Gross profit margin and operating profit margin are two metrics used to measure a companys profitability. Gross profit margin includes the direct costs involved in production, while operating profit margin accounts for operating expenses like overhead. Both metrics are important in assessing the financial health of a company.

As a business owner or investor, understanding the financial health of a company is critical. Two important metrics that provide insight into profitability are operating margin and gross margin. Though they sound similar, these margins examine profitability at different points and can help identify strengths weaknesses and opportunities.

In this article, we’ll explain in simple terms the difference between operating margin and gross margin, how to calculate them, and why both matters

What is Gross Margin?

Gross margin represents the percentage of total revenue that a company retains after accounting for the direct costs associated with producing and distributing its products or services.

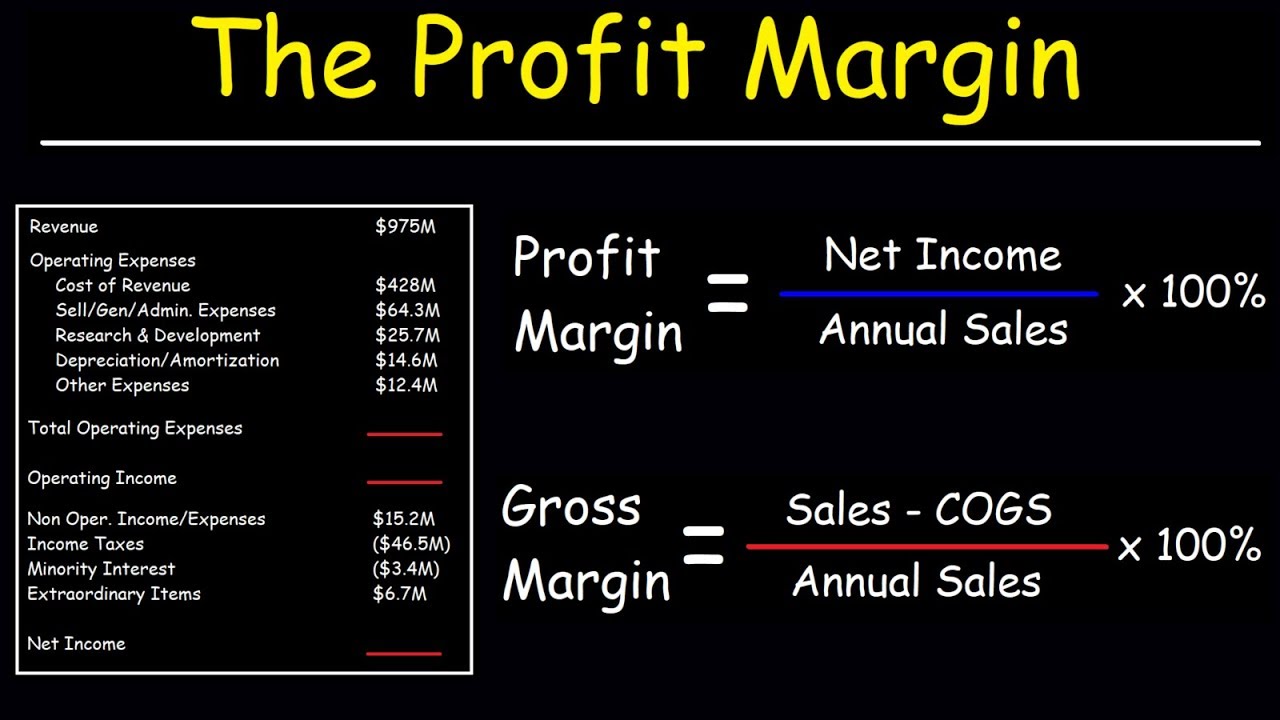

It provides insight into how efficiently a company is utilizing its raw materials and labor. The formula is:

Gross Margin = (Total Revenue – Cost of Goods Sold) / Total Revenue

Let’s look at a simple example:

- A company has $100,000 in total revenue

- It’s direct costs are $65,000

- Gross Margin = ($100,000 – $65,000) / $100,000 = 35%

So this company retains $35 out of every $100 in revenue after paying direct costs.

For product companies, direct costs include raw materials and labor for production. For service companies, it may include labor and overhead for providing the service.

A higher gross margin is generally better, as it means the company is efficient at keeping direct costs low. It has more revenue leftover to pay operating costs and hopefully generate profit.

Trends in gross margin over time can indicate improving or worsening efficiency. Comparing gross margins between competitors can also provide benchmarking.

What is Operating Margin?

While gross margin focuses on direct costs, operating margin looks at profitability after accounting for all operating expenses. This includes things like:

- Sales, general & administrative costs

- R&D, marketing, and advertising costs

- Depreciation and amortization

- Other overhead expenses

The formula is:

Operating Margin = (Revenue – Operating Expenses) / Revenue

Let’s take our example company:

- Revenue is still $100,000

- But now it has $40,000 in operating expenses

- So its Operating Margin is ($100,000 – $40,000) / $100,000 = 60%

The company retains $60 out of every $100 in revenue after accounting for direct and operating costs.

A higher operating margin is better, as it means the company manages operating expenses efficiently. Trends over time and comparisons to competitors also provide useful benchmarking.

Additionally, operating margin shows if a company is profitable enough to take on more financing or investment for growth. Gross margin does not account for operating costs, so it does not provide this complete picture.

Key Differences Between the Margins

While both measure profitability, there are a few key differences:

- Gross margin is always higher – it excludes operating expenses while operating margin includes them

- Gross margin focuses on production efficiency – it looks at just direct costs

- Operating margin is more comprehensive – it accounts for all operating costs

- Operating margin is more insightful for valuation – it shows overall profit levels after operating expenses

- Gross margin is good for evaluating production/service delivery efficiency

- Operating margin better indicates overall profit levels and investment potential

Real World Examples

Let’s look at gross margin and operating margin examples from real companies:

Walmart

- Gross Margin: 24.1%

- Operating Margin: 4.6%

Walmart has a decent gross margin, keeping direct costs low. But operating expenses like staffing thousands of stores keeps operating margin relatively low.

Microsoft

- Gross Margin: 67.7%

- Operating Margin: 41.5%

Microsoft has high gross margins thanks to software requiring low direct costs. The high operating margin shows Microsoft manages operating costs well while still generating significant profit.

Tesla

- Gross Margin: 25.0%

- Operating Margin: 12.1%

Tesla has an average gross margin for an automaker. But high R&D and rapid expansion sinks operating margin. As growth slows this may improve.

Why Both Margins Matter

Looking at both gross margin and operating margin helps paint a complete picture of profitability.

Gross margin shows production/service efficiency. If it is too low, a company should look at ways to reduce direct costs.

Operating margin indicates profit levels accounting for all costs. A low operating margin means trimming operating expenses could help boost profitability.

Monitor changes over time and compare to competitors. Use the margins together to make a comprehensive assessment.

In Summary

- Gross margin excludes indirect costs, while operating margin includes them

- Gross margin focuses on production efficiency, operating on overall profits

- For valuation, operating margin is more insightful

- Assess both over time and relative to peers for a complete view

Understanding the difference between gross margin and operating margin, and analyzing both metrics, allows for better financial analysis and insight into opportunities. Use this knowledge to make informed strategic and investment decisions.

Gross Profit Margin

The gross profit margin shows how well a company generates revenue from direct costs like direct labor and materials used in production. Gross profit is first calculated by subtracting the cost of goods sold from total revenue. Gross profit margin is the difference divided by total revenue and shown as a percentage.

Gross Profit Margin = Revenue − COGS Revenue × 100 where: COGS = Cost of goods sold begin{aligned} &text{Gross Profit Margin} = frac { text{Revenue} – text{COGS}}{ text{Revenue}} times 100 \ &textbf{where:} \ &text{COGS} = text{Cost of goods sold} \ end{aligned} Gross Profit Margin=RevenueRevenue−COGS×100where:COGS=Cost of goods sold

The cost of goods sold (COGS) is the amount a company spends to produce the goods or services it sells.

Operating Profit Margin

Operating profit is derived from gross profit. Operating profit or operating income takes gross profit and subtracts all overhead, administrative, and operational expenses. Operating expenses include rent, utilities, payroll, employee benefits, and insurance premiums. The operating profit calculation excludes interest on debt and the companys taxes.

Operating profit margin is calculated by dividing operating income by total revenue. Like gross profit margin, operating profit margin is expressed as a percentage.

Operating Profit Margin = Operating Income Revenue × 100 begin{aligned} &text{Operating Profit Margin} = frac { text{Operating Income} }{ text{Revenue}} times 100 \ end{aligned} Operating Profit Margin=RevenueOperating Income×100

Gross Margin vs Operating Margin

How do you calculate operating margin?

To calculate operating margin, you first need to know your business’s operating income. That’s total revenue minus all operating expenses, including COGS, as well as depreciation and amortization. The operating margin formula is: (operating income / total sales revenue) x 100 = operating margin

What is the difference between gross profit margin and operating profit margin?

Gross profit margin and operating profit margin are two metrics used to measure a company’s profitability. Gross profit margin includes the direct costs involved in production, while operating profit margin accounts for operating expenses like overhead. Both metrics are important in assessing the financial health of a company.

What is the difference between operating income and operating margin?

Operating income (or loss) is the profit (or loss) from net sales after deducting COGS and operating expenses . Operating margin is the “common size” metric derived from operating income. Common size metrics are expressed as percentages of sales, making it easier to compare companies of different sizes.

What is the difference between gross margin and net margin?

Gross Margin Analysis The Difference Between Gross Margin and Net Margin Gross margin measures the return on the sale of goods and services, while the operating margin subtracts operating expenses from the gross margin.