Within the realms of finance and commerce, two fundamental documents emerge as crucial pillars, wielding immense influence in elucidating a company’s financial well-being and operational prowess: the annual report vs financial statement. These documents bear the weight of scrutiny from financial institutions, discerning investors, and astute businesses, all driven by the pursuit of knowledge that fuels judicious decision-making.

In this expansive and meticulously crafted guide, our journey will lead us to the heart of the perpetual discourse surrounding the annual report versus financial statement, wherein we shall meticulously excavate 12 pivotal distinctions. These distinctions will illuminate the contrasting roles, contents, and the profound significance that each document embodies.

We invite you to embark on this enlightening expedition, for it promises to be a compass in your quest for financial enlightenment and proficiency in the world of business.

An annual report is a comprehensive document that serves as a vital communication tool for businesses. Its primary purpose is to provide stakeholders, including shareholders, investors, customers, and the general public, with a detailed overview of the company’s performance, activities, and financial health over the course of a fiscal year.

It goes beyond mere numbers, offering a narrative that showcases the company’s achievements, challenges, and prospects. Through an annual report, a business aims to build transparency, trust, and credibility, demonstrating its commitment to accountability and corporate governance.

It often includes a letter from the CEO, management’s discussion and analysis (MD&A), and reports on corporate social responsibility, providing a holistic view of the company’s operations and its impact on the community and the environment.

Furthermore, annual reports typically incorporate creative and visually appealing design elements, making them engaging and informative. They may also include interactive features, such as links to videos and supplementary online resources.

Overall, an annual report is a strategic tool that not only informs but also promotes the company’s brand and identity, encouraging stakeholders to continue their support and engagement with the business.

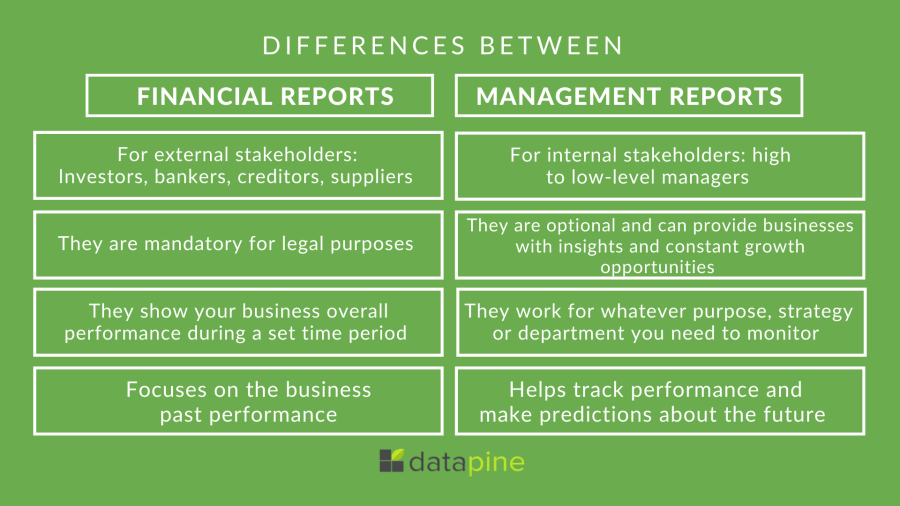

Financial reports and financial statements – it’s easy to use these terms interchangeably But they actually refer to distinct documents with different purposes.

Understanding the unique roles of financial reports vs financial statements is critical for proper financial planning, analysis, and reporting.

In this comprehensive guide we’ll cover

- The definition and purpose of financial reports

- Types of reports that fall under the ‘financial reports’ umbrella

- The key features and uses of financial statements

- Reasons financial statements are considered a subset of financial reports

- Examples of different types of useful financial reports

- Tips for preparing accurate, impactful financial reports and statements

Let’s dive in to better understand the difference between these two cornerstones of financial reporting.

What are Financial Reports?

Financial reports broadly refer to any documents that compile important financial information for internal and external stakeholders. Reports help communicate a business’s financial position and performance.

Common examples of financial reports include:

-

Financial statements – The income statement, balance sheet, and cash flow statement are core financial statements that summarize a company’s financial health. We’ll explore them in more detail shortly.

-

Annual reports – These provide a comprehensive overview of a company’s financial performance and position in the past year, along with a look ahead. Public companies are required to publish detailed annual reports.

-

Quarterly earnings reports – Required summary updates on revenue and profitability over the past 3 months. These are released via press releases, analyst calls, and SEC filings.

-

Internal management reports – Custom performance reports generated for executives, department heads, and other internal decision makers.

So in essence, the term ‘financial report’ encompasses any report communicating money-related information. Next let’s look at the role of financial statements.

Understanding Financial Statements

Financial statements are a specific type of financial report used by businesses to provide detailed information on their financial health. There are three main financial statements:

Income Statement

Also called a profit and loss statement, this shows revenue earned and expenses incurred over a period of time. It summarizes profitability and helps assess operational performance. Important elements include:

-

Revenue – Money brought in from sales of products and services

-

Cost of goods sold – Direct production costs

-

Operating expenses – Ongoing overhead costs like salaries, marketing, facilities etc.

-

Earnings before interest, taxes, depreciation and amortization (EBITDA) – Profitability before accounting adjustments

-

Net income – The final profit or loss after all expenses and adjustments

Balance Sheet

A snapshot of assets, liabilities, and equity on a given date. It helps assess the business’s financial position and health. Key components are:

-

Assets – Resources owned including cash, inventory, property, accounts receivable etc.

-

Liabilities – Debts and obligations owed

-

Equity – Value attributable to shareholders like paid-in capital and retained earnings

Cash Flow Statement

This tracks money flowing in and out during a period. It provides insight on where cash is generated and how it’s used. Key elements:

-

Operating activities – Cash from core business operations

-

Investing activities – Cash from investments and capital expenditures

-

Financing activities – Cash from financing-related activities like loans, equity issuance etc.

Together, these three core statements provide the fundamental data needed to assess a company’s finances.

Why Financial Statements Are Considered Financial Reports

Given the specific purpose of financial statements, why are they considered a type of financial report? There are a few reasons:

Reporting to stakeholders – Like other financial reports, financial statements aim to communicate a business’s financial data to internal and external stakeholders. The audience may include owners, executives, investors, lenders, regulators, and more.

Standard structure – They adhere to established accounting standards for reporting categories, formats, and contents. This standardization facilitates comparison across businesses and industries.

Basic source data – Financial statements form the basis of many other financial reports. Earnings reports, annual reports, and internal performance updates typically draw data from these foundational documents.

Required periodic issuance – In most jurisdictions, businesses must prepare core financial statements regularly, usually quarterly and annually. This consistent financial reporting helps stakeholders track trends over time.

Examples of Other Types of Useful Financial Reports

While they don’t qualify as formal financial statements, various other financial reports provide key insights. Common examples include:

-

Budget reports – Compare actual spending vs. budgeted amounts in a period. Help identify variances.

-

Management dashboards – Highlight key performance indicators (KPIs) like profits, costs, and growth rates in visual formats for quick top-level monitoring.

-

Customer profitability reports – Analyze revenue and profit metrics for customer accounts. Help identify the most valuable customers.

-

Inventory reports – Track inventory balances, turnover, shrinkage, and other metrics. Support optimal investment and mix.

-

Cash flow forecasts – Project expected cash inflows and outflows to inform liquidity planning and cash needs.

The right mix of financial reports provides comprehensive insights to guide planning and operations across the organization.

Tips for Preparing Better Financial Reports and Statements

Follow these best practices to ensure your financial reports and statements are impactful:

-

Prioritize accuracy – All data and calculations should be meticulously validated. Even small errors can undermine trust.

-

Focus on timeliness – Reports should be completed quickly after period close to maximize relevance.

-

Consider audiences – Tailor contents and presentation formats to the needs of each target report audience.

-

Highlight key trends – Use visuals like charts to illustrate important trends and variances vs. past periods or budgets.

-

Consolidate data – Bring together results across all relevant entities, departments, and geographies for unified visibility.

-

Automate generation – Use financial reporting software to automate report and statement creation for speed and consistency.

-

Protect data integrity – Limit system access and maintain change logs to prove the reliability of financial data.

With the right tools and processes, you can efficiently produce financial reports and statements that provide stakeholders timely, accurate, relevant insights.

The next time you prepare or review an important money-related document, consider whether it meets the definition of a financial statement, another form of financial report, or neither. Applying these terms precisely helps ensure shared understanding.

Armed with the distinctions outlined here, you can better leverage financial reports and statements to understand the underlying financial position and performance of any business.

Financial Statement at a Glance

A financial statement for a business serves as a comprehensive snapshot of its financial health and performance over a specific period, typically a fiscal year. It consists of several key components, including the balance sheet, income statement, and cash flow statement.

The balance sheet reveals the company’s assets, liabilities, and shareholders’ equity, providing insights into its overall financial position. The income statement highlights the company’s revenue, expenses, and profitability, showcasing whether the business is making a profit or incurring losses.

Meanwhile, the cash flow statement illustrates how cash moves in and out of the business, crucial for assessing its liquidity and ability to meet short-term obligations.

This financial document is instrumental for various stakeholders, including investors, lenders, and management. Investors use it to evaluate the company’s financial stability and growth potential, while lenders assess its creditworthiness.

For management, financial statements are essential for making informed strategic decisions, tracking performance, and identifying areas that need improvement.

In summary, financial statements are invaluable tools that offer a clear and detailed picture of a business’s financial status, enabling stakeholders to gauge its viability and make well-informed financial decisions.

Historical vs. Current Data

Distinguishing between historical and current data is pivotal when comparing annual reports to financial statements. Annual reports serve as comprehensive archives of a company’s financial performance over an entire fiscal year.

They not only document the culmination of a year’s worth of financial transactions but also provide an expansive overview of the company’s journey during that period. In contrast, financial statements are designed to encapsulate the company’s financial state at a specific point in time or over shorter intervals, like a quarter or a month.

Financial statements focus on the “now,” offering a snapshot of the company’s financial health at the time of reporting. This means that while annual reports paint a broader, more historical picture, financial statements are akin to instantaneous photographs, capturing a moment in the company’s financial timeline.

Understanding this distinction is vital for decision-makers and investors who require different data perspectives for their strategic choices.

In the realm of financial reporting, compliance with regulatory guidelines is paramount. Both annual reports and financial statements are subject to specific regulatory requirements, although the extent of flexibility they offer varies significantly.

Annual reports, on the one hand, are characterized by a degree of flexibility in terms of content and presentation. This leniency allows companies not only to fulfill regulatory obligations but also to showcase their unique brand identity effectively. Companies can use annual reports as a platform to convey their journey, achievements, and corporate values, thereby connecting with a broader audience.

Conversely, financial statements follow a more rigid path. They are bound by stringent accounting standards, ensuring consistency and comparability across the industry.

These standards are designed to provide a common language for financial data interpretation, making it easier for investors and analysts to assess a company’s financial health. This rigidity ensures that financial statements serve their primary purpose effectively, which is to provide standardized, easily comparable financial information for decision-making.

FINANCIAL STATEMENTS: all the basics in 8 MINS!

What is the difference between financial statements and financial reports?

Here are the key differences between financial statements and financial reports: A financial statement, such as a balance sheet or cash flow statement, includes information pertaining to a particular subject, whereas a financial report includes information on many related topics. Put simply, a financial report includes several financial statements.

What information is included in a financial report?

Put simply, a financial report includes several financial statements. For example, a quarterly financial report could include an income statement, a statement of change in equity and a balance sheet. Related: What Information Is Included in Financial Reporting?

What is a financial statement?

Under this umbrella are: Financial statements such as income statement, balance sheet, statement of cash flows. Quarterly earnings that are then distributed via press releases, conference calls, or company website. Quarterly and annual reports for governmental agencies such as the Securities and Exchange Commission (SEC).

Are all financial statements financial reports?

Financial statements are one such report that falls under the financial report umbrella. In other words, all financial statements are financial reports, but not all financial reports are financial statements. Financial reports gather important financial information for distribution to the public. Under this umbrella are: