Business leaders and investors often look at profit as a key metric for evaluating a company’s financial performance However, there are two main types of profit – economic profit and accounting profit While related, these two profit measurements differ in some important ways. In this article, we’ll explain what economic profit and accounting profit are, how to calculate them, and the key differences between the two.

What is Economic Profit?

Economic profit considers both explicit and implicit costs incurred by a company. Explicit costs are out-of-pocket expenses that appear on a company’s financial statements like raw materials equipment, rent, wages and interest expenses.

Implicit costs are more subtle opportunity costs – potential benefits that are forfeited when a company chooses one investment project or production method over another. For example, if Company A invests $1 million in a new factory, the $1 million represents an implicit cost since the money could have been invested elsewhere to generate additional returns.

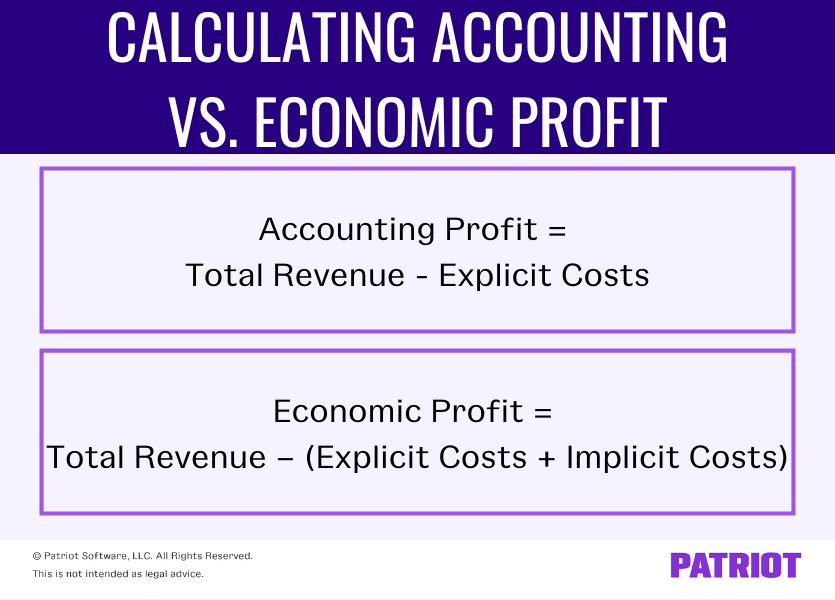

Economic profit is calculated as

Economic Profit = Total Revenue – (Explicit Costs + Implicit Costs)

Positive economic profit means the company is earning surplus revenue over its total costs. Negative economic profit means the company is not recouping its total costs.

Since implicit costs are subjective estimates, economic profit is a theoretical construct rather than a precise figure. Still, it provides useful insight into whether a company is efficiently allocating resources to maximize profitability.

What is Accounting Profit?

Accounting profit, also called net income, focuses purely on explicit revenues and expenses. It appears on a company’s income statement and is calculated as:

Accounting Profit = Total Revenue – Explicit Costs

Explicit costs deducted to determine accounting profit include:

- Cost of goods sold

- Wages and salaries

- Rent

- Depreciation

- Interest expense

- Taxes

- Marketing and advertising

Accounting profit is an objective, verifiable number reported on financial statements. Companies report accounting profit to investors, creditors and tax authorities.

Key Differences Between Economic Profit and Accounting Profit

There are several important distinctions between economic and accounting profit:

-

Accounting profit is objective and verifiable based on accounting rules, while economic profit involves subjective estimates of implicit costs.

-

Economic profit considers opportunity costs, while accounting profit only looks at out-of-pocket expenses.

-

Companies are required to report accounting profit on financial statements, while economic profit is an internal metric.

-

Accounting profit tends to be higher than economic profit since it excludes opportunity costs.

-

Economic profit provides insights into efficient resource allocation, while accounting profit simply shows revenues earned after deducting expenses.

-

A positive accounting profit means a company covers its expenses, while a positive economic profit means it is earning surplus revenues over all costs.

Examples Comparing Economic Profit and Accounting Profit

Let’s look at some examples to further illustrate the differences between economic and accounting profit.

Example 1

John starts a taco stand with $2,000. His explicit costs for rent, ingredients and other supplies total $1,500. After a month, his revenues from taco sales are $2,000.

-

His accounting profit is $2,000 (revenues) – $1,500 (explicit costs) = $500.

-

His economic profit also factors in the opportunity cost of investing his $2,000 into the taco stand rather than somewhere else. If the $2,000 could have earned 5% interest elsewhere, the implicit cost is $100 (0.05 * $2,000). His economic profit is $2,000 (revenues) – $1,500 (explicit costs) – $100 (implicit interest forgone) = $400.

In this example, accounting profit is $500 while economic profit is only $400 due to the consideration of implicit opportunity costs.

Example 2

XYZ Corp reports the following results for 2022:

Revenues: $5,000,000

Expenses:

- Cost of goods sold: $2,000,000

- Rent: $500,000

- Wages: $800,000

- Depreciation: $300,000

- Marketing: $200,000

- Interest: $100,000

-

XYZ’s accounting profit = $5,000,000 revenues – $2,000,000 – $500,000 – $800,000 – $300,000 – $200,000 – $100,000 = $1,100,000

-

However, management estimates that XYZ could have earned an additional $500,000 in profits by investing surplus cash in securities rather than leaving it in low yield savings accounts. This represents an implicit opportunity cost of $500,000.

-

XYZ’s economic profit = $5,000,000 revenues – $2,000,000 – $500,000 – $800,000 – $300,000 – $200,000 – $100,000 – $500,000 (implicit cost) = $600,000

Again, the inclusion of implicit costs reduces economic profit below the accounting profit figure.

Key Takeaways

-

Economic profit deducts both implicit and explicit costs from revenues to estimate true surplus earned, while accounting profit only deducts explicit costs to calculate net income.

-

Economic profit includes opportunity costs and provides insights into efficient resource allocation, while accounting profit is simply revenues less expenses reported to stakeholders.

-

Accounting profit tends to be higher than economic profit in most cases, since implicit costs are subjective and not reported on financial statements.

-

Companies analyze economic profit to make decisions that maximize returns, though accounting profit is still critical for reporting obligations and tax compliance.

-

Understanding the key differences between economic profit and accounting profit provides helpful context for analyzing a company’s financial results and management decisions.

Accounting Profit vs. Economic Profit

Accounting profit is a company’s net earnings on its income statement, whereas economic profit is the value of cash flow that’s generated above all other opportunity costs. This guide will help you thoroughly understand accounting profit vs economic profit, and while they may sound similar, they are actually quite different.

What is Accounting Profit?

Accounting profit is the net income that a company generates, found at the bottom of its income statement. The figure includes all revenue the company generates and deducts all expenses to arrive at the bottom line.

Common sources of revenue include the sale of goods and services, receipt of dividends or interest, and rental income, to name a few.

Common types of expenses include the cost of goods sold (COGS), marketing and advertising expenses, salaries and benefits, travel, entertainment, sales commissions, rent, depreciation and amortization, interest, and taxes.

Learn more in CFI’s Free Accounting Crash Course.

Below is an example showing Amazon’s 2017 consolidated statement of operations (also known as a statement of profit and loss or income statement).

In the example, you can clearly see how the statement starts with revenue (sales) and then deducts all expenses to arrive at net income (a.k.a. accounting profit). In 2017, the figure was $3.0 billion for Amazon.

Learn more in CFI’s Financial Analysis Course.

Economic profit differs quite significantly from accounting profit. Instead of looking at net income, economic profit considers a company’s free cash flow, which is the actual amount of cash generated by a business. Due to accrual accounting principles, the figure is often materially different from accounting profit.

Furthermore, once the company’s free cash flow is calculated, it must then take into account the opportunity cost that managers of the business can expect to earn on comparable alternatives.

Learn more in CFI’s Economic Value Added Guide.

For example, imagine a company has two choices: Invest $1,000 into a new t-shirt product line (Project #1) or invest $1,000 into a new sock product line (Project #2). Project #1 will have revenues of $200 and costs of $125, while Project #2 will have revenues of $300 and costs of $280.

Below is an example (simplified) calculation of how to calculate the economic profit of each project.

The first step is to calculate the cash flow of each project. For a detailed explanation of how to perform the calculation, see CFI’s Ultimate Cash Flow Guide.

The next step is to take the difference between the cash flows of each project and compare them to see which generates more economic profit.

As you can see, Project #2 generates a positive economic profit, relative to Project #1. Learn more in CFI’s Financial Modeling Courses.

Thank you for reading CFI’s guide to Accounting Profit vs Economic Profit. These additional CFI resources will be helpful:

- Share this article

Economic profit vs accounting profit | Microeconomics | Khan Academy

What is the difference between accounting profit and economic profit?

Accounting profit is the profit after subtracting explicit costs (such as wages and rents). Economic profit includes explicit costs as well as implicit costs (what the company gives up to pursue a certain path). As such, accounting profit represents a company’s true profitability while economic profit is indicative of its efficiency.

What is the difference between revenue and economic profit?

Revenue is income from selling a firm’s product; defined as price times quantity sold. Accounting profit is the total revenues minus explicit costs, including depreciation. Economic profit is total revenues minus total costs—explicit plus implicit costs.

What is accounting profit?

Accounting profit is the net income for a company or revenue minus expenses. You can determine economic profit by subtracting total costs from a company or investment’s total revenue or return. Companies report their accounting profits to investors on their income statements and to the IRS for tax purposes.

What is economic profit?

Economic profit is a form of profit that is derived from producing goods and services while factoring in the alternative uses of a company’s resources. It deducts explicit costs from revenue and includes the opportunity costs incurred during that period of time.