This article looks at marginal benefit vs marginal cost and the formula to calculate them. Read also about the different components, examples, and faqs.

If you were a company and there was a way to maximize profits, would you want to know it? Marginal benefit and marginal cost are essential to know in the business world. Well thoroughly go over both with examples.

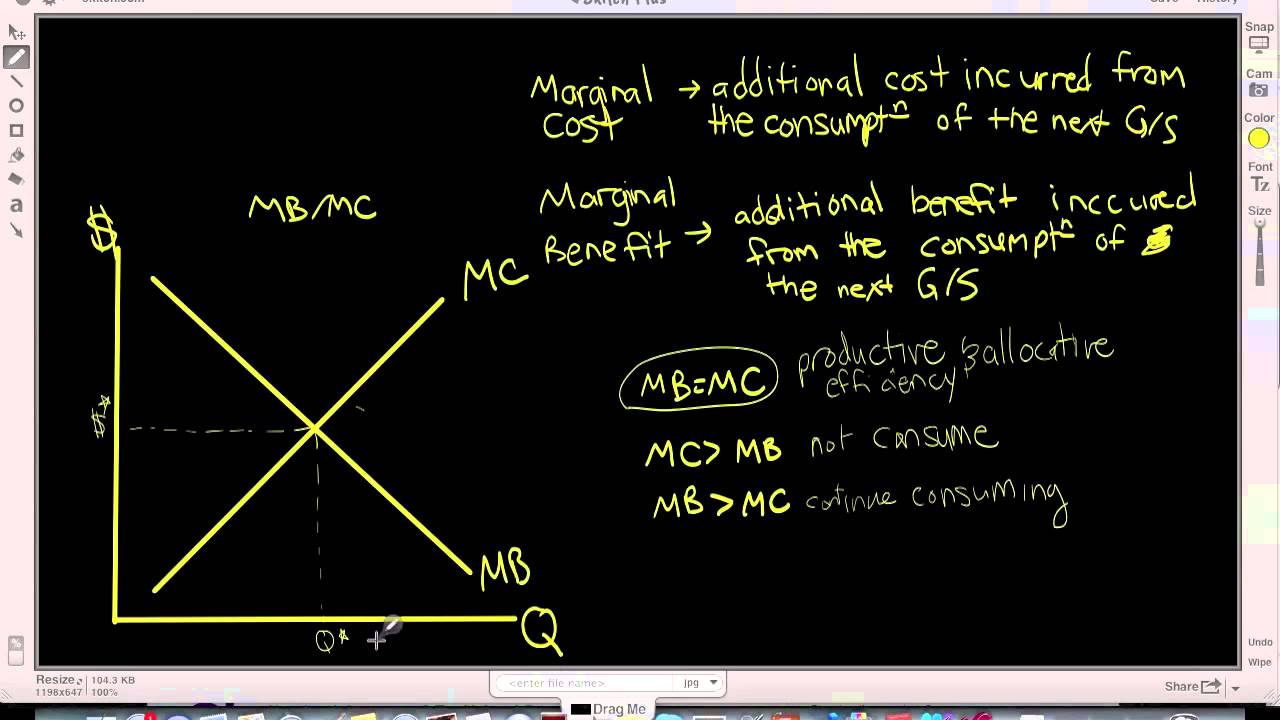

Understanding the relationship between marginal cost and marginal benefit is key to making optimal decisions in economics. As a consumer or business, you want to continue consuming or producing additional units of a good as long as the marginal benefit exceeds the marginal cost.

What is Marginal Cost?

Marginal cost refers to the additional cost incurred by producing one more unit of a product. For example, if it costs a bakery $2 to produce a loaf of bread, and producing one additional loaf increases total costs to $4, the marginal cost of producing that additional loaf is $2.

Some key characteristics of marginal cost

-

Marginal cost tends to increase as production increases due to the law of diminishing returns. Producing additional units becomes more resource intensive.

-

Marginal cost can be calculated as the change in total cost divided by the change in quantity produced.

-

The marginal cost curve plots marginal cost over the quantity produced. The curve usually slopes upwards.

-

Fixed costs like rent are not included in marginal cost. Only variable costs are relevant.

-

At low levels of production, marginal cost may be below average cost. At higher production levels, marginal cost exceeds average cost.

What is Marginal Benefit?

Marginal benefit refers to the additional satisfaction or utility a consumer gains from consuming one more unit of a good or service. For example, if a consumer is willing to pay $5 for a hamburger but only $3 for a second hamburger, the marginal benefit of the second hamburger is $3.

Some key characteristics of marginal benefit:

-

Marginal benefit tends to decrease as consumption increases due to the law of diminishing marginal utility. The additional units provide less extra satisfaction.

-

Marginal benefit can be calculated as the change in total benefit divided by the change in quantity consumed.

-

The marginal benefit curve slopes downwards, showing diminishing marginal utility.

-

Marginal benefit is linked to the demand curve. The price a consumer is willing to pay indicates the marginal benefit.

-

Necessities like food and medicine may not follow the law of diminishing marginal utility.

Comparing Marginal Cost and Marginal Benefit

There are three possible scenarios when comparing marginal cost and marginal benefit:

1. Marginal Benefit Exceeds Marginal Cost

This is the optimal scenario. If the marginal benefit from an additional unit exceeds the marginal cost of producing it, then producing more units will increase total surplus and net benefits to society. For example, if the marginal benefit of a textbook is $60 and the marginal cost is $50, society gains a $10 surplus from producing and consuming it.

In this case, production and consumption should be expanded until marginal benefit equals marginal cost. Society maximizes net benefits at this equilibrium point.

2. Marginal Cost Exceeds Marginal Benefit

Here, producing an additional unit costs more than the extra benefit it provides to consumers. Producing the unit would decrease total surplus and net benefits. For example, if the marginal cost of a textbook is $60 but the marginal benefit is only $50, it is inefficient to produce it.

In this scenario, production and consumption should be reduced until marginal cost and marginal benefit are equal.

3. Marginal Benefit Equals Marginal Cost

This represents the optimal equilibrium where net benefits to society are maximized. There is no incentive to produce more or fewer units in this case. For example, if the marginal cost and marginal benefit of a textbook are both $50, the current level of production is socially optimal.

Expanding production would make marginal cost exceed marginal benefit, while reducing production would make marginal benefit exceed marginal cost. Staying at the intersection maximizes gains.

Applications

Understanding marginal cost vs marginal benefit has many real-world applications:

For consumers – Consume up to the point where marginal benefit equals the market price, maximizing consumer surplus. If marginal benefit < price, don’t buy the product.

For companies – Produce up to where marginal cost equals marginal revenue, maximizing profits. If marginal cost > marginal revenue, cut back production.

For policymakers – Correct negative externalities by taxing activities until private marginal cost equals social marginal cost. Subsidize positive externalities until private marginal benefit equals social marginal benefit.

For the economy – The equilibrium quantity is where supply and demand intersect, i.e. where social marginal cost equals marginal benefit. Deviations cause surpluses or shortages.

Understanding how marginal cost and marginal benefit drive decision-making is fundamental to microeconomics. The concepts permeate choices made by individuals, firms, governments and entire economies. A strong grasp of the marginal tradeoffs provides great insight into rational behavior.

What Is Marginal Cost?

Marginal cost is the additional cost a producer or any business incurs by adding one more unit of production or sales. For example, suppose a company manufactures wireless headphones and increases its production output from 10,000 headphones a week to 12,000 a week. The additional cost of producing the added 2,000 headphones will be the marginal cost.

The marginal cost is a crucial component in finding a company’s profit maximization. It helps managers find the optimal amount of production for the business to become most profitable.

Marginal cost is the change in total cost divided by the change in the number of units produced.

Marginal Cost and Marginal Benefit FAQs

No. If the marginal per unit cost is greater than the marginal benefit received, the company will lose money.

The general rule is:

- Marginal Revenue < Marginal Cost = Decrease Production

- Marginal Revenue > Marginal Cost = Increase Production

- Marginal Revenue = Marginal Cost = Profit Maximized

Marginal Benefit and Marginal Cost

What is an example of a marginal benefit?

For example, as a company scales production, the cost of producing each additional unit decreases. And on the consumer side, the marginal benefit changes with each additional unit consumed; the outcome is that with each unit bought, the less money the consumer is willing to pay for the next unit.

What is marginal cost?

Marginal cost is the additional cost a producer or any business incurs by adding one more unit of production or sales. For example, suppose a company manufactures wireless headphones and increases its production output from 10,000 headphones a week to 12,000 a week.

What is the difference between marginal benefit and marginal cost?

Marginal benefit impacts the customer, while marginal cost impacts the producer. Companies need to take both concepts into consideration when manufacturing, pricing, and marketing a product. Marginal benefit is the maximum amount of money a consumer is willing to pay for an additional good or service.

Why do marginal costs matter?

Lower marginal costs might allow them to produce more products at lower operational costs, which can help balance decreases in marginal benefits. Otherwise, companies might experience decreased profits if their marginal costs are too high compared to marginal benefits. Related: How To Develop Metrics That Matter for Your Business