Learn how to calculate customer acquisition cost (CAC)—the amount you spend to gain new customers—and how to lower it for sustainable business growth.

Customer acquisition cost (CAC) measures how much businesses spend to attract new customers. CAC is a critical business metric for determining the resources to acquire and onboard new customers, and it helps assess your company’s overall health and profitability.

CAC stands for customer acquisition cost and refers to the total cost of resources and efforts a business allocates to gain new paying customers. CAC compares how much money companies spend on acquiring new customers over a specified period against the number of customers they acquire.

Calculating CAC is important for determining the ROI and overall efficiency of your customer acquisition strategies. Businesses become profitable and scalable once they learn to grow their customer base while keeping their CAC low.

Acquiring new customers is essential for business growth, but it comes at a cost. Calculating your customer acquisition cost (CAC) helps you determine the return on investment of your sales and marketing efforts.

In this comprehensive guide I’ll walk you through what CAC is why it matters, how to calculate it, and most importantly – how to use it to improve profitability. With some easy formulas and industry benchmarks, you’ll be able to assess the efficiency of your customer acquisition strategies.

What is Customer Acquisition Cost (CAC)?

CAC refers to the total cost involved in acquiring a new customer. It includes all expenses incurred across marketing, sales, and service departments to convert a lead into a paying customer.

Simply put, CAC shows how much you spend to acquire each new customer. It encompasses:

-

Marketing costs like ads, content creation, SEM, events, etc.

-

Sales costs including salaries, commissions, travel, and bonuses

-

Customer service expenses for onboarding and support

-

Overheads like software, tools, and infrastructure

Understanding your CAC is crucial because it directly impacts your profit margins. A low CAC means you spend less to acquire customers, making it easier to achieve positive ROI.

On the other hand, a high CAC eats into your margins. You may acquire a customer for $1,000 but make a profit of only $500 from them. This makes growth challenging and unsustainable.

That’s why every business should track their CAC to optimize profitability.

Why Calculate Your Customer Acquisition Cost?

There are several compelling reasons to determine your CAC:

Measure Marketing ROI

CAC helps you gauge the return on investment of your marketing initiatives. You can assess if your campaigns are generating customers profitably.

For instance, if your CAC is $500 but your products only bring in $300 per customer, you need to review your marketing strategy.

Forecast Revenue

Since CAC shows your upfront customer acquisition costs, you can forecast revenue more accurately.

If you spend $1,000 to acquire a customer worth $5,000, you know your revenue will be at least $4,000 after recovering the CAC.

Understand Profitability

Compare your CAC to the lifetime value (LTV) of customers. This CAC to LTV ratio indicates your potential for profitability.

Aim for an LTV 3x higher than CAC. This means your customer revenues should be at least three times more than acquisition costs.

Inform Investment Decisions

A high CAC might make investors hesitant. But a low CAC conveys your business can acquire customers efficiently, ensuring favorable ROI.

Allocate Budgets

Knowing your CAC helps allocate marketing and sales resources better. You can identify high-cost initiatives and shift budgets to more profitable channels.

Benchmark Performance

Compare your CAC to industry averages and past periods. This shows areas for improvement and whether acquisition costs are moving in the right direction.

Now that you know why CAC matters, let’s look at how to calculate it.

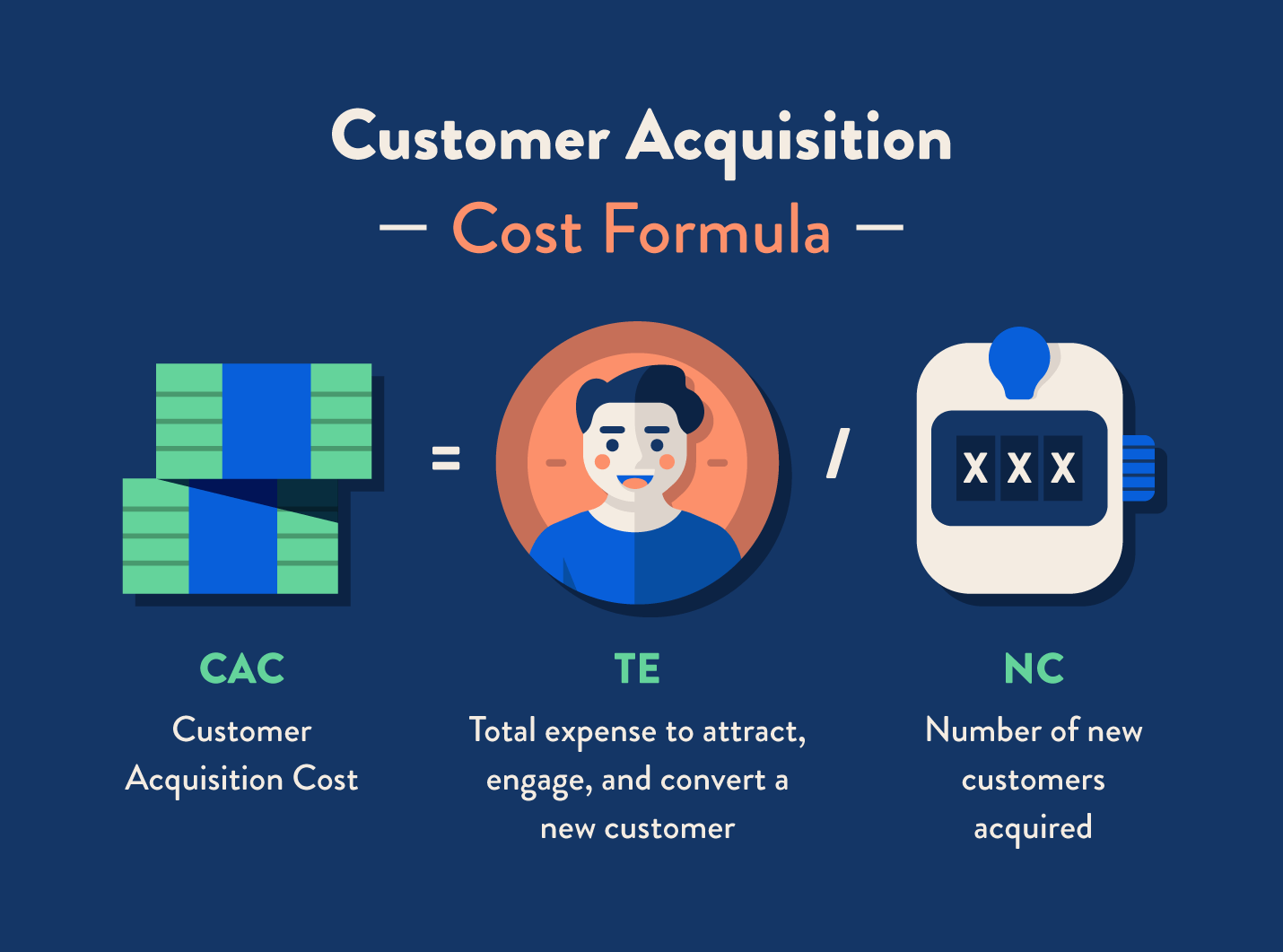

How to Calculate Customer Acquisition Cost (CAC Formula)

Here is a simple 3-step formula to calculate your customer acquisition cost:

Step 1: Define a Time Frame

Choose a set time period to calculate CAC – monthly, quarterly or annually. Using a defined block of time gives more accurate costs.

Step 2. Add Up Your Customer Acquisition Expenses

Sum up all sales, marketing and service expenses used to acquire new customers in that period.

This includes salaries, commissions, ads, events, content creation, sales tools, onboarding costs and allocated overheads.

Step 3. Divide By Total New Customers

Divide the total acquisition expenses by the number of new customers gained in that period.

CAC Formula:

Total Acquisition Cost / Total New Customers AcquiredExample:

Say your total sales, marketing and service costs for Q1 2022 was $250,000. And you acquired 1,000 new customers in that quarter.

Your CAC would be:

$250,000 / 1,000 = $250

This means you spent $250 to acquire each new customer in Q1 2022.

Make sure to segregate costs for existing and new customers to get an accurate CAC. Now let’s look at what expenses to include when calculating your customer acquisition costs.

What Costs to Include in CAC Calculation?

CAC is calculated using your sales, marketing and services expenses. Here are the key costs to factor in:

1. Marketing Costs

All marketing expenses used to generate new customer sign-ups should be included in CAC, such as:

- Paid ads – social, search, display ads

- Events – tradeshows, webinars, seminars

- Content creation – blogs, guides, videos

- PR and outreach

- Marketing software tools

- Website hosting, SEO costs

- Marketing team salaries

- Agency fees

2. Sales Costs

Any sales activities targeted at new customer acquisition are relevant for CAC:

- Sales team salaries + commissions

- Lead generation tools

- Sales collaterals and kits

- Sales travel expenses

- Events like demos, trials, onboarding

- Sales software, CRM, analytics

3. Customer Service Costs

The costs incurred to onboard and support new customers should be factored in:

- Onboarding and implementation

- Customer support team salaries

- Support infrastructure like call centers

- Feedback systems and surveys

- Customer service software

4. Allocated Overheads

A portion of overheads like office space, supplies and utilities used by sales, marketing and service teams responsible for customer acquisition.

Now that you know what costs to factor in, let’s look at some examples.

Customer Acquisition Cost Calculation Examples

Let’s see some examples of calculating CAC across different business types:

Example 1: SaaS Startup

- Marketing costs: $150,000

- Sales costs: $200,000

- Customer service costs: $100,000

- Total new customers: 1,500

CAC = (150,000 + 200,000 + 100,000) / 1,500

= $450,000 / 1,500

= $300

The SaaS startup spends $300 to acquire each customer.

Example 2: Ecommerce Site

- Marketing costs: $500,000

- Sales costs: $0 (online only sales)

- Customer service costs: $50,000

- Total new customers: 100,000

CAC = (500,000 + 0 + 50,000) / 100,000

= $550,000 / 100,000

= $5.50

The ecommerce site spends $5.50 to acquire each new customer.

Example 3: Enterprise Software

- Marketing costs: $2,000,000

- Sales costs: $1,500,000

- Customer service costs: $250,000

- Total new customers: 500

CAC = (2,000,000 + 1,500,000 + 250,000) / 500

= $3,750,000 / 500

= $7,500

The enterprise software company spends $7,500 to acquire each new customer.

These examples show how CAC varies significantly across industries depending on deal sizes, sales cycles, and marketing costs.

Now let’s explore some industry benchmarks for customer acquisition costs.

Customer Acquisition Cost Benchmarks

CAC varies widely across sectors based on business models, product prices, and market dynamics. Here are some average industry CAC benchmarks:

| Industry | Average CAC |

|---|---|

| SaaS | $243 |

| Ecommerce | $113 |

| Finance | $332 |

| Healthcare | $403 |

| Media | $157 |

Factors like deal size, purchase frequency and your market also impact CAC. For instance, SMB SaaS CAC is $243 but enterprise SaaS CAC can be $2,000+.

Review your CAC by industry averages and your company’s growth stage. Startups should focus on lowering acquisition costs to spur growth. Mature companies may increase spending to gain market share.

How to Reduce Your Customer Acquisition Cost

Here are 5 proven ways to lower your CAC:

1. Improve Conversion Rates

Optimizing your sales funnel and website for higher conversions means you can acquire more customers for the same spend.

2. Drive More Referrals

Referrals convert better and have near-zero acquisition costs. Focus on referral programs and influencer collaborations.

3. Nurture Leads

Automated email and lifecycle campaigns reduce sales team efforts to convert leads.

4. Cross-Sell/Upsell

Selling additional products to existing customers has higher success rates than new acquisitions.

5. Retain Customers

Retaining happy customers is cheaper than acquiring new ones. Strengthen loyalty programs

How to calculate customer acquisition cost

There are multiple ways to measure and interpret CAC, so you must understand which formula best serves your company’s needs.

The paid CAC formula

Paid CAC = Marketing and sales expenses (without salaries and overhead costs) / Number of new customers gained via paid channels

Paid CAC is a more specific performance metric that evaluates the effectiveness of paid channels. The paid CAC formula excludes salaries and overhead expenses from the calculation and only accounts for new customers acquired through paid channels.

To get the paid CAC calculation right, companies must define the attribution rules for paid channels. Digital analytics tools like Amplitude enable marketers and product managers to attribute conversions across channels to the right touch points in the customer’s journey.

For instance, if a customer visits your company website after viewing a Google search ad, followed by a Facebook banner ad, Amplitude can assign credit for that visit to multiple touch points using multi-touch attribution. In this case, Google and Facebook each receive credit for the visit.

Customer Acquisition Cost | How to Calculate it with an Example

How to calculate customer acquisition cost?

Below is the formula that you can use to calculate CAC for your business. You can calculate customer acquisition cost by using this formula: Customer Acquisition Cost = Cost of Sales and Marketing divided by the Number of New Customers Acquired. We can see how this formula plays out in the graphic below. Download for Free

How much does it cost to acquire a customer?

For example, if the customer lifetime value of your average customer is only $500 and it costs close to $1,000 to acquire them (via advertising, marketing, special offers, labor, etc.), then they’re losing you money, and you’ll need to pare back your acquisition costs and/or increase CLV through other products and services.

What is Customer Acquisition Cost (CAC)?

The Customer Acquisition Cost (CAC) is a SaaS metric that measures the amount spent on average by a business to acquire a new customer. CAC stands for “Customer Acquisition Cost” and is a critical metric in the SaaS industry used to determine the cost efficiency at which a particular company operates.

How do I track the evolution of my customer acquisition cost?

Input your marketing expense, sales expense, and new customer figures on a monthly basis to track the evolution of your CAC. What is the Cost of Acquiring a Customer? The amount of funds a business invests in marketing and sales efforts to turn a lead into a client is known as the customer acquisition cost, or CAC.