To deliver a product or service within a specified time and budget you have to juggle a variety of activities, responsibilities, and stakeholders. Estimating the project’s cost and keeping tabs on actual spending are two crucial aspects for project managers. Budget to actual variance analysis is the comparison of the budgeted and the actual cost of the project as it progresses.

Understanding the difference between budget variance and actual variance is crucial for any business. These metrics allow you to compare your budgeted costs and revenues to what actually happened.

Doing regular variance analysis gives you insights into your business performance. It highlights problem areas and helps you make better forecasts.

In this comprehensive guide we’ll cover everything you need to know about budget vs actual variance analysis.

What is Budget Variance?

A budget variance measures the difference between your budgeted amount and actual amount for a given period.

For example, if you budgeted $50,000 for marketing expenses in Q1, but actually spent $60,000, your budget variance would be:

Actual Amount – Budgeted Amount$60.000 – $50000 = $10.000

In this case, it’s an unfavorable variance of $10,000, because you spent more than originally budgeted.

Budget variances can occur for both revenues and expenses. They indicate how much actual results deviated from the budget.

What is Actual Variance?

An actual variance compares actual results between two periods. For example, you can calculate the variance between:

- This month and last month

- This quarter and last quarter

- This year and last year

The formula is:

Actual This Period – Actual Last Period

So if your marketing expenses were $60,000 in Q1 and $55,000 in Q4, the actual variance would be:

$60,000 – $55,000 = $5,000

Actual variances show you how current performance compares historically. Significant shifts may indicate changing business conditions.

Key Differences Between Budget and Actual Variances

While budget and actual variances sound similar, there are some important distinctions:

-

Budget Variance compares actuals to budget. Actual Variance compares actuals across time periods.

-

Budget variance indicates planning accuracy. Actual variance measures performance trends.

-

Budget variance is tied to your forecasts. Actual variance depends on historical data.

-

Favorable budget variances mean actuals exceeded plans. Favorable actual variances mean improved performance vs. history.

-

Budgets are set internally. Actual performance depends on external factors.

Why Perform Variance Analysis?

Regular variance analysis provides valuable insights into your business. Here are some key benefits:

-

Measure forecast accuracy – Do your budgets reflect reality? Or are there large, persistent variances? This tells you how good your planning process is.

-

Understand performance drivers – Analyzing variances helps you identify what’s driving better or worse performance. This allows you to address problems or replicate success.

-

Improve future plans – Reviewing past variance patterns helps you create more accurate budgets and forecasts next time.

-

Monitor trends – Actual variances highlight increases or decreases in key metrics over time. This helps you spot changes in performance.

-

Provide accountability – Comparing actuals to budgets keeps departments and managers accountable for hitting targets.

Overall, variance analysis gives you insights to make smarter decisions and better plans. It’s a vital tool for controlling costs, increasing profits, and driving continuous improvement.

How to Calculate Budget vs Actual Variances

Let’s go through an example of how to calculate budget and actual variances step-by-step:

Step 1) Gather Budgeted and Actual Amounts

To start variance analysis, you need to gather:

- Budgeted amounts for the period

- Actual amounts for the period

Let’s say you’re analyzing Q1 results. Your budgeted and actual revenue numbers are:

| Metric | Budgeted | Actual |

|---|---|---|

| Revenue | $100,000 | $90,000 |

Step 2) Calculate Budget Variance

Use this formula:

Budget Variance = Actual Amount – Budgeted Amount

Plug in the numbers:

$90,000 – $100,000 = -$10,000

The budget variance is -$10,000. It’s unfavorable since actuals were below budget.

Step 3) Calculate Actual Variance

You’ll need the actual amounts for two periods. Let’s say last quarter’s revenue was $85,000.

The formula is:

Actual Variance = Current Period Actual – Prior Period Actual

So our calculation is:

$90,000 – $85,000 = $5,000

The actual variance is $5,000. This is favorable because revenue increased versus last quarter.

Step 4) Analyze Variances

With both variances calculated, you can now analyze the results:

- The negative budget variance means our Q1 forecast was too high. We didn’t hit our target.

- But the positive actual variance shows that revenue improved from Q4 to Q1.

This tells us that while we’re growing quarter-over-quarter, we’re still over-forecasting. We need to revise our budgets to be more realistic based on current trends.

Regularly performing these variance calculations allows you to spot issues, trends, and opportunities in your business.

Presenting Variances for Analysis

Once you’ve calculated variances, you need to present them effectively for further analysis.

Here are some best practices to follow:

-

Show favorable and unfavorable variances separately – Breaking these out makes it easier to interpret at a glance. Green and red color coding also helps.

-

Include variance percentages, not just absolute amounts – The percent difference provides useful context on the scale of deviations.

-

Analyze drivers and segments – Break down analysis by business units, products, regions etc. to pinpoint sources of variance.

-

Add commentary to explain root causes – Don’t just present the numbers. Add notes explaining your assessment of why variances occurred.

-

Use charts and graphs to visualize trends – Charts allow you to easily spot variance patterns over time.

-

Update forecasts based on findings – Change future budget assumptions to account for new realities uncovered through variance analysis.

Presenting insightful variance reporting leads to productive analysis discussions and better business decisions.

Budget vs Actual Variance Analysis Example

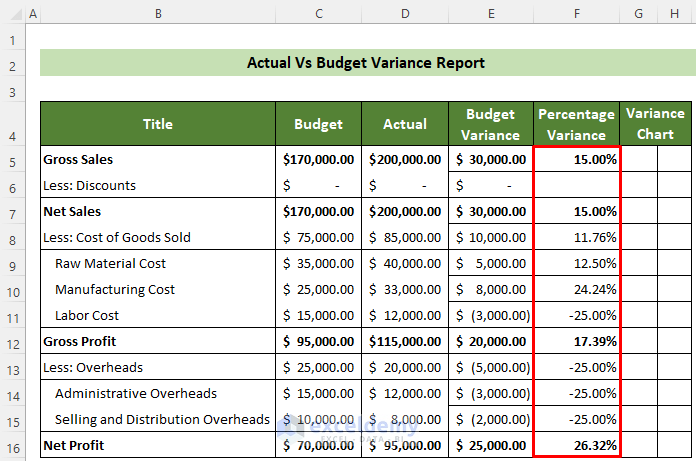

Let’s go through a detailed example to see budget vs actual variance analysis in action.

Imagine it’s the end of Q1. You want to evaluate your company’s performance against the Q1 budget.

First, gather the actual and budgeted revenue and expense amounts for Q1:

| Metric | Budget | Actual |

|---|---|---|

| Revenue | $250,000 | $200,000 |

| Product Costs | $100,000 | $80,000 |

| Marketing | $50,000 | $65,000 |

| Payroll | $60,000 | $55,000 |

| Rent | $10,000 | $12,000 |

| Total Expenses | $220,000 | $212,000 |

Then, calculate the budget and actual variances:

| Metric | Budget Variance | Actual Variance |

|---|---|---|

| Revenue | -$50,000 | +$10,000 |

| Product Costs | +$20,000 | +$5,000 |

| Marketing | -$15,000 | +$3,000 |

| Payroll | +$5,000 | -$2,000 |

| Rent | -$2,000 | +$500 |

| Total Expenses | +$8,000 | +$6,500 |

With the variances calculated, you can now analyze and interpret the results:

-

Revenue – We missed our revenue goal for the quarter. But revenue was up 10% from Q4, which is positive.

-

Product Costs – Favorable budget and actual variance due to production increasing slower than sales. This led to lower unit costs.

-

Marketing – We went over budget due to extra social media advertising spend. But marketing expenses decreased from Q4.

-

Payroll – Headcount was slightly lower than planned. However payroll ticks up in Q1 due to yearly raises.

-

Rent – Unfavorable budget variance due to unplanned space expansion. But consistent with past quarters.

-

Expenses – Total expenses were under budget. But increased versus Q4 due to normal seasonal upticks in Q1.

This analysis gives you insights into the business. You can see the impact of marketing overspend and slower than expected revenue growth. For next quarter, you may adjust the marketing budget and sales projections based on these results.

Regular variance analysis like this helps you continuously improve planning and performance.

Tips for Effective Variance Analysis

Follow these tips to get the most out of your variance analysis:

-

Establish a consistent cadence – Monthly or quarterly is best practice. Analyze at consistent intervals for easy comparisons.

-

**

Why is budget vs. actuals important?

Accurate forecasting and tracking of budget vs. actual provides a clear picture of the financial performance of the project, the department, and organization as a whole. So what’s the difference between budgeting to forecasting? Budgeting involves planning and allocating resources for a specific period, while forecasting involves predicting future outcomes based on past data and current trends.

It allows project managers to identify and address any cost overruns or inefficiencies. This information also helps to make informed decisions to bring the project back on track. Accurate tracking also ensures that the project remains on schedule and within budget. Plus, it also helps to find cost savings and resource optimization opportunities, which is obviously critical for any project managers or finance teams using this information.

Let’s take a deeper look at why understanding your budget vs. actuals is important:

How do you calculate the variance?

The formula for variance in budget vs. actual depends on the context and the data or information being analyzed. Variance in budget versus actual refers to the difference between the budgeted amount and the actual amount spent in a given period. And it can be used to assess performance and identify areas where adjustments may be needed.

Variance = Actual amount – Budgeted amount

Continuing with our example, here is a snapshot of actuals vs. budget variance analysis:

We had estimated about 570 hours of time and $5,100 as the total projected cost of the project. Turns out we ended up spending 635 hours and $56,640. That means that we overran our initial estimate by 65 hours and $6,500.

Let’s analyze budget vs. actual to figure out what caused this overrun:

- More time spent by backend developer and product designer

Overall, the backend developer ended up spending 360 hours on the project vs. the 300 hours estimated. Similarly, the product designer spent 85 hours vs. the budgeted 60 hours.

- Higher hourly rate for the Project Manager and Product Designer

Here are the budgeted hourly rates that were uploaded in Beebole.

And here are the actual hourly rates that were logged in Beebole.

We ended up paying $160/hour to the project manager vs. $150/hour in the budget. Similarly, for the project manager we spent $120/hour vs. the $100/hour in the budget.

Budget Vs. Actual Variance Analysis: Data Modeling, DAX, or Worksheet Formulas? 365 MECS Class 19

What is budget vs actuals variance analysis?

Budget vs. actuals variance analysis is a process used to compare actual financial results with the budgeted amounts. This comparison provides insights into the accuracy of budget projections and helps to identify areas where actual results deviated from the budget.

What is a favorable variance in a budget vs actual variance analysis?

When performing a budget vs. actual variance analysis, you may encounter two types of variance outcomes: A favorable variance occurs when the actual results are better than the budgeted or expected amount. A business might encounter a favorable variance if they receive higher revenues than predicted or pay lower costs than they’d budgeted.

Does a budget have a variance?

However, budgets are static and don’t consider variations like economic conditions, accounting errors, or any other deviations from the plan. That’s where variance analysis comes into play, and Windes Financial Planning & Analysis Services can help ensure you’re on target to hit your goals. What is budget vs. actual?

What should be included in a budget vs variance analysis?

Highlights which areas especially need focus. The real value of the budget vs. actual variance analysis comes from the resulting actions. The report should highlight areas that need attention—cost blocks with significant variations or KPIs not on target—and the team should define how to address those areas.