expenses. This provides a more accurate picture of your income and retained earnings on financial statements.

For example, if you don’t record accrued revenue, all of your revenues may be pushed into the next accounting period. This means your revenue would be understated in the current period, while expenses are properly stated. Your financials would show a loss in the current period, even though you actually earned a profit once accrued revenue is considered.

Track Accounts Receivable

Accrued revenue will show up as an account receivable on your balance sheet. This allows you to track the amount of revenue earned that customers still owe you. Understanding your accounts receivable is critical for managing cash flow.

Understand True Profitability

By matching revenues and expenses in the proper period, accrued revenue helps you understand true profitability. You get a clearer picture of what your actual income was during a certain time period.

Adhere to Accounting Standards

Recording accrued revenue is necessary to adhere to the revenue recognition and matching principles under generally accepted accounting principles (GAAP). This ensures your financial reporting is consistent and comparable across businesses.

How to Record Accrued Revenue

Now that we’ve covered the importance of accrued revenue, let’s look at how to actually record it on your books. Here are the key steps:

1. Identify Accrued Revenue

First, review your financial records and identify any revenues that have been earned but not yet paid. Common examples include:

- Services performed but not yet billed (e.g. graphic design, consulting, etc.)

- Interest earned on loans but not yet received

- Rent earned but not yet collected

Make sure to only include revenues where work has been fully completed. Revenues for incomplete work are considered unearned revenues, not accrued revenues.

2. Make Adjusting Journal Entry

To get accrued revenue on the books, you need to record an adjusting journal entry. This should be done at the end of each accounting period.

The adjusting entry will:

- Debit Accounts Receivable

- Credit Revenue

For example, let’s say you provided $5,000 worth of services in June that have not yet been billed to customers. Here is what the adjusting entry would look like:

| Account | Debit | Credit |

|

What is the Accrual Accounting Method?

The accrual basis of accounting is broader than accrued revenue. Accrual accounting covers both accrued revenue and accrued expenses. Accrual accounting requires recording expenses in the same accounting period as related revenue, based on the GAAP matching principle.

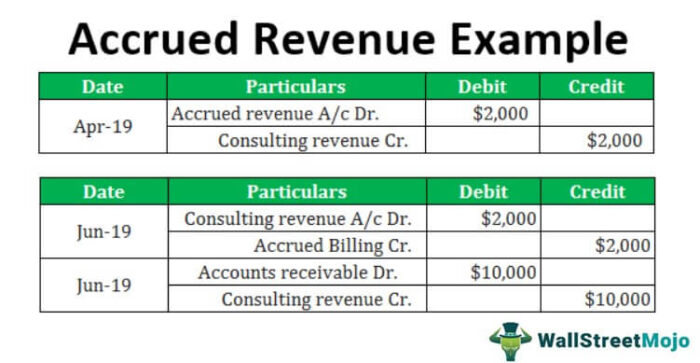

How to Record Accrued Revenue

Recording accrued revenue requires adjusting journal entries with double-entry bookkeeping and reversing the accrued revenue journal entry when product shipments or services are billed as accounts receivable. When interest income is earned but not yet received in cash, the current asset account titled accrued interest income is used to record this type of accrued revenue.

Accrued Revenue MADE EASY | Adjusting Entries

What is accrued revenue journal entry?

On the contrary, when the payment is actually made, the accrued revenue journal entry is made to the asset account. These accrued revenue figures enter the financial statements of a business as soon as the customers receives the delivery.

How do you record accrued revenue on a balance sheet?

On your company income statements, list it as earned revenue. Next, accrued revenues will appear on the balance sheet as an adjusting journal entry under current assets. Finally, once the payment comes through, record it in the revenue account as an adjusting entry. You can break the process into five steps:

What is accrued revenue?

To recap: Accrued revenue is an asset. You should record it after performing a service. It appears on financial statements before the actual payment comes through. You earn deferred revenue when customers pay for a service before you provide it. Accrued revenue uses the reversed process where payment follows a service.

What happens when a company records accrued revenue?

When one company records accrued revenues, the other company will record the transaction as an accrued expense, which is a liability on the balance sheet. When accrued revenue is first recorded, the amount is recognized on the income statement through a credit to revenue.