We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free – so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict , this post may contain references to products from our partners. Heres an explanation for . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. Bankrate logo

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next. Bankrate logo

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Bankrate logo

Having a credit card comes with many responsibilities. One of those is carefully monitoring your statement and current balances to avoid late fees, interest charges, and damage to your credit. But what exactly is the difference between your statement balance and current balance? And how can understanding this difference help you manage your account and credit score? In this comprehensive guide, we’ll explain everything you need to know about statement vs. current balance, including easy ways to keep track of both.

What is a Statement Balance?

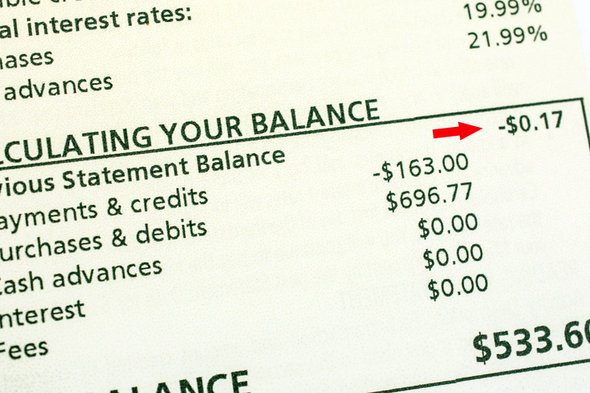

Your statement balance is the total amount you owed on your credit card at the end of your last billing cycle. Your billing cycle is usually the period between the day your credit card statement is generated each month (anywhere from 28-33 days).

Every month, your credit card company will send you a statement listing all of your account activity – purchases, payments, credits interest charges and fees – for that billing cycle. The statement balance is the sum of those transactions. Here are some examples of how a statement balance is calculated

-

If you made $500 in purchases and paid $200 toward your balance, your statement would show $500 in purchases minus $200 in payments = $300 statement balance

-

If you made $300 in purchases, took a $500 cash advance, and paid $100, your statement would show $300 in purchases + $500 cash advance – $100 payment = $700 statement balance.

-

If you made $700 in purchases but also had a $200 credit from a return, your statement would show $700 in purchases – $200 credit = $500 statement balance.

The key things to understand are:

- The statement balance only includes activity within that billing period, not any new charges after.

- It is calculated after payments and credits are subtracted.

- You must pay at least this amount by the due date to avoid interest on purchases.

What is the Current Balance?

Your current balance, on the other hand, is the full amount you owe on your credit card right now. This includes all charges made during the current billing cycle, even those not yet billed.

For example, let’s say your last statement balance was $300. But in the time since your last statement cut, you charged $200 more to your card. Your current balance would now be $500, even though your last statement only shows the $300.

The current balance is a running total that changes daily as you use your card. It’s basically an up-to-the-minute look at what you owe. This is different than the statement balance, which just gives a periodic snapshot.

Other key differences:

-

The current balance takes into account charges made after the statement date. The statement balance does not.

-

The current balance is updated in real-time. The statement balance updates monthly.

-

You can view your current balance at any time by logging into your account. The statement balance is only listed on your monthly billing statement.

When Are the Balances the Same Amount?

In some cases, your statement balance and current balance may match. When does this happen? There are two main scenarios:

1. You haven’t used your credit card since your last statement period ended.

For example, let’s say your billing cycle ends on the 15th of each month and your last statement on the 15th showed a balance of $500. If you haven’t made any new charges on that card between the 15th and today, your current balance would still show $500.

2. You’ve paid your balance down to $0 since your last statement.

If you owed $500 on your last statement but have since paid off the entire balance, your current balance would now show $0 as well. That’s because you no longer have a balance carried over from the previous cycle.

As long as you refrain from new charges after paying your card to zero, the statement and current balances stay in sync at $0. But as soon as new activity occurs, they’ll diverge again.

How Knowing the Differences Can Help You

Now that you understand what statement and current balances are, let’s explore how knowing the distinction can help you make smarter choices about using your credit card and managing your account.

Avoid Late Fees and Interest Charges

To avoid late fees and interest on purchases, it’s critical to pay at least your statement balance by the due date each month. This “resets” your billing cycle and keeps that interest-free grace period intact.

But paying just the statement balance leaves outstanding new charges unpaid. The interest-free period won’t apply to those, meaning you could accrue interest until they’re paid off as well.

By also keeping an eye on your up-to-date current balance, you can determine if you should pay above the statement amount. This minimizes expensive interest which can quickly negate any rewards you earn.

Better Understand Your Financial Habits

Checking both balances frequently can provide helpful insight into your spending patterns.

For instance, let’s say your current balance is $500 higher than your last statement balance. This signals that you’ve swiped your card a lot lately. Seeing that discrepancy might prompt you to curb unnecessary expenses for the remainder of the cycle.

On the flip side, if your current balance is lower than your statement balance, it means you’ve made significant payments toward your debt recently. Tracking this can motivate you to continue positive payment behavior.

Avoid Exceeding Your Credit Limit

Paying attention to your current balance makes it easy to avoid maxing out your credit card – a big no-no for your credit score.

For example, say your credit limit is $1000 and your statement shows you’ve used $700 of that. But your current balance is now $900, meaning you’ve charged another $200 since then. Knowing this, you can be careful not to spend more than $100 until your statement cuts again to avoid busting your limit.

Plan Payments in Your Budget

Knowing both your current and statement balances makes it easier to budget for upcoming card payments each month.

Glancing at your current balance gives you an idea of what you already owe on your card right now. You can use this figure to start setting aside money to pay it down.

Then when your statement cuts, showing the official statement balance due, you can fine-tune your budgeted payment amount accordingly.

Maximize Rewards

Many credit cards offer rewards programs that let you earn points, miles, or cash back on your spending. To maximize these programs, it helps to have visibility into what you’ve spent so far in the current cycle (via your current balance) vs. what’s already been billed (your statement balance).

You can then strategize your remaining monthly spending to ensure you earn the most rewards possible from bonus categories or by hitting spending thresholds.

Keep Your Credit Utilization Low

Credit utilization is the percentage of your total credit limits that you’re using. This metric has a major impact on your scores.

To keep your utilization low, keep tabs on your current balances so you know exactly how much of your credit line you’re using up at any given time. Avoid getting too close to your caps.

If your statement balance alone crept close to your limit, your current balance could put you way over without you realizing. But catching it early lets you pay down balances before statement reporting.

Easy Ways to Track Both Statement and Current Balances

Managing both your statement and current balances doesn’t have to be complicated. Here are some easy ways to stay on top of both:

-

Review statements carefully each month – Don’t just glance at your statement balance and pay it. Read through the whole statement to understand your spending that period.

-

Log into your online account frequently – Check your current balance at least weekly to spot trends. Set up email alerts for balance thresholds.

-

Use your card issuer’s app – Mobile apps make checking your balances a breeze. Add your card to your digital wallet for instant access.

-

Sign up for balance notifications – Many issuers let you choose to receive balance alerts via text, email, or app. Utilize them.

-

Mark statement closing dates on your calendar – Reminders prevent forgetting when your statement amount will be “locked”.

-

Note balances on a tracking app or spreadsheet – Recording both balances helps you monitor directional trends over time.

-

Ask for lower credit limits if needed – Having higher limits can risk overspending. Right-size your limit to your needs.

Key Takeaways on Statement vs. Current Balance

-

Your statement balance is your total owed at the end of your last billing cycle. It can be found on your monthly statement.

-

Your current balance is what you owe in real-time, accounting for charges made after the statement date.

-

Checking both frequently helps you budget payments, avoid fees and interest, maximize rewards, and keep credit utilization low.

-

Making payments by the due date covers the statement balance but not always the current balance. Paying the current balance pays off your card fully.

-

Setting balance alerts, recording balances consistently, and reviewing statements helps you easily track both amounts.

Understanding the difference between your credit card’s statement and current balances gives you greater control over your account. You can spot unhealthy spending patterns, avoid costly mistakes, plan smarter payments, and buil

What is a statement balance?

A credit card statement balance shows the amount you owe on the last day of the billing cycle. It includes the total of any purchases, interest charges, fees and unpaid balances from the billing cycle, which can last from 28 to 31 days. The statement balance is listed on the monthly statement from your credit card issuer.

Keep in mind that the beginning and end of a billing cycle can fall on any day of the month and aren’t dictated by calendar months.

Why is the statement balance different from the current balance?

It’s pretty common for the current balance to be higher than the statement balance. Let’s say your credit card company issued your statement on July 31, and the statement balance was $600. Your payment won’t be due until at least 21 days later, thanks to the Federal Credit CARD Act of 2009.

In the meantime — before you pay the bill — you buy that pair of shoes, which costs $75. With the new $75 shoe purchase, your current balance would increase to $675. But your statement balance would remain at $600 because the new purchase would show up as part of the next statement’s billing cycle.

On the other hand, your statement balance could be higher than your current balance if you received a refund after the billing cycle ended. Of course, both the statement balance and current balance should be the same if you don’t have any transactions on your credit card between monthly billing cycles.