Businesses of all kinds, retail or online eCommerce, will have come across the term-ending inventory. Learning how to calculate it is practically a requirement to be successful.

By reading through this article, determine how much saleable stock you have left to sell after a specific accounting period. Table Of Contents

Knowing your ending inventory is crucial for inventory accounting. It might be challenging for many to figure out how much sellable stock you have on hand after an accounting period. Forty-three percent (43%) of small businesses aren’t tracking their inventory, meaning many entrepreneurs aren’t fully optimizing their operations.

The entire value of the items you have in stock for sale at the end of an accounting period, such as your fiscal year, is known as ending inventory. An inventory accounting technique aids merchants in precise stock inspections, financing applications, and net income benchmarking.

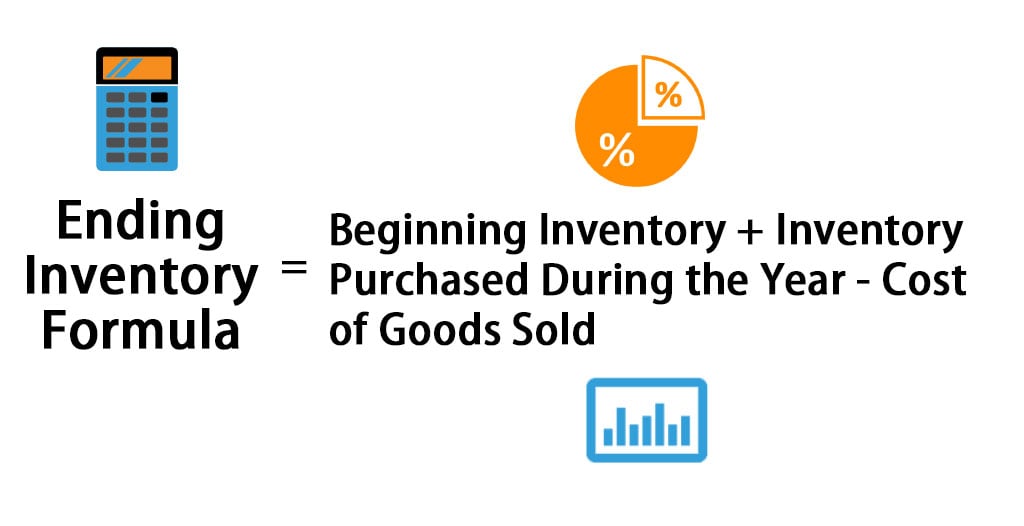

The simplest way to calculate ending inventory is to add new purchases to the beginning list (your stock at the start of a period) and then deduct the cost of products sold (COGS). This is called the ending inventory formula.

As a retail business owner accurately calculating your ending inventory is a crucial part of managing your finances. Your ending inventory is the value of products you have left in stock at the end of an accounting period. Getting this number right on your balance sheet impacts everything from your tax obligations to your ability to obtain financing.

In this comprehensive guide, I’ll explain what ending inventory is, why properly calculating it matters, and walk through the step-by-step process to figure it out accurately. I’ll also share examples, tips, and alternate calculation methods to ensure you choose the right approach for your retail operation.

What is Ending Inventory?

Ending inventory refers to the total dollar value of products a retail business has in stock at the end of an accounting period. This could be the end of a month quarter or year.

It’s also known as closing inventory or closing stock. Ending inventory appears on your balance sheet under current assets. It directly impacts the cost of goods sold (COGS) calculation on your income statement.

The formula to calculate ending inventory is:

Beginning Inventory + Purchases – Cost of Goods Sold = Ending Inventory

For example, if you started the month with $10,000 in inventory, made $5,000 in new purchases, and sold $7,000 worth of product, your ending inventory would be $10,000 + $5,000 – $7,000 = $8,000

Knowing your accurate ending inventory value is crucial for several reasons:

- It allows you to take a periodic full inventory count to ensure your books match reality

- It impacts the calculation of net income on your income statement

- It provides the beginning inventory figure for the next accounting period

- It demonstrates assets to obtain financing from lenders

Now let’s look at the step-by-step process for accurately calculating ending inventory for your retail business.

How to Calculate Ending Inventory

Follow these six steps to accurately determine your ending inventory each accounting period:

1. Calculate Beginning Inventory

This is the value of your stock on hand at the start of the accounting period. Review your inventory records from the prior period’s ending inventory total.

For example, if you had $15,000 left in stock at the end of last month, that’s your beginning inventory for this month.

2. Add Purchases

Add the total value of all inventory purchases made during the current accounting period. Include all additional products, materials, and supplies used to manufacture items.

If you purchased $18,000 in new inventory this month, add that to the beginning total.

3. Calculate Cost of Goods Sold

COGS is the direct costs tied to the production and sales of inventory. For retailers, this includes:

- Product purchase costs

- Freight for deliveries

- Vendor and supplier fees

Review your accounting records, point-of-sale system, and inventory management software to determine your total COGS for the period.

Let’s say your COGS was $22,000 for the month.

4. Subtract COGS from Beginning + Purchases

Take your beginning inventory ($15,000) + purchases $18,000) and subtract your COGS ($22,000).

In our example so far, the math would be:

$15,000 + $18,000 – $22,000 = $11,000

This gives you your ending inventory figure under the basic formula.

5. Factor in Shrinkage

Account for any inventory losses from shoplifting, employee theft, spoilage or damage. These shrinkage costs lower your true ending inventory.

If you lost $1,500 worth of inventory this month, deduct this from the subtotal above.

Revised ending inventory = $11,000 – $1,500 = $9,500

6. Verify with a Physical Count

Finally, take a complete physical inventory count to validate your ending inventory calculation.

Count every item on hand and compare to your books. Make adjustments to match the physical total.

This step is crucial to provide accuracy and set up the next period correctly.

Ending Inventory Calculation Methods

The basic formula above is the most straightforward way to arrive at your ending inventory. However, other more advanced methods exist which more closely align with accounting standards.

Here are four alternate endings inventory calculation methods:

First In, First Out (FIFO)

- Assumes oldest inventory purchased is sold first

- Commonly used in inflationary environments

- Results in higher ending inventory value

Last In, First Out (LIFO)

- Assumes newest inventory purchased is sold first

- Used when inventory costs are rising over time

- Produces lower ending inventory value

Weighted Average Cost

- Calculates an average inventory cost per unit

- Considers total inventory costs divided by total units

- Provides a balanced perspective between old and new

Gross Profit Method

- Relies on your gross profit margin percentage

- Calculates estimated COGS based on sales

- Best for retailers without detailed COGS data

You can explore examples of each method online to determine which approach makes the most sense for your retail operation. Just be sure to be consistent across accounting periods.

Tips for Calculating Ending Inventory

Follow these tips for a smooth and accurate ending inventory process each period:

- Maintain detailed inventory records in a central software or app

- Track inventory purchases down to the SKU level

- Log all inventory sales in your POS and accounting systems

- Note any inventory shrinkage as it occurs

- Stick to the same calculation method consistently

- Take a physical count to validate your totals

- Use ending inventory to guide purchasing decisions

- Compare to sales velocities and turnover rates

The Importance of Ending Inventory

Hopefully this guide has demonstrated how vital accurately calculating your ending inventory is for retail success. When done right, it provides immense benefits:

- Optimizes inventory levels – Avoid dead stock buildup and stockouts

- Saves money – Identify excess purchasing and shortage risks

- Increases efficiency – Speed up cycle counts and financial reporting

- Boosts profitability – Tie inventory to sales trends and margins

- Enables growth – Secure financing to expand locations and products

Weighted average cost method (WAC)

For WAC, you take the total amount you spent on inventory and divide it by the quantity. It “weighs” the average since it accounts for the volume of goods bought at various price points.

Imagine your business has an inventory of 100 goods valued at $2.50 when the accounting year starts. Then, you spend $3.50 on 300 more goods. Thus, the total value of the inventory is $250 + $1050, which comes to around $1300. The weighted average is $3.25 when you divide this by 400.

FIFO Method (first in/first out)

FIFO assumes that your company’s oldest purchases were utilized to create the products sold first. Simply put, this technique implies that the first products ordered will be the first to be sold. When using FIFO, the cost of the most recent purchases is added to the ending inventory. This value is still available at the end of the period, while the cost of the oldest purchases is added to COGS first.

To help illustrate this, let’s assume you start out with ten (10) items purchased at $25. Then several months later, you bought another 10 of the same item at $30. If those 20 items are available and sell seven (7) of them, the FIFO method says that you unload the items that were first bought for $25. This amounts to a $175 cost of goods sold.

Thus the ending inventory would be calculated as follows:

$250 (beginning inventory) + $300 (new goods purchased) – $175 (COGS) = $375 ending inventory

Calculate Ending Inventory Using the FIFO Method

What is ending inventory formula?

The Ending Inventory formula refers to the mathematical equation that helps calculates the value of goods available for sale at the end of the accounting period. Usually, it is recorded on the balance sheet at a lower cost or its market value. You are free to use this image on your website, templates, etc, Please provide us with an attribution link

What is the difference between beginning inventory and ending inventory?

Beginning inventory refers to the value of goods or products that a retail business has in its stock at the start of an accounting period. Ending inventory refers to the value of goods or products still in stock at the end of that same accounting period. What is an example of ending inventory?

How do you calculate ending inventory using retail?

Multiply the gross profit percentage by sales to find the estimated cost of goods sold. Subtract the cost of goods available for sold from the cost of goods sold to get the ending inventory.

How to estimate ending inventory?

The gross profit and retail methods can be used to estimate ending inventory when accurate inventory counts are not feasible. Inventory management software can automate inventory tracking and simplify the calculation of ending inventory.