Quarterly earnings reports are a highly anticipated event for stock investors because they reveal net income — accounting profit — for a company. Economic profit differs from net income because it subtracts opportunity costs, which are the profits forfeited by choosing one course of action over another.

Economic profit (or loss) is what remains after deducting both normal accounting expenses and the cost of pursuing one business strategy instead of another. If a company chooses the more profitable of two business options, then it accrues economic profit, and if it chooses the less-profitable option, then it incurs economic loss.

Regulators dont require economic profit to be calculated or disclosed, but understanding how it works can shed light on the decisions a management team makes, plus confer some lessons in personal finance.

As a business owner or investor, understanding how to calculate economic profit is crucial for making informed financial decisions Unlike accounting profit which only accounts for explicit monetary costs, economic profit factors in implicit opportunity costs to provide a more complete picture of profitability

In this comprehensive guide, I’ll walk through the step-by-step process for calculating economic profit using examples and provide tips for how to leverage this metric in your business or investments.

What is Economic Profit?

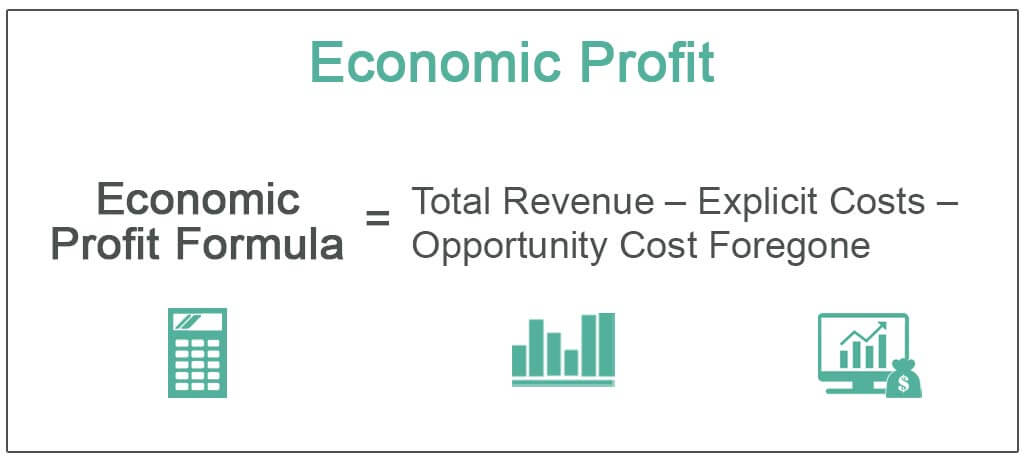

Economic profit measures the true economic value generated by a company or investment after accounting for all costs – including implicit opportunity costs It is calculated as

Economic Profit = Total Revenue – Total Opportunity Cost

Total opportunity cost includes both explicit monetary costs and implicit opportunity costs

-

Explicit costs – Direct monetary costs like materials, rent, labor, etc.

-

Implicit costs – Indirect opportunity costs like wages or investment returns forgone.

For example, if you invest $100,000 of capital into your business that could have earned a 5% return elsewhere, that lost 5% return is an implicit cost.

Economic profit provides a more accurate measure of value creation than accounting profit by factoring in these implicit costs.

Why Calculate Economic Profit?

There are two main reasons to calculate economic profit:

-

Evaluate business/investment performance – Economic profit provides a complete picture of true profitability after all costs. This helps assess the real value generated by a business or investment opportunity.

-

Make better decisions – By understanding the true economic profit, you can make better decisions regarding investments, pricing, expansions, and more. You may turn down opportunities that are unprofitable on an economic basis.

Essentially, economic profit helps you allocate capital more efficiently to drive growth and returns.

How to Calculate Economic Profit Step-by-Step

Follow these steps to calculate economic profit:

1. Calculate Total Revenue

- Sum all sources of revenue generated over a period.

- For a business this includes sales, services, interest, etc.

- Be comprehensive by including all revenue streams.

2. Calculate Explicit Costs

- Sum all direct monetary costs incurred over the same period.

- Examples include materials, rent, wages, utilities, etc.

- Extract these costs from financial statements or business records.

3. Calculate Implicit Costs

- Sum all indirect opportunity costs over the period.

- Consider wages, investment returns, or other income forgone.

- Quantify implicit costs by estimating the value of the next best opportunities.

4. Subtract Total Costs from Total Revenue

- Add together explicit and implicit costs to get total opportunity cost.

- Subtract total cost from total revenue.

- The result is the economic profit.

This captures the true economic value created after accounting for all cost factors.

Economic Profit Example

Let’s walk through an example to see economic profit in action:

John invests $50,000 to start a lemonade stand business. In the first year, his total revenue from lemonade sales is $15,000.

His explicit costs total $7,000, including materials, a rented stand, and wages for a part-time employee.

John also gave up a side gig that paid $4,000 per year to focus on the lemonade stand, so that $4,000 is an implicit cost.

- Total Revenue = $15,000

- Explicit Costs = $7,000

- Implicit Costs = $4,000

- Total Costs = $7,000 + $4,000 = $11,000

- Economic Profit = $15,000 – $11,000 = $4,000

Although accounting profit is $8,000, the real economic profit is just $4,000 after factoring in the implicit opportunity cost.

This provides John with a more accurate assessment of the value created by his lemonade stand business.

Tips for Using Economic Profit

Keep these tips in mind when using economic profit:

- Use comparable time periods for revenue and costs.

- Be comprehensive in including all revenues and costs.

- Quantify implicit costs by estimating the value of alternatives forgone.

- Compare economic profit year-over-year or against competitors.

- Make investment and pricing decisions to maximize economic profit.

Improving economic profit should be a core focus, as it directly translates to creating shareholder value.

Limitations of Economic Profit

While economic profit provides valuable insights, recognize a few limitations:

- Implicit costs can be subjective to estimate.

- It doesn’t account for future growth potential.

- It’s difficult to compare across different companies/industries.

- It’s often used in combination with other metrics.

Still, flaws and all, economic profit delivers a significantly enhanced measure of value creation compared to accounting profit alone.

Now you have a solid grasp of what economic profit is and how to calculate it step-by-step using revenues, explicit costs, and implicit costs. Use this metric to support smarter business and investment decisions focused on driving real economic value.

Just remember to carefully quantify both monetary and opportunity costs. With some practice, you’ll be able to quickly estimate economic profit to identify your best options and maximize value.

Economic profit vs. accounting profit

Accounting profit, better known as net income, is the money that remains in a reporting period after direct expenses such as labor, fixed expenses like rent, and non-operating expenses such as taxes and depreciation, are subtracted from revenue.

While accounting profit is calculated and used by investors, economic profit is more relevant for a companys management. Companies are required to report accounting profit, while opportunity cost assessments and resulting economic profit numbers are rarely revealed.

How to calculate economic profit

Economic profit (or loss) can be calculated as revenue minus explicit costs minus opportunity cost. Explicit costs are all costs typically accounted for, such as labor expenses, materials costs, marketing, depreciation, and taxes. As previously noted, opportunity or implicit cost is the theoretical cost for a company of not pursuing a business option.

Lets say a steel manufacturing company owns raw steel it could sell for $1 million, or it could use the same raw steel to manufacture steel products, which it can then sell to consumers for $3 million. The company decides to manufacture steel products and earns $3 million, but it incurs expenses of $2.5 million.

The companys accounting profit is $500,000, and its economic profit is the accounting profit minus the $1 million in sales it could have earned by simply selling unfinished steel. Rather than accruing an economic profit, the company, at least in the short term, incurs an economic loss of $500,000.

Economic profit is best calculated over long time horizons because short-term economic losses often become long-term economic profits. The same steel manufacturing company could conceivably lower its production costs in subsequent years, which would turn the initial economic loss to a long-term economic profit.

If manufacturing steel products is expected to produce an economic profit for the company in the long term, than it would be acceptable to incur the short-term economic loss by forgoing the income from selling raw steel.

How to Calculate Accounting and Economic Profit

What is economic profit formula?

The economic profit formula is a precise profitability assessment. It accounts for the risk associated with a project or investment. If a venture generates economic profit or returns that exceed the cost of the capital invested, it suggests that the venture is profitable and justifies the inherent risks.

What is economic profit?

Economic profit is the financial amount that remains after subtracting both explicit costs and opportunity costs from revenue. Opportunity costs are the profits that a business misses out on when choosing to pursue one business venture over another. Economic profit is used for internal analysis and is not required for transparent disclosure.

What are economic costs and economic profit?

Economic costs are the sum of cash outflows and opportunity costs. Economic profit is estimated as the product of net operating profit after taxes (NOPAT) and (1 – cost of capital ). Economic profit measures the economic value added because it is calculated by subtracting both the explicit and implicit costs from revenues.

What is the difference between accounting profit and economic profit?

Accounting profit is the total revenues minus explicit costs, including depreciation. Economic profit is total revenues minus total costs—explicit plus implicit costs. Explicit costs are out-of-pocket costs for a firm—for example, payments for wages and salaries, rent, or materials.