Understanding the differences between gross, net, and operating profit is crucial for anyone looking to analyze or invest in a business. However, the jargon and technical terms involved can make it confusing for beginners. In this comprehensive guide, I’ll explain in simple terms what each of these profit metrics mean, how they are calculated, and why they matter.

What is Profit and Why Does it Matter?

At the most fundamental level, profit is what is left over when a business sells products or services at a price higher than the costs to produce them. Without making a profit, a business cannot survive in the long run. Profitability provides funds to reinvest in growing the business, pay back investors, and reward shareholders through dividends. For potential investors, profitability signals the financial health and sustainability of a business.

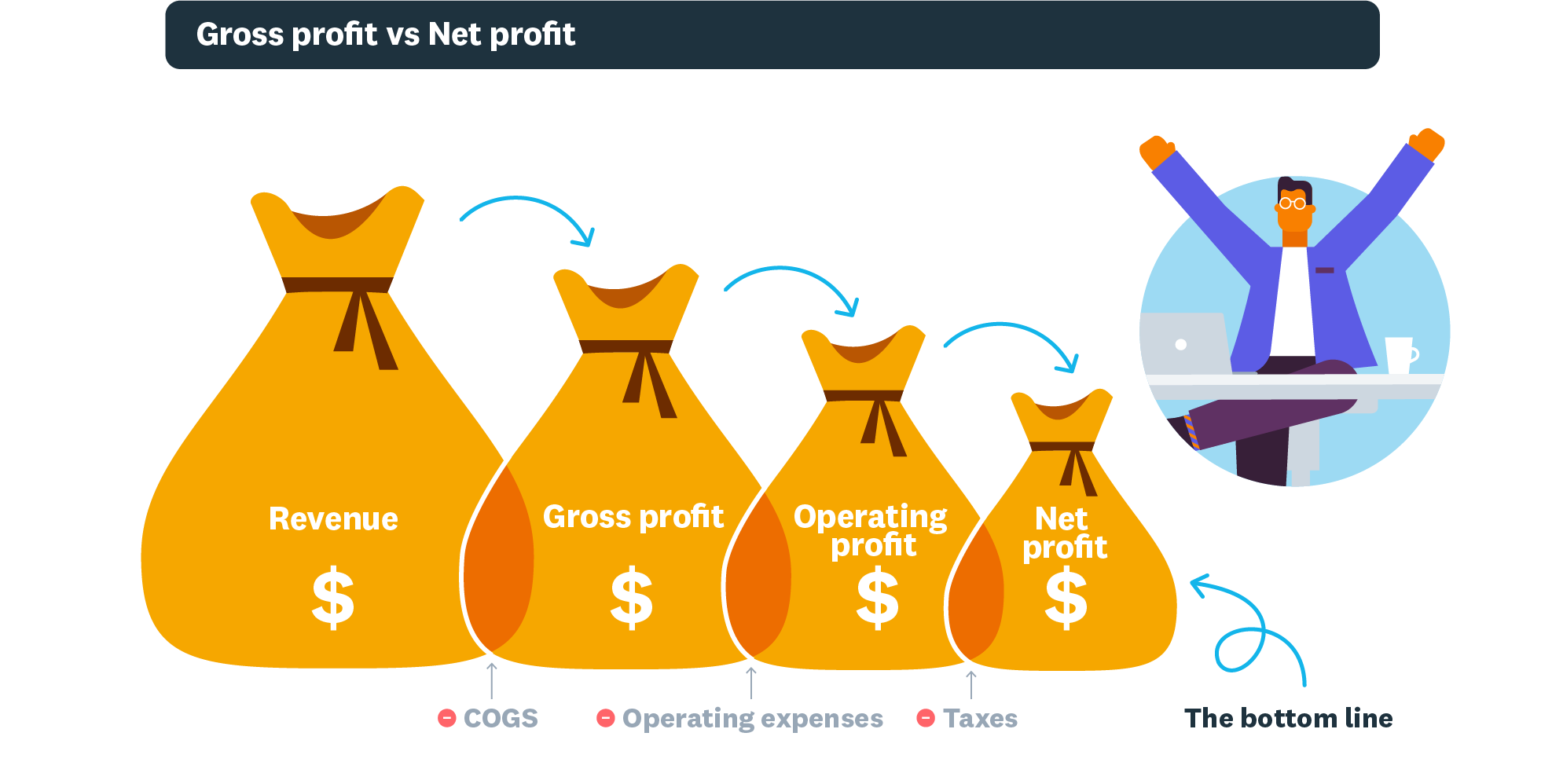

There are three commonly used profit metrics – gross profit, operating profit, and net profit. Each one measures profitability at a different point in the revenue generation process. To determine which companies are worthy of investment, savvy investors dig into the specifics of these profit metrics rather than relying on blanket statements about profitability.

Gross Profit

Gross profit focuses solely on the costs directly associated with production It is calculated by subtracting the cost of goods sold (COGS) from total revenue COGS includes only the direct costs attributed to production, such as

- Materials

- Labor

- Manufacturing overhead

Gross profit excludes indirect operating costs like marketing, administration, and research and development. It provides insight into the efficiency of production operations and product pricing separate from the other operations of the business.

Here is a simple example to illustrate how to calculate gross profit

- A company sells widgets for $50 each

- It costs $20 in raw materials and labor to produce each widget

- In a period, they sell 1,000 widgets generating $50,000 in revenue

- The cost of goods sold is $20 x 1,000 units = $20,000

- So the gross profit is $50,000 (revenue) – $20,000 (COGS) = $30,000

The gross margin is gross profit expressed as a percentage of total revenue. In this example, the gross margin is $30,000/$50,000 = 60%.

A higher gross margin indicates that production costs are low compared to the sales price, leading to higher profitability. Investors will compare gross margin between competitors and track how it changes over time to gauge production efficiency.

Operating Profit

While gross profit focuses on production costs, operating profit looks at the big picture profitability across the entire business. Also called earnings before interest and taxes (EBIT), it accounts for all operating expenses involved in regular business operations.

In addition to COGS, operating expenses include:

- Research and development

- Marketing and advertising

- General and administrative costs

- Depreciation and amortization

- Salaries and benefits

To calculate operating profit, you take gross profit and subtract total operating expenses. Using the previous example:

- Gross profit was $30,000

- Operating expenses total $10,000

- So operating profit is $30,000 – $10,000 = $20,000

And the operating margin is $20,000/$50,000 = 40%.

The operating margin shows how efficiently a company can convert gross profit into bottom-line profitability after accounting for operating expenses. A higher operating margin signals greater operational efficiency and profitability.

Net Profit

Also referred to as net income or the bottom line, net profit factors in all revenue and expenses involved in operating the business. As the final profit number, it indicates the actual residual income left for shareholders after all obligations are paid.

To move from operating profit to net profit, you also factor in taxes, interest expense, and any other income or expenses not related to central operations:

- Interest expense from debts

- One-time income from selling assets

- Tax expense

If we build on the previous example:

- Operating profit was $20,000

- The company pays $5,000 in interest on loans

- Income tax expense is $3,000

- Net profit = $20,000 – $5,000 – $3,000 = $12,000

The net margin expresses net profit as a percentage of total revenue, in this case 24% ($12,000/$50,000).

Net profit and net margin show the bottom-line profitability and indicate how effective leadership is at generating income for shareholders. Investors use net profit trends and comparisons to determine investment potential.

Why All Three Metrics Matter

While net profit gets the most focus as the bottom line, savvy investors dig deeper into gross profit and operating profit. Each metric highlights profitability at a different stage in the business. Comparing all three paints a full picture of where a company is doing well or poorly.

Gross profit shows production efficiency, operating profit examines operating activities, and net profit looks at the total bottom line. Changes in gross margin could signal rising production costs. A declining operating margin may show bloated operating expenses. Falling net profit could come from increased interest costs or tax rates.

For any business, generating a profit is essential to survival and success. But not all profit is equal. Gross, operating, and net profit metrics each capture profitability at different points in the operations of a business.

Gross profit examines production efficiency and pricing power. Operating profit analyzes profit after covering operating expenses. Net profit shows bottom line profitability after all expenses and obligations.

For investors and analysts, looking at all three provides a holistic perspective on the financial health of a company. Calculating and comparing each metric reveals strengths, weaknesses, and competitive positioning. Businesses that wish to improve must dig into these numbers rather than looking only at net profit.

So next time you hear a company talk about strong profits, take a closer look. Understanding the differences between gross, operating, and net profit will make you a much smarter investor.

Operating Profit Margin

Operating efficiency forms the second section of a company’s income statement and focuses on indirect costs. Companies have a wide range of indirect costs which also influence the bottom line. Some commonly reported indirect costs includes research and development, marketing campaign expenses, general and administrative expenses, and depreciation and amortization.

Operating profit margin examines the effects of these costs. Operating profit is obtained by subtracting operating expenses from gross profit. The operating profit margin is then calculated by dividing the operating profit by total revenue.

Operating profit shows a company’s ability to manage its indirect costs. Therefore, this section of the income statement shows how a company is investing in areas it expects will help to improve its brand and business growth through several channels. A company may have a high gross profit margin but a relatively low operating profit margin if its indirect expenses for things like marketing, or capital investment allocations are high.

Gross Profit Margin

Gross profit margin analyzes the relationship between gross sales revenue and the direct costs of sales. This comparison forms the first section of the income statement. Companies will have varying types of direct costs depending on their business. Companies that are involved in the production and manufacturing of goods will use the cost of goods sold measure while service companies may have a more generalized notation.

Overall, the gross profit margin seeks to identify how efficiently a company is producing its product. The calculation for gross profit margin is gross profit divided by total revenue. In general, it is better to have a higher gross profit margin number as it represents the total gross profit per dollar of revenue.

EBITDA vs Net Income vs Operating Profit vs. Gross Income – Understanding Profit Measurements

What is the difference between operating profit and net profit?

Operating profit is the amount of the gross profit minus operational costs. Net profit is the total amount left over after the business has accounted for all deductions, including interest and taxes. Gross and net profit are standard inclusions on an income statement, but businesses commonly leave out their operating profit.

What is the difference between gross profit and net income?

Gross profit is total revenue minus the cost of goods sold (COGS). From gross profit, operating profit or operating income is the residual income after accounting for all expenses plus COGS. Net income is the bottom line, or the company’s income after accounting for all cash flows, both positive and negative.

What is the difference between operating profit and gross profit?

Operating profit–also called operating income –is the result of subtracting a company’s operating expenses from gross profit. Gross profit is revenue minus a company’s COGS, which provides the profit from production or core operations.

What is the difference between operating profit margin and net income?

The margin is best evaluated over time and compared to those of competing firms. A higher operating profit margin means that the company is managing its costs well and earning more in revenue per dollar of sales. Net income, also called net profit, reflects the amount of revenue that remains after accounting for all expenses and income in a period.