Before making any investment decision, it’s helpful to think about how long it will take back to recover your initial cost. This is the basic principle behind the payback period. Learn more about how to calculate payback period, and what it means for your investments, below.

Have you ever wondered how long it will take to recoup the cost of a major purchase or investment? As a savvy consumer and investor, it’s important to understand payback periods so you can make informed financial decisions.

In this comprehensive guide, I’ll walk you through everything you need to know about calculating the payback period formula. By the end, you’ll have the skills to determine payback periods for potential investments and assess if they are worth pursuing.

What is a Payback Period?

The payback period refers to the amount of time it takes to recover the initial cost of an investment It’s a simple but useful metric that measures how long your investment will take to “pay you back” and reach the break-even point

The payback period is commonly used to evaluate and compare capital projects, equipment purchases, real estate investments, and other longer-term financial commitments. Investors favor shorter payback periods because it means recouping the investment more quickly and reducing risk exposure.

Here are some examples of when you’d want to calculate the payback period:

- Deciding between two new equipment options for your business

- Evaluating whether to install solar panels on your home

- Comparing investment properties with different renovation costs

- Analyzing the ROI timeline for launching a new product line

Now let’s look at the step-by-step process for how to calculate the payback period formula.

Step 1: Identify the Initial Investment Cost

The first step is to determine the total initial outlay or investment required. This is a one-time, upfront cost that you will need to recoup.

For example, if you are considering installing a $10,000 solar panel system on your home, $10,000 is your initial investment cost.

When evaluating multiple investment options, make sure you record the initial cost for each scenario.

Step 2: Estimate the Annual Cash Inflows

Next, you need to estimate the annual cash inflows generated by the investment. This represents the money coming back to you each year as a result of your initial investment.

For the solar panel example, let’s say the panels are projected to save $1,500 per year on electricity bills. The annual cash inflow is $1,500 in this case.

Annual cash inflows may include:

- Revenue from additional sales or production capacity

- Savings on overhead costs like energy and supplies

- Rental income from an investment property

To get an accurate payback period, your cash inflow estimates need to be realistic and account for ongoing expenses.

Step 3: Divide Initial Investment by Annual Cash Inflows

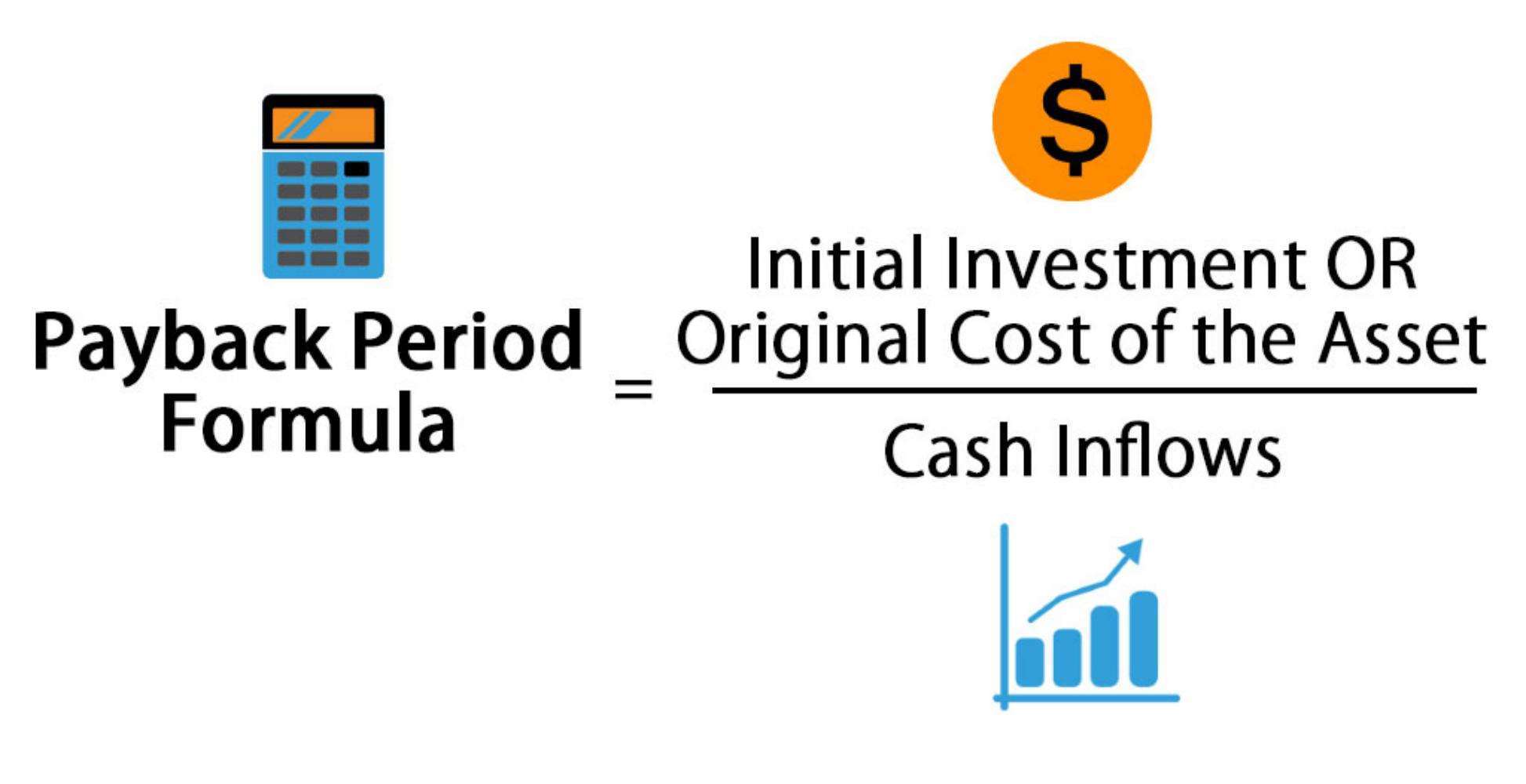

Now comes the fun part! To calculate the payback period, simply divide the initial investment cost by the expected annual cash inflows:

Payback Period Formula:

Initial Investment / Annual Cash Inflows

Let’s plug in the numbers from our solar panel example:

$10,000 initial cost / $1,500 annual savings = 6.67 years

So in this case, the payback period is 6.67 years. This means it will take approximately 6 years and 8 months to recover the upfront $10,000 investment through electricity bill savings.

Make sure to follow this formula and run the numbers for each investment scenario you are comparing.

Step 4: Assess and Compare Payback Periods

Once you’ve calculated the payback period for different options, you can assess whether it falls within your acceptable timeline to recoup the investment.

Shorter payback periods tend to be lower-risk investments since you recover the initial outlay faster. As a rule of thumb:

- 2 years or less: Very short payback period

- 3-5 years: Short to moderate payback period

- 5-10 years: Moderate to long payback period

- 10+ years: Very long payback period

Compare payback periods between your options and determine if one stands out as getting paid back significantly quicker. Just remember that speed of recouping your investment is not the only factor to consider. The profitability and longevity of each option is important too.

Step 5: Factor in Other Metrics like ROI

While payback period focuses strictly on the breakeven point, wise investors also consider longer-term return on investment (ROI) and other metrics.

An option with a quick payback period may ultimately be less profitable than one with slower recoup but higher lifetime returns. Make sure to analyze:

- Total projected earnings over the lifetime of the investment

- ROI metrics like internal rate of return (IRR)

- Qualitative benefits such as increased capabilities

Weighing the payback period along with these other factors will give you the full picture. An attractive investment balances quick recouping of costs with solid ongoing returns.

Payback Period Formula Examples

Now that we’ve covered the 5 steps for calculating payback period, let’s look at some detailed examples.

Comparing Equipment Options

ABC Company needs to purchase a new machine to increase production capacity. They are evaluating two models:

Machine A:

- Initial investment: $30,000

- Expected production increase: $7,500 additional revenue per year

Machine B:

- Initial investment: $50,000

- Expected production increase: $15,000 additional revenue per year

Payback period calculations:

Machine A: $30,000 initial investment / $7,500 increased annual revenue = 4 years

Machine B: $50,000 initial investment / $15,000 increased annual revenue = 3.33 years

Even though Machine B has a higher upfront cost, it generates more additional revenue to offset the investment. So Machine B has a shorter payback period of 3.33 years compared to 4 years for Machine A.

Evaluating Real Estate Investments

Sara wants to purchase a rental property and is evaluating two options:

Property A:

- Purchase price and renovation costs: $250,000

- Expected monthly rental income: $1,800

Property B:

- Purchase price and renovation costs: $200,000

- Expected monthly rental income: $1,500

Payback period calculations:

Note: Monthly rental income is multiplied by 12 to get annual inflows

Property A: $250,000 initial investment / ($1,800 x 12) $21,600 annual inflows = 11.57 years

Property B: $200,000 initial investment / ($1,500 x 12) $18,000 annual inflows = 11.11 years

Even though Property A has higher rental income potential, the upfront investment is also much larger. Property B has a slightly quicker payback period due to the lower initial outlay.

Sara determines both options have quite long payback periods. She decides to keep looking for a better rental property investment.

Installling Solar Panels on a Home

Nick wants to install solar panels on his home but isn’t sure if the upfront cost will pay off.

- Initial investment for solar panel system: $18,000

- Projected annual energy bill savings: $1,100

Payback period calculation:

$18,000 initial investment / $1,100 annual savings = 16.36 years

The payback period of over 16 years is very long for a solar panel system. Nick determines the upfront cost is too high to generate savings that would recoup the investment in a reasonable timeframe.

He decides to revisit the option in future when panel technology improves and installation costs decrease.

Key Takeaways on Payback Periods

Now that you’re a pro at calculating payback periods, let’s recap the key learnings:

-

The payback period measures how long an investment takes to break even and recover initial costs through generated cash inflows.

-

A shorter payback period signal lower risk, while longer payback periods are riskier and tie up your capital for longer.

-

To calculate, divide initial investment by the expected annual cash flows like revenue or savings.

-

Realistic cash flow projections are key to an accurate payback period.

-

Compare payback periods between investment options, but also factor in metrics like ROI and qualitative benefits.

Understanding payback periods gives you an important risk analysis tool when making major financial decisions as an individual or business. With the formula down pat, you can quickly assess investments and focus your money on options that recoup costs on an acceptable timeline.

What future purchases or investments will you be using payback periods to evaluate? Are you leaning towards options that break even quickly or those with elongated but steady returns on investment?

Pros of payback period analysis

Acting as a simple risk analysis, the payback period formula is easy to understand. It gives a quick overview of how quickly you can expect to recover your initial investment. The payback period also facilitates side-by-side analysis of two competing projects. If one has a longer payback period than the other, it might not be the better option.

What does payback period mean?

The payback period is the amount of time it would take for an investor to recover a projects initial cost. Its closely related to the break-even point of an investment.

Payback period is a quick and easy way to assess investment opportunities and risk, but instead of a break-even analysis’s units, payback period is expressed in years. The shorter the payback period, the more attractive the investment would be, because this means it would take less time to break even.

Payback period is used not only in financial industries, but also by businesses to calculate the rate of return on any new asset or technology upgrade. For example, a small business owner could calculate the payback period of installing solar panels to determine if they’re a cost-effective option.

How to Calculate the Payback Period

What is a payback period formula?

The payback period formula is used for quick calculations and is generally not considered an end-all for evaluating whether to invest in a particular situation. The result of the payback period formula will match how often the cash flows are received. An example would be an initial outflow of $5,000 with $1,000 cash inflows per month.

How to calculate payback period in Excel?

Payback Period Formula = Total initial capital investment /Expected annual after-tax cash inflow = $ 20,00,000/$2,21000 = 9 Years (Approx) Some important advantages of the concept of payback period in excel are as follows: It is easy to calculate.

What is discounted payback period method?

A variation of payback method that attempts to address this drawback is called discounted payback period method. It does not take into account, the cash flows that occur after the payback period. This means that a project having very good cash inflows but beyond its payback period may be ignored.

How do you calculate a payback period for a new building?

Still undecided about whether to purchase a new building, you decide to calculate your payback period. To calculate it, you would divide the investment by the cash flow the investment would create. Here, the monthly savings or cash flow amount would be $6,000 per month or $72,000 per year.