As an investor or business analyst, you likely look at financial ratios to assess a company’s performance and financial health. Ratios help provide insight into how well management is running the business. One lesser known but useful metric is the sales to administrative expenses ratio.

In this article, I’ll explain what the sales to administrative expenses ratio is, walk through the formula, provide examples, and discuss how to interpret it You’ll discover why this ratio matters and how it can be used to analyze companies

What is the Sales to Administrative Expenses Ratio?

The sales to administrative expenses ratio compares a company’s total sales revenue to its administrative expenses for a period Administrative expenses are the fixed overhead costs related to the general management and administration of a business

This includes expenditures like:

- Office salaries, supplies, and rent

- Finance, HR, and executive management salaries

- Legal, auditing, and accounting fees

- Business travel and entertainment

- Depreciation of office equipment and furniture

- Insurance premiums

These are ongoing expenses required to keep the business operating, as opposed to direct expenses tied to production or selling.

The sales to admin expenses ratio shows how many dollars of sales are generated for each dollar spent on administrative overhead. A higher ratio indicates greater operating efficiency.

Calculation of the Sales to Administrative Expenses Ratio

The formula is straightforward:

Sales to Administrative Expenses Ratio = Net Sales / Administrative Expenses

The components are found on the income statement. Net sales are at the top. Administrative expenses are usually combined into one line item for SG&A (selling, general and administrative) expenses. To isolate just administrative costs, selling expenses would need to be subtracted from the SG&A total.

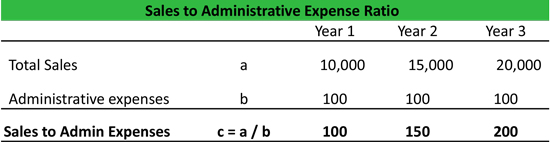

Let’s look at an example for hypothetical Company A over 3 years:

-

In Year 1, net sales were $100,000 and administrative expenses were $20,000.

- Sales to Admin Expenses Ratio = $100,000 / $20,000 = 5

-

In Year 2, net sales grew to $150,000 while admin expenses held steady at $20,000.

- Sales to Admin Expenses Ratio = $150,000 / $20,000 = 7.5

-

In Year 3, net sales were $200,000 and administrative expenses remained $20,000.

- Sales to Admin Expenses Ratio = $200,000 / $20,000 = 10

As Company A grew sales while keeping administrative costs flat, its sales to admin expenses ratio improved from 5 to 10. This indicates increasing efficiency in its overhead spending.

How to Analyze the Sales to Administrative Expenses Ratio

When interpreting this ratio, a higher number is preferable. It means the business needs to spend less on administrative overhead to generate each dollar of sales.

Consider the ratio over time to see if it is improving or declining. Compare it to industry competitors or benchmarks. Also review management’s commentary to understand if administrative expenses are expected to increase or decrease.

Here are insights the sales to admin expenses ratio provides:

-

Operating Leverage – Growth in sales without increasing administrative costs boosts this ratio, demonstrating positive operating leverage. It shows the company can support more sales with existing infrastructure.

-

Efficiency – A high and improving ratio indicates efficient use of administrative expenses to facilitate sales. Declining ratios can signal bloat or inefficiency in overhead.

-

Scalability – This measures a company’s ability to scale. Tech startups, for example, want to see this ratio increase as their business scales quickly.

-

Synergies – In an acquisition, the combined company aims to improve this ratio by consolidating duplicative back office functions and administrative staff.

-

Technology Investment – Declining ratios could mean the business needs to upgrade outdated IT systems and processes to gain efficiency.

-

Cost Management – The ratio improves when management prudently minimizes discretionary administrative spending.

While this ratio provides helpful insights, it does have some limitations:

-

Administrative expenses are difficult to isolate because most companies report one line for SG&A.

-

It ignores the sales expense component of SG&A spending.

-

One-time or non-recurring administrative costs can distort the picture.

-

It doesn’t account for differences in capital intensity across industries.

Overall, analyzing the sales to administrative expenses ratio over time and within an industry context allows making reasonable assessments of management efficiency. As with any metric, it should not be used in isolation but rather as part of a holistic analysis.

Real World Examples

Let’s look at some real examples of using this ratio on public company financials:

-

Amazon – For 2021, Amazon had $469.8 billion in net sales and $38.3 billion in SG&A expenses which includes fulfillment center costs. Backing out an estimated $30 billion in fulfillment costs gives about $8.3 billion of administrative expenses. The sales to admin expenses ratio is then 56.7, indicating extremely high efficiency. This showcases Amazon’s ability to scale sales with minimal incremental overhead.

-

Starbucks – In 2021, Starbucks recorded $29.1 billion in net revenues and $4.2 billion in SG&A expenses. Let’s assume $2 billion of that is sales and marketing, leaving $2.2 billion in administrative expenses. The sales to admin expense ratio is then 13.2. While lower than Amazon, this still demonstrates Starbucks’ ability to generate significant revenues per dollar of administrative overhead.

-

Delta Airlines – For 2021, Delta had total operating revenues of $29.9 billion. It’s SG&A expense was $8.4 billion, which is likely almost entirely administrative since most of Delta’s sales expense relates to fuel. This results in a sales to admin ratio of 3.6. Compared to Amazon and Starbucks, this lower ratio highlights the heavy administrative overhead in the airline industry.

How to Improve Your Sales to Administrative Expenses Ratio

Here are 5 tactics businesses can use to increase their sales to administrative expenses ratio:

-

Leverage technology to automate processes and reduce manual administrative tasks. Cloud-based solutions are ideal.

-

Centralize functions like HR, accounting and legal to consolidate staffing needs.

-

Limit overhead hiring by leveraging outsourced services when possible.

-

Reduce travel & entertainment costs through online meetings and prudent travel policies.

-

Renegotiate vendor contracts to optimize administrative purchasing costs.

While minimizing overhead is great, be careful not to trim too much to the point of impacting the support functions employees need. Find the right balance.

Key Takeaways on the Sales to Administrative Expenses Ratio

-

This ratio measures sales generated per dollar of administrative overhead spending. A higher ratio indicates greater efficiency.

-

It’s useful for assessing operating leverage, scalability, management cost control, and more.

-

Compare the ratio over time and to competitors, aiming for it to increase.

-

Technology, centralization, and prudent spending can improve the ratio.

So next time you analyze a company’s financial statements, take a look at its sales to administrative expenses ratio. It provides valuable insights on how efficiently management is running the administrative side of the business. Add this metric to your financial analysis toolkit to make more informed decisions.

What Is Gross Margin?

A companys gross margin is its net sales less its cost of goods sold. Its what a business earns from the sale of its services or products before deducting administrative expenses.

What Are Some Semi-Variable Administrative Expenses?

Semi-variable administrative expenses can include salaries, audit and legal fees, vehicle use, and commissions. They can also include utility costs that charge a base amount due plus an extra expense associated with usage.

Understanding Sales to Administrative Expenses Ratio

What is the sales to administrative expenses ratio?

Sales to Administrative Expenses Ratio = Net Sales / General and Administrative Expenses Net sales are the total amount of sales the company has generated over the past year after subtracting any discounts, damages, returns, or other losses taken. General and administrative expenses are the overhead costs involved in executing the sales.

What is sales to administrative expense ratio (SAE)?

The sales to administrative expense ratio (SAE) is a financial metric that assesses a company’s ability to handle its non-operating expense to help other operations to bring in more sales. Simply put, if you are managing your fixed costs well, you should have smooth day-to-day operations. In turn, this should lead to improved sales.

Why is a sales-to-administrative expense ratio important?

Management is strongly motivated to maintain low administrative expenses relative to other costs because this allows a business to use leverage more effectively. The sales-to-administrative expense ratio helps companies measure how much sales revenue is being portioned to cover administrative costs.

Is administrative expense a selling expense?

Administrative expenses, on the other hand, are costs associated with general company operations that are not related to sales. These can include items such as payroll, rent, and utilities. 5. Is sales commission a selling or administrative expense?