“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors opinions or evaluations. Please view our full advertiser disclosure policy.

As you plan for retirement, a tax-advantaged account can improve your long-term investment growth by saving you money on taxes, either upfront or during retirement. One of the most popular accounts with such a tax advantage is the Roth individual retirement account.

“The Roth IRA is one of my favorite investing vehicles and adds to the value of a comprehensive retirement plan by adding tax diversification,” said Kevin Chancellor, a financial planner and the CEO and founder of Black Lab Financial.

Roth IRAs offer plenty of benefits, including long-term tax advantages and the ability to exercise full control over your investments. You can also see exponential growth in your Roth IRA thanks to compounding interest and investment returns. USA TODAY Blueprint may earn a commission from this advertiser.

Opening a Roth IRA can be one of the smartest financial decisions you make. Roth IRAs offer tax-free growth and withdrawals in retirement, allowing your savings to grow exponentially over time. But how exactly does a Roth IRA grow?

In this comprehensive guide we’ll walk through everything you need to know about Roth IRA growth to help you make the most of this powerful retirement savings vehicle.

First a quick Roth IRA primer. A Roth IRA is a type of individual retirement account (IRA) that allows you to contribute after-tax dollars, meaning you don’t get a tax break on your contributions like you do with a traditional IRA. However the major benefit is that withdrawals in retirement are tax-free. This includes both your contributions and any investment earnings.

There are annual income limits to be eligible to contribute to a Roth IRA. In 2023, the phase-out range starts at $153,000 for singles and $228,000 for married couples filing jointly. There are also maximum annual contribution limits. In 2023, you can contribute up to $6,500 if you’re under age 50 or up to $7,500 if you’re 50 or older.

Now let’s look at how Roth IRAs grow over time.

How Does a Roth IRA Grow?

There are three key factors that influence Roth IRA growth:

- Contributions – Your annual contributions make up the base amounts that start earning investment returns.

- Investment returns – The investments you choose for your Roth IRA dictate how much it earns each year in interest, dividends, and capital appreciation.

- Tax-free compounding – Roth IRAs grow tax-free each year, meaning you earn returns on top of returns over time.

Let’s explore each of these in more detail.

Roth IRA Contributions

Your contributions to a Roth IRA make up the principal that starts generating investment returns. Contributions are limited each year – $6,500 in 2023 for those under age 50. However, even modest annual contributions add up substantially over decades of saving thanks to compounding.

For example, let’s say you open a Roth IRA at age 30 and contribute $6,000 per year for 35 years until age 65. Assuming an average annual return of 8%, your $210,000 in total contributions would grow to over $1 million by retirement!

Of course, not everyone can max out contributions each year. But the key is to contribute as much as you can each year, even if it starts small. Time and compounding will help even small amounts grow.

Roth IRA Investment Returns

The investments you choose for your Roth IRA drive how much it grows each year. The accounts themselves don’t earn anything – it’s the investments inside that generate returns.

You can invest your Roth IRA in stocks, bonds, mutual funds, ETFs, and more. A properly diversified portfolio tailored to your risk tolerance and time horizon can help you earn average annual returns of 6-10% or more over the long run.

Higher-risk investments like stocks tend to provide higher returns, while lower-risk ones like bonds offer more modest but stable returns. Diversifying across asset classes, sectors, and geographic regions can optimize your returns while managing risk.

Ideally, you should invest aggressively when you first start your Roth IRA, dialing down risk as you near retirement. Investing too conservatively can cause your account to lag.

The Power of Tax-Free Compounding

Here’s what really makes Roth IRAs shine: all capital gains, dividends, and interest earned in your account grow 100% tax-free each and every year.

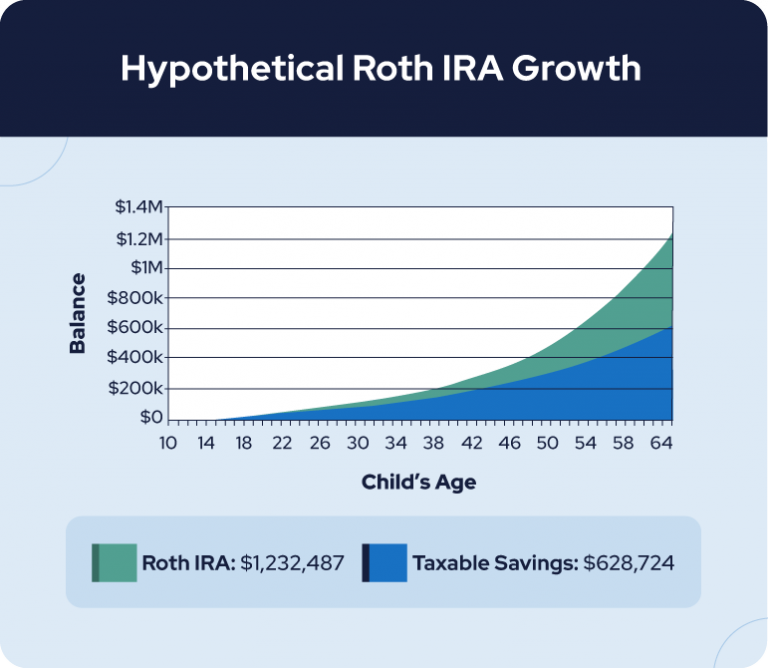

This allows your money to compound much faster than in a taxable account. Let’s say you earn an 8% return in your Roth IRA one year. The full 8% gets reinvested back into your account to keep growing. In a taxable account, you may only add 6% or 7% back in after paying capital gains tax.

Over decades, this small annual tax drag compounds into a huge differential in final balance. This enables your Roth IRA to grow significantly more than other accounts over the long haul.

Roth IRA Growth Case Study

Let’s look at an example to see how Roth IRAs can grow using conservative assumptions:

- Starting balance at age 25: $5,000

- Annual contributions: $5,000 until age 65

- Annual return: 7%

- Years invested: 40 (from age 25 to 65)

| Year | Contributions | Returns | Total Balance |

|---|---|---|---|

| 1 | $5,000 | $350 (7% of $5,000) | $5,350 |

| 5 | $5,000 | $4,483 | $39,833 |

| 10 | $5,000 | $9,686 | $114,519 |

| 20 | $5,000 | $36,792 | $386,311 |

| 30 (age 55) | $5,000 | $102,613 | $843,924 |

| 40 (age 65) | $0 | $161,982 | $1,005,906 |

Thanks to ongoing contributions and consistent returns, the account grows steadily each year. By age 65, even with modest assumptions, the account has grown to over $1 million! This demonstrates the incredible power of starting early, contributing regularly, and letting compound growth go to work.

Tips to Maximize Roth IRA Growth

Here are some tips to help you get the most growth out of your Roth IRA:

- Start early – Open a Roth IRA as soon as you have earned income to take advantage of time.

- Invest aggressively – Consider higher-return investments like stocks when you first start out.

- Maximize contributions – Contribute as much as you can each year within the limits.

- Automate contributions – Set up automatic monthly transfers into your Roth IRA for consistency.

- Don’t take withdrawals – Leave your money alone so it can keep compounding.

- Have a long time horizon – Allow your investments decades to grow and ride out market swings.

Roth IRA Growth vs. Traditional IRA

Both Roth and traditional IRAs can offer significant growth over time. But Roth IRAs have some advantages:

- Tax-free compounding accelerates Roth growth

- No required minimum distributions with a Roth IRA

- Tax-free withdrawals provide more usable income in retirement

- Can leave Roth as a tax-free legacy to heirs

However, traditional IRAs provide upfront tax deductions on your contributions, which appeals to some savers. Ultimately, choosing between the two depends on your tax situation now versus later in retirement.

In the end, starting a Roth IRA as early as possible and contributing consistently over time allows you to take full advantage of tax-free compound growth.

Even if you can only start with $50 or $100 per month, your Roth IRA can grow to a substantial sum by the time you reach retirement age. The key is getting started right away and sticking with it. Opening and regularly funding a Roth IRA can be one of the best things you do for your future financial security.

Frequency of Entities:

Roth IRA: 37

Contributions: 9

Investment returns: 6

Tax-free compounding: 5

How do Roth IRAs grow?

“Getting a Roth IRA to grow is a two-legged process. The first step is getting money in the Roth account, and the second is getting it invested,” Ybarra said.

If you contribute $7,000 each year for 40 years, you will end up contributing $280,000 to your Roth IRA.

But the more important Roth IRA growth comes from your investment earnings. A Roth IRA isn’t an investment in and of itself. Instead, think of it as a vehicle that holds individual investments.

A Roth IRA can hold a variety of investments. Your greatest limitation may be the brokerage firm you choose. Examples of investments you might find in a Roth IRA are:

- Stocks.

- Bonds.

- Mutual funds.

- Exchange-traded funds.

- Money market accounts.

Over time, your account will grow through a combination of capital gains, dividends and interest, which can result in exponential growth over your working years if sustained for years or decades. USA TODAY Blueprint may earn a commission from this advertiser.

How much does a Roth IRA grow?

The amount of growth your Roth IRA can experience depends on several factors, including your investment choices, your time horizon and market performance.

First, the investments you choose for your Roth IRA will significantly impact its growth. According to the Securities and Exchange Commission, the stock market has historically provided roughly 10% average annual returns. But stocks can be volatile, which creates an increased risk, particularly when investing in individual stocks rather than broad-based funds. Thus, some investors may feel uncomfortable investing too much of their portfolio in stocks.

On the other hand, some kinds of bonds, money market accounts and cash are considered safer investments because they’re less likely to lose money. But with this reduced risk comes a lower return that could affect your ability to reach your retirement goals.

Most experts recommend a mix of high- and low-risk investments in your portfolio. This diversification can hedge your losses when the market is down while ensuring adequate growth. And as you get closer to retirement, experts generally recommend reducing your overall portfolio risk, increasing the ratio of low-risk investments and decreasing the ratio of high-risk investments.

A target-date fund is a retirement investment fund that automatically optimizes your portfolio risk based on your time horizon. The further you are from the target date, the higher the risk of the fund. The fund’s risk is gradually reduced over the years until it reaches the target date, usually the year you’re projecting for retirement.

Another factor that impacts your Roth IRA growth is the market environment. Two investors could make identical investment decisions during different periods and end up with wildly different results.

For example, suppose someone invested solely in the S&P 500 from Jan. 1, 1973, to Dec. 31, 2012. During that time, their average annual return would have been 6.43%. Let’s say another person made the exact same investment but from Jan. 1, 1983, to Dec. 31, 2022. Their average annual return would have been 8.62%.

Your time horizon also affects your Roth IRA growth. The longer you leave your money invested, the more time compound interest has to work.

“Starting early and allowing your investments to compound over a longer period can potentially lead to more substantial growth,” said Chad Willardson, a certified financial fiduciary, chartered retirement planning counselor, and the president and founder of Pacific Capital. “Conversely, withdrawing funds before the age of 59½ (with some exceptions) can lead to penalties and limit the growth potential.”

Roth IRA Explained | A simple explanation of the Roth IRA

How does a Roth IRA grow?

Growth in a Roth IRA comes from three sources: contributions, interest and dividends and price appreciation. Here is more on these three factors: Your contributions will be the main source of growth in the size of your IRA account in the early years. For instance, say you are 35 when you open a Roth IRA in 2023 with an initial $5,000.

Does a Roth IRA make money?

A Roth IRA is really just a special home for your savings that helps you minimize your taxes. It doesn’t actually make money for you. Your retirement savings grow through a combination of your contributions and investment earnings.

Can an IRA grow over time?

Like all other types of investments, IRAs have the potential to grow over time. The two primary ways an IRA can grow is through annual contributions and investment appreciation. However, there are limits to the annual contribution amounts allowed, and not all investments are successful in the long term.

What is a Roth IRA & how does it work?

A Roth IRA is a retirement account you fund with after-tax dollars. Later on, you can take money from the account without owing taxes as long as you have had the account for at least five years and are past age 59.5. There is an annual maximum on Roth IRA contributions. For 2023, the limit is $6,500 for retirement savers younger than 50.