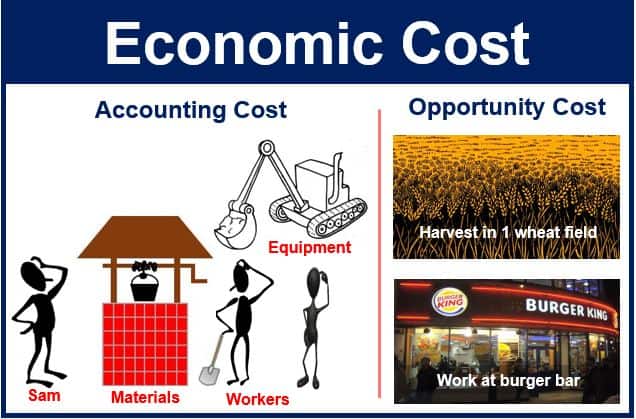

When operating a business, it’s critical to track the factors that impact the bottom line. Two of these factors are accounting costs and economic costs. What are they and why are they important?

The difference between accounting costs and economic costs is something all accounting majors learn in an accounting degree program. They can help organizational leaders better manage both short-term and long-term strategies.

Understanding the differences between accounting cost and economic cost is crucial for business leaders making strategic decisions. While accounting cost reflects actual expenses economic cost factors in potential “what-if” scenarios.

In this comprehensive guide, we’ll break down key concepts around accounting and economic costs, when to use each approach, and walk through examples to illustrate how they differ.

Grasping these core principles will equip you to leverage both methodologies in analyzing your business operations and planning for the future

What is Accounting Cost?

Accounting cost represents the total explicit expenses incurred over a period of time to run your business. This includes:

- Rent and utility payments

- Insurance premiums

- Payroll and employee benefits

- Office supplies and equipment

- Marketing, advertising and PR

- Legal and professional services

- Inventory costs

- Transportation and travel

Essentially accounting cost encompasses every cash outlay your business makes. It’s calculated by subtracting all expenses from total revenue.

Accounting cost alignment with generally accepted accounting principles (GAAP). It focuses solely on actual monies paid out, ignoring potential alternative uses of assets.

Accounting cost is vital for:

- Financial reporting

- Budgeting

- Determining profitability

- Filing business taxes

- Assessing spending efficiency

Businesses rely on accounting cost data to operate successfully day-to-day and maintain profitability.

What is Economic Cost?

Economic cost takes a broader perspective beyond explicit expenses. It represents the full opportunity cost of using resources for one purpose rather than an alternative.

To determine economic cost, you first tally all accounting costs. Then add the implicit cost of assets tied up in your business that could potentially be utilized differently.

For example:

- The salary you pay yourself as owner

- Rental income from a building used for your offices

- Interest you could earn from invested capital

Economic cost analysis creates a hypothetical scenario of maximizing assets in alternative ways. While accounting cost relies on historical data, economic cost uses assumptions about the future.

Key reasons companies evaluate economic costs:

- Deciding between capital investments

- Assessing new location or expansion decisions

- Comparing make vs. buy choices

- Determining opportunity costs of major strategic shifts

By including implicit costs, economic cost provides a complete picture of tradeoffs to inform big decisions.

Key Differences Between Accounting and Economic Costs

Let’s recap the major differences between accounting and economic costs:

| Accounting Cost | Economic Cost |

|---|---|

| Explicit expenses only | Incorporates implicit costs |

| Based on actual monies paid | Considers hypothetical scenarios |

| Focuses on past data | Models future assumptions |

| Required for financial reporting | Optional for strategy decisions |

| Used for day-to-day operations | Applies to long-term decisions |

While accounting cost is mandatory, economic cost provides supplemental insights.

When to Use Accounting Cost Metrics

Accounting costs are indispensable for operating your business effectively. Key uses include:

-

Measuring profitability – Revenues minus accounting costs equal net income. This metric determines profit levels and earning power.

-

Creating budgets – past accounting costs provide the foundation for financial plans and budgets. This helps allocate future expenses.

-

Filing taxes – Businesses deduct accounting costs from revenue to calculate taxable income. Explicit expenses must be documented.

-

Managing cash flow – Understanding accounting costs is vital in ensuring sufficient cash to cover outlays each month.

-

Assessing spending – Analyzing accounting costs by category or department can pinpoint waste to trim expenses.

-

Financial reporting – Accounting costs drive the income statement, balance sheet, and cash flow statement to convey performance.

For daily functions and obligations, accounting cost data is indispensable. Company leaders examine accounting costs constantly to guide operations.

When to Factor in Economic Costs

While accounting costs are ingrained in regular business financials, economic costs play a supplemental role in strategic decisions by management.

Key situations where economic cost analysis provides vital insights:

-

Capital budgeting – Major equipment purchases, new facilities, renovations, and other projects require comparing economic costs versus benefits.

-

Make vs. buy – When deciding whether to make a product in-house or outsource production, economic costs reveal the full tradeoffs.

-

Location changes – Relocating facilities or opening new locations necessitates weighing economic costs like lost rent revenue.

-

Major initiatives – Before undertaking new product launches, service expansions, or entering new markets, economic cost models assess the implicit costs.

-

Opportunity costs – Economic costs always consider opportunity costs – the potential benefits lost from choosing one option over another.

Evaluating economic costs provides complete information before leaders commit major capital or strategic moves.

Accounting Cost vs. Economic Cost Example

Let’s look at a simplified example to demonstrate the difference between accounting and economic cost calculations:

Johnson Furniture Company has the opportunity to invest in high-tech new production equipment costing $2 million. The new machinery is estimated to improve efficiency by 10% once fully operational. Johnson’s president must decide whether to approve the capital expenditure.

Accounting costs: Looking at accounting costs alone, the machinery would appear as a $2 million expense deducted from revenues over 5 years through depreciation. But this ignores potential economic benefits.

Economic costs: Factoring in economic costs paints a different picture:

- Accounting cost of new machinery: $2 million

- Implicit cost of lost production during 6 months of installation and testing: $1 million

- Implicit cost of alternative investment in marketing to grow sales: $500,000

Total economic costs: $3.5 million – the full picture shows higher costs. While accounting costs focus on the equipment price tag, economic costs incorporate hidden factors.

This economic cost analysis provides vital context beyond just accounting data to make a wise decision. Adding all potential costs provides the complete financial impact.

Achieve Success by Understanding Cost Differences

Mastering the nuances between accounting and economic costs enables business leaders to:

- Accurately assess profitability

- Build realistic budgets grounded in past expenses

- Weigh strategic moves incorporating implicit factors

- Optimize spending and resources using complete data

While accounting costs power day-to-day operations, economic costs provide crucial insights for major investments and long-term strategy.

Wielding expertise in both methodologies leads to improved decision making to drive business growth and maximize success.

What are Accounting Costs?

Accounting costs measure the monetary value of taking an action. They are the explicit costs involved with the business.

For example, if a company wants to open a satellite office in a new market, they must make investments, such as new hires, computer equipment, software systems, rent, and inventory. If the total spent on all these areas is $700,000, then that is the accounting cost.

Accounting costs are sometimes referred to as “hard costs.” They are easily tracked and include dollar amounts spent in typical areas such as payroll, equipment, production, and leases.

What are Economic Costs?

Economic costs, also known as opportunity costs, look at the potential difference between taking one action over another. They measure both the explicit and implicit costs of following a strategy.

In the example above, a company spent $700,000 to open a new satellite office at location A. But what if:

- They opened a satellite office at location B?

- They bought the office location, but leased it to another company?

- They did not open the new office, but instead put more money into the main location?

The total of the accounting costs, plus the differences in costs between choosing the other options instead of option A, is the economic cost. Economic costs include both the explicit and implicit costs of an action.

Another example is if a company has an asset — an orange grove, for example — and uses an economic cost analysis to determine if it would be better to maintain and harvest the orange grove or lease it to another company to do the work. Finding the differences in costs between the two options is the benefit of using an economics cost analysis.

Episode 21: Accounting Costs vs. Economic Costs

FAQ

What is the difference between accounting cost and economic cost?

What is the difference between accounting and economics?

What is an example of economic cost?

What is the economic cost opportunity cost and accounting cost?

What is economic cost?

Economic cost is a step further than typical bookkeeping basics and is often used by economists to compare two separate courses of action. It also looks at the impact each action would have on your business. Economic cost is calculated by taking your accounting cost, which has already been calculated, and also subtracting any implicit costs.

What is the difference between accounting costs and economic costs?

Accounting costs are hard costs comprising business necessities like payroll, production costs, and marketing budgets. Economic costs are inclusive of accounting costs and implicit costs and are theoretical or potential expenses such as opportunity costs. What is an example of economic cost? There are several examples of economic costs.

What is the difference between accounting profit and economic profit?

Accounting profit is the total revenues minus explicit costs, including depreciation. Economic profit is total revenues minus total costs—explicit plus implicit costs. Explicit costs are out-of-pocket costs for a firm—for example, payments for wages and salaries, rent, or materials.