FloQast™ Ops is a workflow manager that extends the power of FloQast Close, providing greater control over accounting operations and optimizing workflows across every function.

Effective accounting practices demand a litany of skills and knowledge, and fiscal acuity is especially critical for time and resource-challenged small- to medium-sized organizations. Every buck counts and organizing and reporting on them within a cogent General Ledger not only provides insight and discipline but results in improved processes that impact practical outcomes such as regulatory compliance. Enter the Chart of Accounts, aka COA, for our current consideration, as a key metric of financial health.

A chart of accounts is one of the most important tools for any business owner or accounting professional But if you’re new to accounting and bookkeeping, the term may leave you scratching your head. Don’t worry – I’m here to provide a beginner’s guide to understanding charts of accounts.

In this comprehensive article, we’ll cover:

- What a chart of accounts is

- The 5 main components of a chart of accounts

- How to set up and organize a chart of accounts

- Examples of charts of accounts

- Why a chart of accounts is so critical for business finance

- Frequently asked questions about charts of accounts

So whether you’re a new business owner setting up your accounting system or just looking to brush up on accounting basics, read on to learn all about charts of accounts!

What is a Chart of Accounts?

A chart of accounts is a complete listing of every account in the general ledger of a business. It works as an index or map of your business’s financial transactions, with accounts organized into specific categories.

The chart of accounts provides a big-picture view of a company’s finances all in one place. It sums up every financial transaction conducted by a business during an accounting period.

Each account listed in the chart is assigned a unique account number and title to identify it. The title briefly summarizes what the account tracks – for example, “accounts receivable” or “office supplies.”

Accounts are then categorized into five main types

- Assets

- Liabilities

- Equity

- Revenue

- Expenses

We’ll explore each of these account types more in-depth shortly.

Think of your chart of accounts as a filing cabinet – the accounts are like the folders that hold all your financial transaction records. A well-organized chart of accounts makes locating info quick and easy.

The 5 Main Components of a Chart of Accounts

While you can customize your chart of accounts to match your business needs, most charts will contain these five account categories as the foundation:

1. Asset Accounts

These accounts track what your business owns. Assets are resources with monetary value that a company can convert into cash.

Common examples include:

- Cash

- Accounts receivable

- Inventory

- Office equipment

- Vehicles

- Land

Assets are organized on the chart of accounts in order of liquidity. This means listing cash first, as it’s most readily converted to cash. Accounts receivable come next, then inventory, etc.

2. Liability Accounts

These accounts record debts or obligations that a business owes. Liabilities represent services or items that your company has received but hasn’t yet paid for.

Some common liability accounts:

- Accounts payable – bills owed to vendors/suppliers

- Credit cards payable

- Interest payable

- Taxes payable

- Loans payable

- Unearned revenue – money received before providing goods/services

Liabilities are organized from short-term to long-term debts on the COA.

3. Equity Accounts

Equity accounts track the owners’ or shareholders’ claims to the assets of a company. Equity is calculated as:

Assets – Liabilities = Equity

For a sole proprietorship, the equity account is simple – Owner’s Equity. But corporations will have more complex equity accounts like:

- Common stock

- Preferred stock

- Retained earnings

- Treasury stock

4. Revenue Accounts

These accounts record income generated from the regular business operations. Revenues come from sales of products and services.

Some examples of revenue accounts:

- Service revenue

- Product revenue

- Rental revenue

- Interest revenue

Revenue accounts are listed in the order they appear on the income statement.

5. Expense Accounts

Expense accounts track costs related to generating business revenues. These are the day-to-day operating costs of running your company.

Some common examples:

- Rent expense

- Payroll expense

- Supplies expense

- Utilities expense

- Marketing expense

Like revenue, expenses are organized in the order they’d appear on the income statement.

How to Set Up and Organize a Chart of Accounts

Now that you understand the main components, let’s look at how to actually set up your own chart of accounts.

While you can create a chart of accounts manually on paper or a spreadsheet, most businesses use accounting software, which speeds up the process.

Step 1: Identify Main Accounts

Start by identifying your company’s main accounts that fit into each of the five categories: assets, liabilities, equity, revenues, expenses.

For example, your pizza restaurant will have very different accounts compared to a law firm. Make sure to consider accounts specific to your industry and business operations.

Step 2: Assign Account Numbers

Next, assign each account a unique number, usually formatted as follows:

- Assets: 1000s

- Liabilities: 2000s

- Equity: 3000s

- Revenue: 4000s

- Expenses: 5000s

Account numbers help organize the COA and make accounts easy to locate.

Step 3. Add Account Details

For each account, include 2-3 word name summarizing the account, plus 3-4 word description of what it tracks.

For example:

- Cash – All business checking and savings accounts

- Equipment – Owned restaurant ovens, freezers, furniture

Step 4. Categorize & Order Accounts

Place accounts under the appropriate categories and order them logically. Most companies organize assets from most to least liquid, then list liabilities from short-term to long-term maturity.

Step 5: Review and Finalize COA

Review your final chart of accounts for any errors or inconsistencies. Make sure accounts are labeled clearly and nothing important is missing.

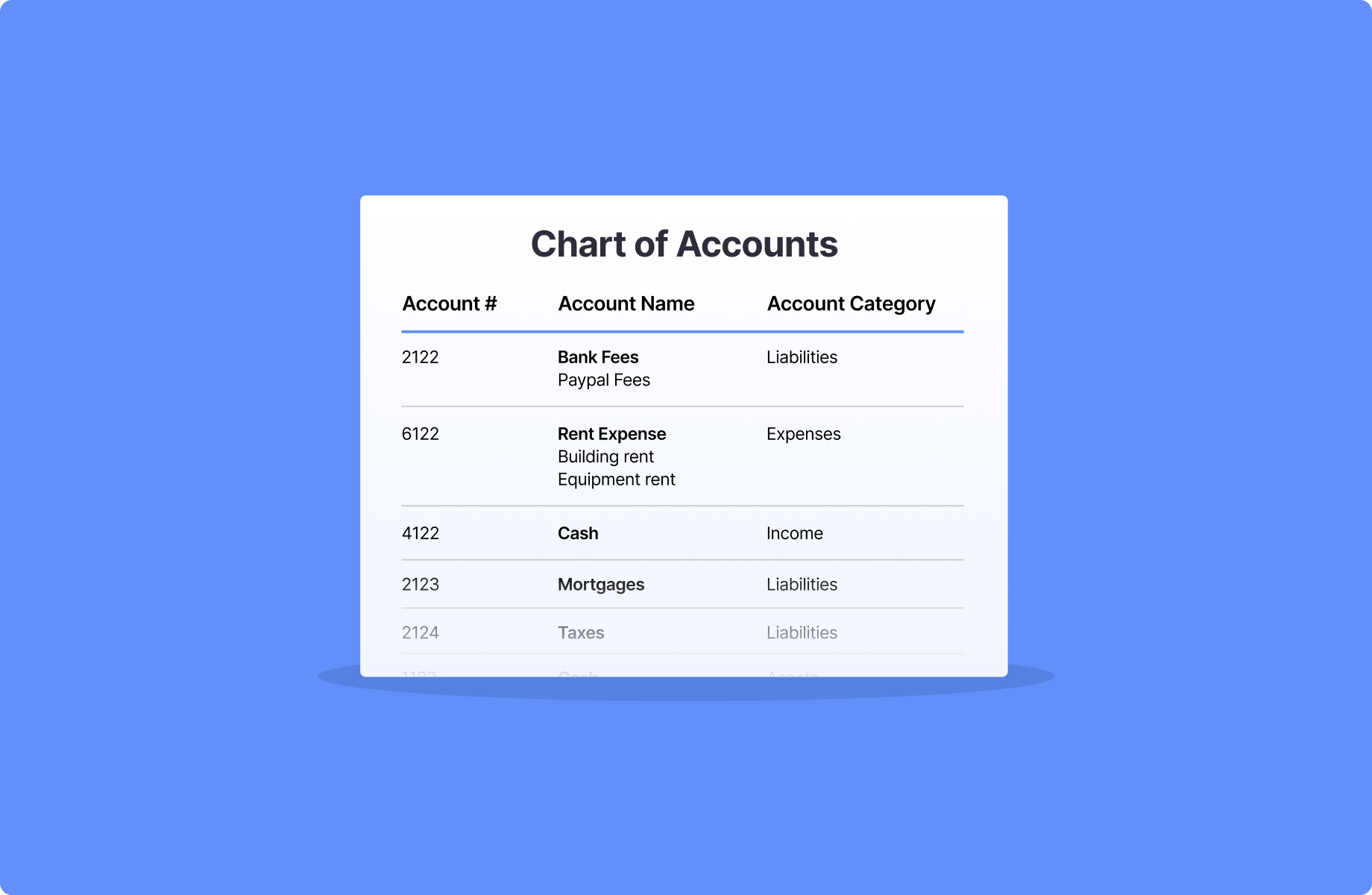

Examples of Charts of Accounts

To help visualize what a completed COA looks like, here are two examples for different business types:

Law Firm Chart of Accounts

| Account Number | Account Title | Type |

|---|---|---|

| 1000 | Cash | Asset |

| 1300 | Accounts Receivable | Asset |

| 1400 | Supplies Inventory | Asset |

| 1500 | Office Equipment | Asset |

| 2000 | Accounts Payable | Liability |

| 2100 | Credit Card Payable | Liability |

| 3000 | Owner’s Equity | Equity |

| 4000 | Legal Services Revenue | Revenue |

| 5000 | Rent Expense | Expense |

| 5100 | Payroll Expense | Expense |

| 5200 | Office Supplies | Expense |

| 5300 | Professional Services | Expense |

| 5400 | Utilities Expense | Expense |

Clothing Boutique Chart of Accounts

| Account Number | Account Title | Type |

|---|---|---|

| 1000 | Cash | Asset |

| 1100 | Inventory | Asset |

| 1200 | Accounts Receivable | Asset |

| 2000 | Accounts Payable | Liability |

| 3000 | Owner’s Equity | Equity |

| 4000 | Retail Sales | Revenue |

| 4100 | Online Sales | Revenue |

| 5000 | Cost of Goods Sold | Expense |

| 5100 | Rent Expense | Expense |

| 5200 | Payroll Expense | Expense |

| 5300 | Supplies Expense | Expense |

| 5400 | Utilities Expense | Expense |

| 5500 | Marketing Expense | Expense |

Why a Chart of Accounts is Critical

Maintaining a detailed, well-organized chart of accounts provides many benefits for managing your company’s finances:

-

Summarizes finances – The COA provides a snapshot of your business’s financial position all in one place.

-

Enables reporting – The structured COA makes it easy for accountants to produce financial statements like balance sheets, income statements, and cash flow statements.

-

Supports planning – Analyzing your COA helps uncover trends to inform budgeting and forecasting.

-

Tracks transactions – Detailed accounts ensure transactions are posted correctly.

-

Simplifies tax filing – Clear revenue and expense tracking streamlines compiling info needed for tax returns.

Bottom line – taking time to thoughtfully set up your chart of accounts will provide the foundation to manage your company’s financial health long term.

Frequently Asked Questions

Here are answers to some common questions business owners have about charts of accounts:

How many accounts should be on the chart of accounts?

This varies by company size and industry, but most small businesses have between 20-100 accounts on their chart of accounts.

How much detail is needed for each account?

2-4 word names and 3-5 word description of each account is sufficient. Avoid lengthy titles.

Can I change my chart of accounts later?

Yes, you can modify and add accounts as your business grows. But avoid removing accounts entirely once transactions are recorded.

Do I need a unique chart of accounts for each department?

No, the COA summarizes your

Income or Revenue represents the gains amassed from multiples sources

Sales, including income derived from the delivery of a product or service.

Interest income such as earned interest on bank accounts or other investments.

Over and under billing adjustments.

Basic Chart of Account Categories

While every COA will differ, there are some basic categories that most organizations will want to include, or at least consider, tailored to the specific nature of your business.