Struggling with profit and loss? Or still, figuring out how to calculate the profit margin in excel? Here is your answer, the Profit margin is an important figure for business because it tells the percentage of each profited sale. Profit margins are important when pricing products, pursuing financing and generating sales reports.

If you create the spreadsheet and input the formula properly, Microsoft Excel will calculate profit margins. If you need to calculate a profit margin, you can easily do so with a simple formula that uses the sale price and the cost. Knowing how to calculate your profit margin will help you take control of your business and ensure that each sale nets the profit you expect.

If Yes, you will enjoy this guidebook on ‘Excel Vlookup Formulas’ – VLOOKUP, HLOOKUP, MATCH & INDEX.

Calculating profit and profit margin in Excel is a key skill for accountants, finance analysts, and business owners.

Whether you’re tracking company profitability, analyzing product lines, or managing inventory – knowing your profit numbers is crucial

In this comprehensive guide, I’ll show you the easiest ways to calculate different profit metrics in Excel using basic formulas.

By the end, you’ll have the skills to analyze revenues, costs, and profits for better business decisions.

Let’s get started!

What is Profit and Why Does it Matter?

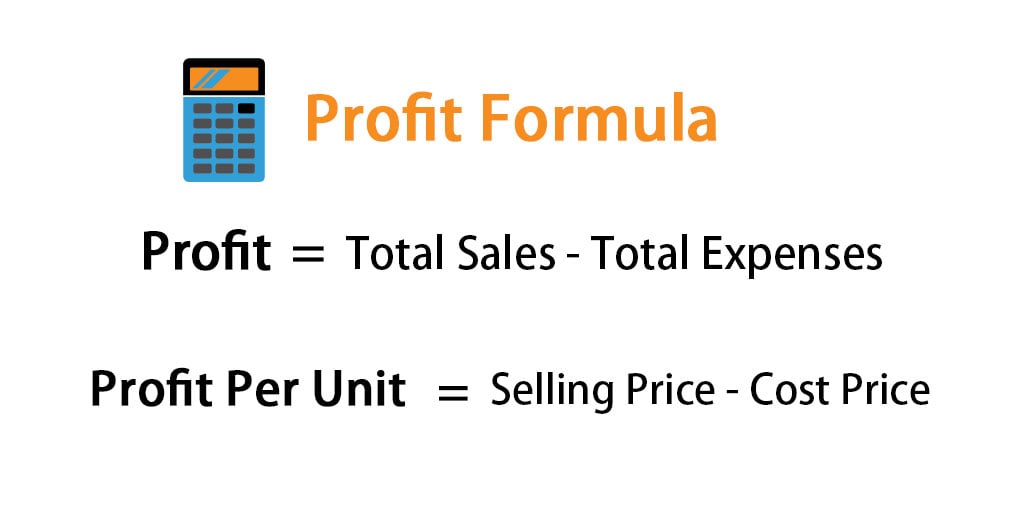

Profit refers to the money earned by a business after deducting all expenses from its total revenues. In simple terms:

Profit = Total Revenue – Total Expenses

Without making sufficient profit, a business cannot survive and grow over time. Profitability determines the success and financial health of a company.

That’s why regularly calculating and tracking profit is critical in business. Effective profit analysis also helps optimize pricing, costs, product mix, and overall strategy.

With Excel, you can easily compute different profit metrics to evaluate performance.

Types of Profit Metrics to Calculate

There are three key profit calculations every business should track:

- Gross Profit

- Operating Profit

- Net Profit

Let’s look at each profit type and how to calculate it in Excel.

How to Calculate GROSS PROFIT in Excel

Gross profit is the basic profitability metric for a product or service.

It calculates profit after deducting only the direct costs of production from total revenue.

Gross Profit Formula

Gross Profit = Total Revenue – Cost of Goods Sold

Where:

Cost of Goods Sold = Direct material costs + Direct labor costs + Manufacturing overhead

Calculating Gross Profit in Excel

To calculate gross profit in Excel:

-

Enter the revenue from sales in one column

-

Input costs of goods sold (COGS) in the next column

-

In the third column, use the formula =Revenue cell – COGS cell

-

Drag the formula down to auto-populate for all rows

This gives the gross profit for each product.

You can also show gross margin percentage by creating another column with the formula:

= Gross Profit / Revenue

How to Calculate OPERATING PROFIT in Excel

Operating profit deducts all operating expenses from gross profit to give profit from core business operations.

Operating Profit Formula

Operating Profit = Gross Profit – Operating Expenses

Where operating expenses include:

- Selling & Distribution Expenses

- General & Administrative Expenses

- Depreciation

- Amortization

Calculating Operating Profit in Excel

To calculate operating profit in Excel:

-

Input gross profit figures from previous steps

-

Enter operating costs like marketing, salaries, rent etc. in the next column

-

Use the formula = Gross Profit cell – Operating Expenses cell

-

Autofill to copy formula down for all products/services

This provides the operating profit. Calculate operating margin % using:

= Operating Profit / Revenue

How to Calculate NET PROFIT in Excel

Net profit gives the final bottom line earnings after deducting all expenses, interest and taxes.

Net Profit Formula

Net Profit = Operating Profit – Interest – Taxes

Calculating Net Profit in Excel

To calculate net profit in Excel:

-

Input operating profit figures from previous steps

-

Enter interest and tax expenses in the next two columns

-

Use the formula = Operating Profit cell – Interest cell – Tax cell

-

Copy the formula down using autofill

This gives the net profit. Get net profit margin % using:

= Net Profit / Revenue

Excel Template to Calculate All Profit Metrics

To easily compute all three profit metrics together, you can use this Excel template:

[Insert link to Excel template download]

It includes preset formulas to calculate:

- Gross profit and gross margin percentage

- Operating profit and operating margin percentage

- Net profit and net margin percentage

Simply input your revenue and cost data. The profit metrics will auto-calculate!

Tips for Effective Profit Analysis in Excel

Here are some tips to accurately calculate and effectively analyze profit in Excel:

-

Use absolute references in formulas to prevent errors when copying

-

Calculate profit metrics for individual products to identify low performers

-

Add conditional formatting to highlight high or low profit percentages

-

Create PivotTables to analyze profit by segments like region, product, channel etc.

-

Make charts like column or pie charts to visualize profit data

-

Compare percentages over time to identify profitability trends

-

Breakdown expenses into fixed and variable costs

-

Factor in one-time or non-operating expenses impacting profit

Key Takeaways

-

Gross profit deducts COGS, operating profit deducts operating expenses, and net profit deducts all costs from revenue

-

Use simple Excel formulas to calculate each profit type and profit margin percentage

-

Analyze profit metrics by product, segment, and timeline to gain insights

-

Effective profit analysis is key for better pricing strategies and cost control

With this step-by-step guide, you can easily calculate revenues, expenses, and different profit metrics in Excel.

The next step is using the profit data to make smart business decisions for growth and success!

Method 1: What is Profit Margin in Excel, here’s the simple step?

Profit Margin Formula in Excel is an input formula in the final column the profit margin on sale will be calculated. The Excel Profit Margin Formula is the amount of profit divided by the amount of the sale or (C2/A2)100 to get value in percentage. Example: Profit Margin Formula in Excel calculation (120/200)100 to produce a 60 percent profit margin result.

Also to calculate profit percentage in excel, type profit percentage formula of Excel i.e. (A2-B2) into C2 the profit cell. Once you calculate the profit percentage in D2 Cell, drag the corner of the cell to get the rest of the profit percentage of sale data.

Step 2: Before we calculate profit margin formula, we need to calculate the profit by input a formula in the cells of column C. the formula would be like this in cell C2:

=(A2-B2) The formula should read “=(A2-B2)” to subtract the cost of the product from the sale price. The difference is your overall profit, in this example, the formula result would be $120. Then press ENTER.

How to Calculate Profit Margin Percentage in Excel (Fastest Method)

FAQ

What is the formula to calculate profit in?

How do I calculate profit margin on Excel?

How do you calculate profit factor in Excel?

How to calculate income in Excel?

How to calculate operating profit margin in Excel?

Step 1) Select the cell containing the results (the decimal number) Step 2) Go to the Home tab > Number group > click the percentage icon. Applying the percentage format to it will give you the profit margin as a percentage. To calculate the Operating Profit Margin (OPM) in Excel, divide the figure for “Operating Profit” by the “Revenue”.

How to calculate net profit in Excel?

When calculating net profit in Excel, you need the following information: You can calculate net profit by subtract COGS, operational expenses, interest expenses and taxes paid from your revenue, then subtracting the result by the revenue. Operating profit represents another type of profit for businesses to calculate and review.

How to calculate gross profit percentage in Excel?

Double click the Fill Handle icon. You can see that we’ve got the results in decimal form. Now, we will convert this value into percentage form. Select all the cells of the Percentage column. Choose the Percentage (%) format from the Number group. Look at the result and you should see the Gross Profit Percentage.

How to convert profit to percentage in Excel?

Drag the Fill Handle icon. You’ll get the profit by subtracting cost from revenue. Go to Cell F4 Then type the below formula. Double click the Fill Handle icon. You can see that we’ve got the results in decimal form. Now, we will convert this value into percentage form. Select all the cells of the Percentage column.