A cash flow statement is one of the most important financial statements for any business. It provides a detailed summary of the cash inflows and outflows for a company over a specific period of time.

Understanding how to prepare a proper cash flow statement is crucial for making informed business decisions and managing finances effectively. In this comprehensive guide, we will walk through the steps to create a cash flow statement from scratch.

What is a Cash Flow Statement?

A cash flow statement records the cash generated and used by a company during an accounting period. It breaks down and reports changes in cash and cash equivalents into three sections:

- Operating activities

- Investing activities

- Financing activities

The cash flow statement measures how well a company manages its cash position internally finances its operations and generates extra cash from external financing. It provides a reality check on the financial health of a business as it reflects the actual cash received and spent.

Compared to the income statement and balance sheet, the cash flow statement is most useful for:

- Analyzing liquidity issues

- Assessing operational efficiency

- Determining financial flexibility

- Evaluating investment decisions

- Forecasting future cash flows

Regularly creating and analyzing cash flow statements helps businesses monitor their cash flow and make better financial decisions

How to Prepare a Cash Flow Statement in 5 Steps

Follow these five steps to create a complete cash flow statement from scratch

Step 1: Calculate Cash Balance at the Beginning of the Period

The first step is to identify the cash balance at the start of the accounting period. This opening cash balance can be found on the balance sheet from the previous reporting period.

If it is the first cash flow statement you are preparing, look up the cash balance in the first month’s balance sheet. The opening cash balance sets the starting point for the rest of the calculations.

Step 2: Calculate Cash from Operating Activities

The operating activities section shows the amount of cash generated or used by regular business operations.

Operating activities include cash transactions related to sales, cost of goods sold, depreciation, taxes, payroll, supplies, maintenance, etc. Operating cash flows indicate how well a company can cover its expenses through core operations.

You can use either the direct or indirect method to calculate cash from operations.

Direct method

- List all cash inflows from sales and other operating revenues.

- List all cash outflows from operating expenses.

- Subtract outflows from inflows to get net cash from operations.

Indirect method

- Start with net income from income statement.

- Add back non-cash expenses like depreciation.

- Adjust for changes in working capital like accounts receivable.

- Make other adjustments to accrual-based figures.

- Arrive at net cash from operating activities.

The direct method is easier to interpret while the indirect method is faster to prepare. Both methods yield the same result for cash from operations.

Step 3: Calculate Cash from Investing Activities

The investing activities section shows the amount of cash generated or used by investments in long-term assets like property, equipment, securities, etc.

Investing cash flows include:

- Capital expenditures

- Purchases of securities

- Sales of fixed assets

- Business acquisitions

- Loans advanced to other entities

- Interest and dividend payments received

This section highlights how much cash was tied up in (or freed up from) long-term investments during the period.

Step 4: Calculate Cash from Financing Activities

The financing section presents cash flows from raising capital like debt and equity or returning capital like share buybacks and dividend payments.

Typical financing cash flows are:

- Issuing and paying off debt instruments

- Issuing and repurchasing equity shares

- Paying dividends and interest

- Making finance lease payments

The financing section shows how dependent a company is on external funding to meet its capital needs.

Step 5: Calculate the Ending Cash Balance

To arrive at the final cash balance, add up the net cash from all three activities:

Beginning cash balance

-

Net cash from operating activities

-

Net cash from investing activities

-

Net cash from financing activities

= Ending cash balance

The ending cash balance indicates the net increase or decrease in cash during the accounting period. It becomes the opening cash balance for the next reporting period.

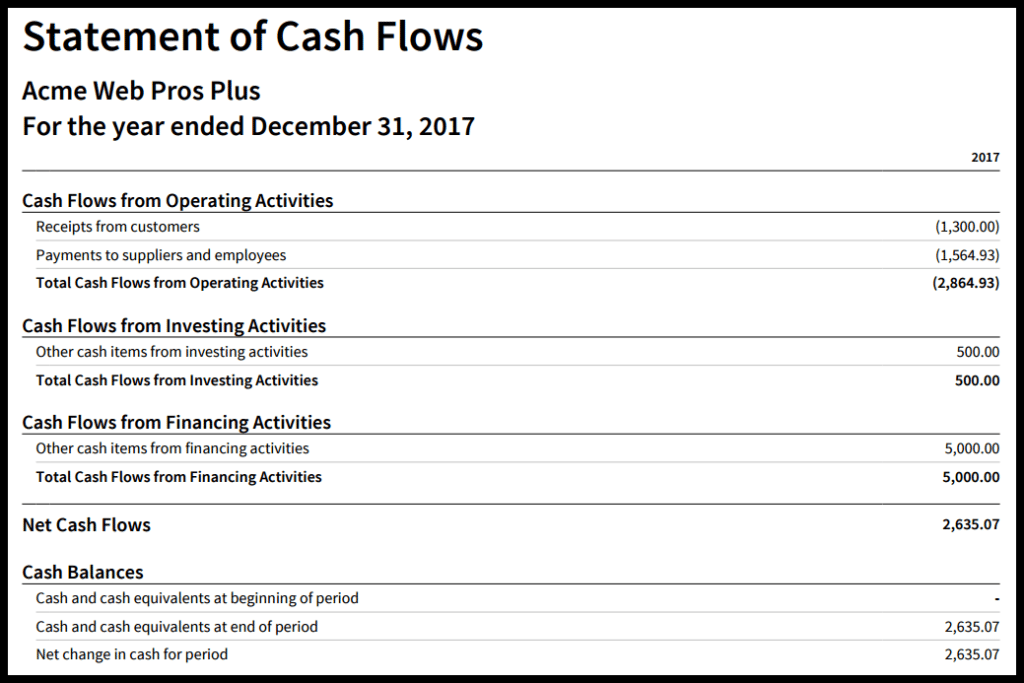

Cash Flow Statement Example

Let’s create a sample cash flow statement for a fictional company using the steps outlined above.

ABC Company Cash Flow Statement

For Year Ended December 31, 20X1

| Amount ($ 000s)

|-|-|

|Opening cash balance | 100

|Operating Activities|-|

|Cash from customers | 550

|Cash paid for inventory | (200)

|Cash paid to employees | (60)

|Cash paid for other expenses | (30)

|Net cash from operating activities|260|

|Investing Activities|-|

|Purchased equipment| (150)

|Net cash used in investing activities|(150)|

|Financing Activities|-|

|Issued new shares| 250

|Paid dividends| (50)

|Net cash from financing activities |200|

|Net increase in cash|310|

|Ending cash balance|410|

This sample cash flow statement was created using the direct method for operations. It breaks down the individual cash inflows and outflows from operating, investing, and financing.

The statement shows that the company generated a net cash inflow of $310,000 during the year, driven by positive operating cash flow of $260,000. The ending cash balance increased to $410,000.

This example highlights the importance of the cash flow statement in tracking changes in cash balances caused by business activities throughout the reporting period.

Tips for Preparing Cash Flow Statements

Here are some tips to prepare accurate, useful cash flow statements:

-

Clearly separate the three sections – operating, investing, financing. Don’t mix categories.

-

Use the direct method for cash from operations if possible. It provides more clarity.

-

Include only actual cash flows, not accounting accruals.

-

Add explanatory notes on major cash transactions if required.

-

Tie the ending cash balance to the balance sheet.

-

Compare cash flow statements over multiple periods to identify trends.

-

Break down cash paid for taxes and interest between operations and financing.

-

Ensure totals tally. Proofread for errors.

Importance of Cash Flow Statements

- Evaluate company’s ability to generate cash from operations

- Identify need for external financing

- Assess reasons for cash surplus or deficit

- Analyze effects of management decisions on cash flows

- Determine liquidity and solvency

- Forecast future cash positions

- Make investment and borrowing decisions

- Comply with accounting regulations

Regularly creating and studying cash flow statements helps managers monitor their company’s financial health, identify issues proactively, and maintain adequate cash reserves.

Cash Flow Statement vs. Income Statement vs. Balance Sheet

The cash flow statement measures the performance of a company over a period of time. But it is not as easily manipulated by the timing of non-cash transactions. As noted above, the CFS can be derived from the income statement and the balance sheet. Net earnings from the income statement are the figure from which the information on the CFS is deduced. But they only factor into determining the operating activities section of the CFS. As such, net earnings have nothing to do with the investing or financial activities sections of the CFS.

The income statement includes depreciation expense, which doesnt actually have an associated cash outflow. It is simply an allocation of the cost of an asset over its useful life. A company has some leeway to choose its depreciation method, which modifies the depreciation expense reported on the income statement. The CFS, on the other hand, is a measure of true inflows and outflows that cannot be as easily manipulated.

As for the balance sheet, the net cash flow reported on the CFS should equal the net change in the various line items reported on the balance sheet. This excludes cash and cash equivalents and non-cash accounts, such as accumulated depreciation and accumulated amortization. For example, if you calculate cash flow for 2019, make sure you use 2018 and 2019 balance sheets.

The CFS is distinct from the income statement and the balance sheet because it does not include the amount of future incoming and outgoing cash that has been recorded as revenues and expenses. Therefore, cash is not the same as net income, which includes cash sales as well as sales made on credit on the income statements.

Cash From Financing Activities

Cash from financing activities includes the sources of cash from investors and banks, as well as the way cash is paid to shareholders. This includes any dividends, payments for stock repurchases, and repayment of debt principal (loans) that are made by the company.

Changes in cash from financing are cash-in when capital is raised and cash-out when dividends are paid. Thus, if a company issues a bond to the public, the company receives cash financing. However, when interest is paid to bondholders, the company is reducing its cash. And remember, although interest is a cash-out expense, it is reported as an operating activity—not a financing activity.

The CASH FLOW STATEMENT for BEGINNERS

How do you create a cash flow statement?

You use information from your income statement and your balance sheet to create your cash flow statement. The income statement lets you know how money entered and left your business, while the balance sheet shows how those transactions affect different accounts—like accounts receivable, inventory, and accounts payable.

How to build a cash flow statement from balance sheet and income statement?

In order to build a cash flow statement from balance sheet and income statement, you will need the following: a copy of the company’s balance sheet for two accounting periods (previous year and current year) and a copy of the company’s income statement for the current accounting period.

Can a cash flow statement be put together?

Assuming the beginning and end of period balance sheets are available, the cash flow statement (CFS) could be put together—even if not explicitly provided—as long as the income statement is also available. Net Income ➝ Net income from the income statement flows in as the starting line item on the cash flow from operations section of the CFS.

What information can be used to prepare a cash flow statement?

This information can be used to prepare a cash flow statement. A statement of cash flows contains information about the flows of cash into and out of a company, and the uses to which the cash is put.