Calculating total cost is an important skill in personal finance, business management and investing. Being able to accurately determine your total costs allows you to budget effectively, price products and services appropriately and evaluate investments and opportunities. In this comprehensive guide, I’ll walk you through the step-by-step process of calculating total cost in various contexts.

Calculating Total Cost for a Personal Budget

Creating a personal budget is crucial for managing your finances and ensuring you live within your means. To budget effectively, you need to know your total cost of living for a set period of time, usually monthly. Here’s how to calculate it:

1. Tally Up Fixed Costs

Fixed costs are expenses that remain the same each month and are non-negotiable. These include:

- Rent/mortgage

- Car payments

- Insurance premiums

- Loan payments

- Utilities like electricity, gas, water, internet, cable, etc.

- Mobile phone bills

- Groceries and household necessities

Add up the amounts you pay for each fixed cost monthly Be sure to include any recurring subscriptions or memberships too.

2. Add Variable Costs

Variable costs are flexible expenses that vary depending on your lifestyle choices. These include:

- Dining out

- Entertainment like movies, concerts, etc.

- Clothing and accessories

- Gifts

- Travel and vacations

- Hobbies

- Miscellaneous shopping

Tally up your variable costs for the month. Be sure to include cash purchases too – look back at receipts or your purchase history.

3. Fixed + Variable = Total Cost

To calculate total cost, simply add up your fixed and variable costs for the month.

Total Cost = Fixed Costs + Variable Costs

This gives you your total monthly personal budget.

4. Track Expenses

To determine your actual costs each month, track your daily expenses using an app or spreadsheet. This will help you:

- Identify where your money is going

- Cut down on non-essential variable costs

- Adjust your budget as needed

- Plan for anticipated future costs

Establishing a system to monitor monthly costs can help you make smart financial choices.

Calculating Total Cost for a Business

For a business, total cost includes all expenses incurred during operations. Accurately calculating this is key for proper budgeting, setting prices, and assessing profitability. Follow these steps:

1. List All Fixed Costs

A business’s fixed costs are expenses that remain unchanged regardless of production output. These overhead costs include:

- Rent

- Leases

- Loan payments

- Salaries for employees not involved in production like administrative staff

- Insurance

- Regular maintenance and repairs

- Depreciation of assets like equipment and machinery

Tally up the amounts for each fixed business cost per month.

2. Determine Variable Costs

Variable costs are expenses directly tied to production volume. These include:

- Raw material costs

- Packaging costs

- Labor for production line workers

- Inventory and shipping fees

- Utilities like power and water if usage fluctuates with production

- Commissions or production-based bonuses

Add up variable costs for the month. These will change depending on output.

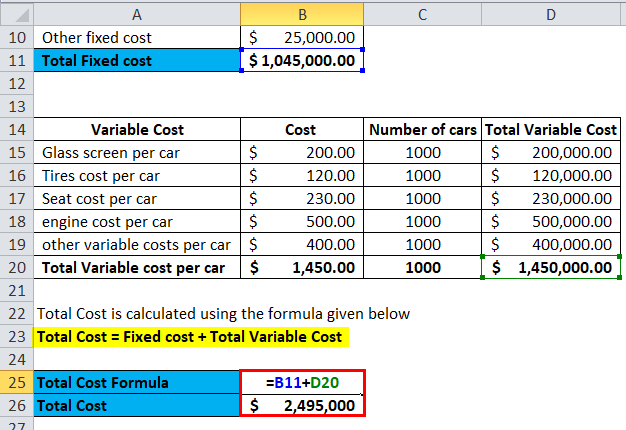

3. Fixed + Variable = Total Cost

Calculate your business’s total monthly cost using this formula:

Total Cost = Fixed Costs + Variable Costs

This provides you with the total operating cost. Compare it to revenue to assess profitability.

4. Consult Financial Statements

A business’s income statement and balance sheet contain data that can help determine costs.

- Income statements list revenues, expenses, profits.

- Balance sheets show assets, liabilities, equity.

Reviewing these documents can help identify all monthly costs.

Monitoring total cost trends over time allows businesses to control expenses and set optimal pricing.

Figuring Out Total Investment Cost

When investing, total cost includes the amount invested plus any fees, commissions, and taxes. Here’s how to calculate it:

1. Identify Amount Invested

This is the principle or amount you actually invest, not including any costs. For example, if you put $10,000 into stocks, $10,000 is the invested amount.

2. Add Advisory Fees

Most investors pay an advisor either through:

- Hourly fees for services

- Commission percentage of invested amount

Add any advisory fees for the investment period to the total.

3. Include Any Commissions

If your advisor charges commission, add this percentage of the invested amount to the total cost.

For example:

1% commission on $10,000 is $100

4. Account for Taxes

Some investments may incur taxes like capital gains tax when you buy or sell.

Add any taxes you need to pay on the investment to the total cost.

5. Investment Amount + Fees + Commission + Taxes = Total Cost

This gives you the all-in cost of your investment for proper analysis.

Monitoring total investment costs allows you to assess net gains and make better decisions.

Key Takeaways

- For personal budgets, total cost = fixed costs + variable costs

- For businesses, total cost = fixed overhead costs + variable operating costs

- For investments, total cost = amount invested + fees + commissions + taxes

- Track your total costs routinely to make better financial decisions

- Accurately calculating total costs takes some work but is worth the effort

Following these steps can help you determine total costs in various contexts. Know your numbers, budget smartly, and make financially-informed choices. Proper total cost analysis is the foundation of money management and financial success.

You Might Also Like

Co-authored by:

To calculate total cost for a personal budget, start by tracking your spending for 1 month to determine your average monthly expenses. Once you have a good idea of how much you spend in a typical month, figure out your total cost of living by tallying up all of your fixed costs, such as rent, utilities, phone bills, gasoline for the car, and groceries. Next, add up your variable costs for 1 month, such as nights out, clothing, and vacations. Finally, add your fixed costs to your variable costs to get your total costs. To learn how to calculate the total cost for a business, keep reading!

Reader Success Stories

-

Serenity Gates “I liked how you illustrated all the steps.”

Serenity Gates “I liked how you illustrated all the steps.”

How to Calculate Total Cost, Marginal Cost, Average Variable Cost, and ATC

How do you calculate the average total cost?

Here’s the formula for calculating the average total cost: Average total cost = (Total fixed costs + Total variable costs) / Number of units produced Related: FAQs: Plant, Property, and Equipment (PP and E) Assets Here are the steps that outline how to calculate total cost: 1. Identify fixed costs

How do you calculate fixed cost per unit?

The calculation is as follows: (Average fixed cost + Average variable cost) x Number of units = Total cost A company is incurring $10,000 of fixed costs to produce 1,000 units (for an average fixed cost per unit of $10), and its variable cost per unit is $3. At the 1,000-unit production level, the total cost of the production is:

How do you calculate the total cost of production?

To calculate the total cost of production, you can add the total fixed and variable costs. Here’s an example to demonstrate how you can calculate this value, followed by the formula: The manufacturing company’s accountant adds the total fixed costs of $344,000 and the total variable costs of $197,000.

What is the average total cost?

The average total cost is the per-unit cost of the number of products that are made. Business and financial managers might use this information to make decisions on product pricing. In order for a company to be profitable, businesses price products above the average total cost.