Imagine your finances as a bustling marketplace, with each stall representing a different source of income or expense. The partial income statement is like focusing on just one stall in that marketplace, examining its offerings, customers, and profits. Understanding the partial income statement is like exploring that individual stall â it helps you analyze a specific aspect of your financial marketplace, whether revenue from a particular product line, client base, or sales channel. Just as understanding one stall contributes to the vibrancy of the entire marketplace, comprehending the partial income statement provides valuable insights into your overall financial ecosystem, empowering you to optimize your offerings and maximize your profits for sustainable growth.

A partial income statement is a financial statement that shows a company’s revenues, expenses and net income for a specific period that is shorter than the company’s fiscal year. It provides valuable insights into a company’s financial performance during a particular timeframe, but does not show the full picture for the entire year In this comprehensive guide, we will explore what partial income statements are, when they are used, how to read them, and how they differ from full income statements

What is a Partial Income Statement?

A partial income statement, sometimes called an interim income statement, only covers a portion of a company’s fiscal year rather than the full 12 months For example, a company may issue a quarterly income statement for the first 3 months of its fiscal year, another for the first 6 months, and so on. These interim reports allow investors to monitor a company’s financial health and performance on a more frequent basis, rather than just annually

Specifically, a partial income statement shows:

- Revenues earned over the shortened period

- Costs and expenses incurred over the same timeframe

- The resulting net profit or net loss

The components are similar to a full annual income statement, reporting sales, cost of goods sold, operating expenses, interest, taxes and net profit or loss. The key difference is the shortened time period covered, such as a month, quarter or half year.

When are Partial Income Statements Used?

There are several common situations when a company may issue a partial income statement rather than waiting until year end:

-

Quarterly Earnings Reports – Most public companies are required to issue quarterly earnings statements every 3 months during their fiscal year. This allows investors to monitor performance rather than waiting a full year.

-

Newly Acquired or Merged Companies – When one company acquires another, monthly or quarterly partial income statements may be needed to consolidate results.

-

Corporate Restructuring – If a company undergoes major restructuring like spinning off a division, partial statements may help report pre- and post-restructuring results.

-

Bankruptcy Filings – Firms filing for bankruptcy may need to provide monthly or quarterly income statements to demonstrate their financial situation.

-

Private Companies – Private companies that don’t report as regularly as public firms may use monthly or quarterly partial income statements for internal monitoring.

-

Seasonal Businesses – Companies with seasonal revenue spikes may analyze high and low periods using partial income statements for those timeframes.

How to Read and Analyze a Partial Income Statement

When reviewing a partial income statement, many of the same analysis techniques used for full annual statements can be applied, with a few modifications:

-

Look at trends – Compare the current partial period to prior periods to spot positive or negative trends. This could be year-over-year or quarter-over-quarter.

-

Consider seasonality – Account for natural business cycles and how the timing of the partial period may impact results.

-

Note irregularities – Watch for any unusual jumps or drops in revenue or expenses compared to historical norms.

-

Compare estimates – See how reported figures match analyst estimates provided for that interim period.

-

Focus on key metrics – Pay special attention to gross margin, operating margin and profitability metrics.

-

Review cash flow – Since partial income statements may exclude non-cash items, also look at operating cash flow.

-

Read the notes – Check the footnotes for details on restatements, accounting changes or other factors impacting interim results.

The shortened window with a partial income statement means users should take care not to read too much into small fluctuations. But monitoring for any significant variances or developing trends can provide an early warning on potential issues.

Partial Income Statement vs. Full Income Statement

While partial and full income statements contain similar elements and follow the same accounting standards, there are some key differences:

Timeframe

-

Partial – Covers shorter period, such as monthly, quarterly or semi-annually.

-

Full – Reports all 12 months of a fiscal year.

Frequency

-

Partial – Issued multiple times during the year as interim reports.

-

Full – Typically issued annually.

Completeness

-

Partial – May exclude some non-recurring or infrequent items.

-

Full – Provides complete results for the fiscal year.

Audit Status

-

Partial – Typically unaudited.

-

Full – Usually audited annually.

Cash Flows

-

Partial – May not show cash from operations.

-

Full – Includes full cash flow statement.

Projections

-

Partial – Results may be harder to project for full year.

-

Full – Shows total annual results.

Key Components of a Partial Income Statement

While covering a shorter timeframe, the core components of a partial income statement are similar to a full version. Key line items include:

Revenue

This reflects all company sales over the period covered. For a manufacturing firm, this is primarily sales of finished goods. For a service company, it represents services rendered. For a merchandising business, this is sales of goods purchased for resale.

Cost of Goods Sold

For product companies, this shows the direct costs involved in producing the goods sold during the period. It includes materials, labor and factory overhead.

Gross Profit

Calculated as revenues minus cost of goods sold. This shows the profit left over after accounting for direct production costs.

Operating Expenses

Includes recurring expenses such as salaries, utilities, depreciation, and other indirect costs required to run the business operations.

Operating Income

This line item reflects earnings before interest and taxes are accounted for. It is revenues less cost of goods sold and operating expenses.

Other Income and Expenses

Additional income earned or expenses incurred outside of core operations. May include interest, taxes, one-time gains or losses, dividend income, etc.

Net Income

The bottom line profit or loss after subtracting all expenses from total revenues for the period covered. Also called net earnings or net profit.

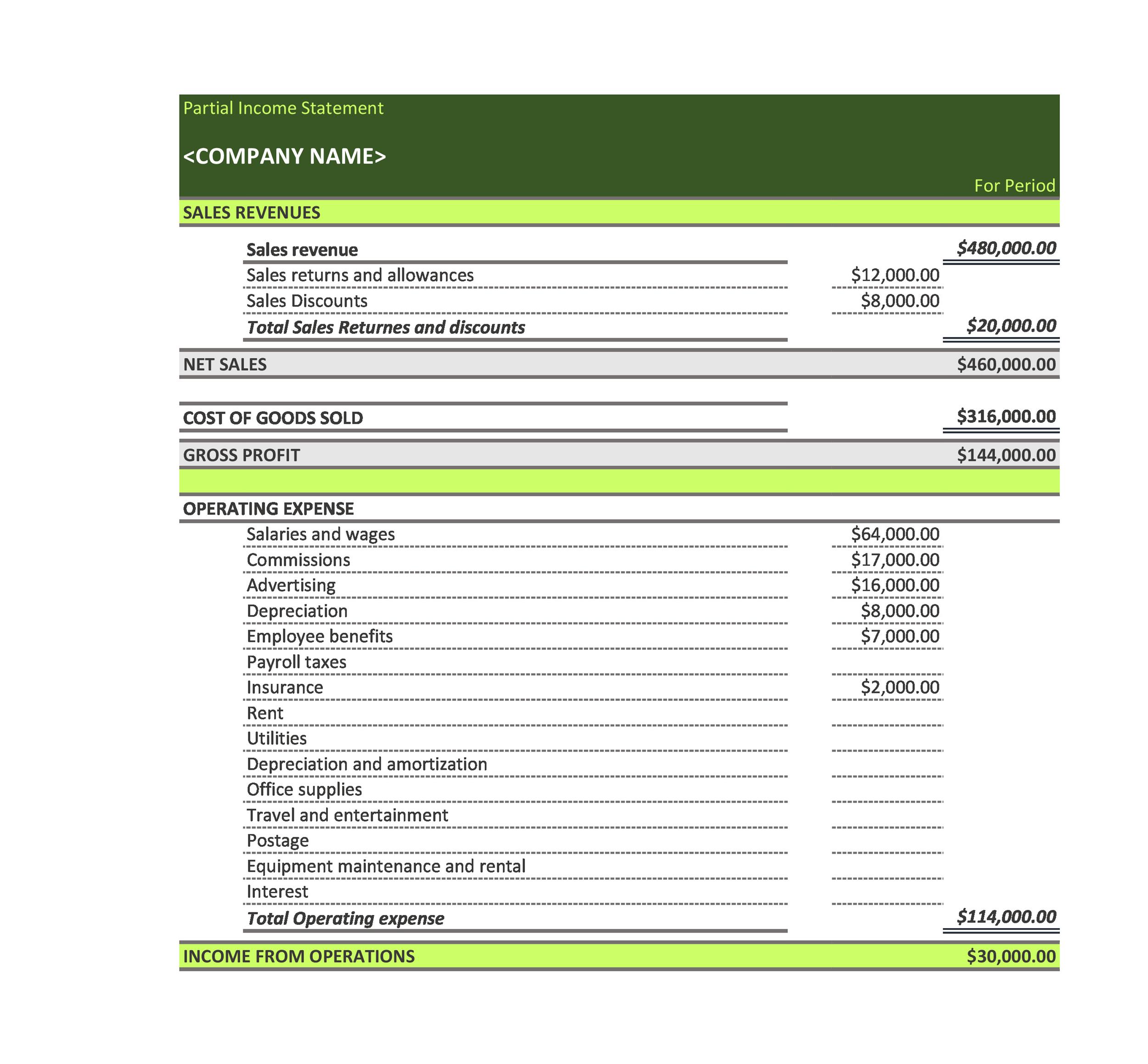

Example of a Partial Income Statement

To illustrate the components and format of a partial income statement, here is an example for the first quarter of a fictional company:

ACME Company

Partial Income Statement

For the Quarter Ended March 31, 20X1

| Total |

|-|-|

| Revenue | $250,000 |

| Cost of Goods Sold | $100,000 |

| Gross Profit | $150,000 |

| Operating Expenses: ||

| Selling | $20,000 |

| General & Administrative | $80,000 |

| Depreciation | $10,000 |

| Total Operating Expenses | $110,000 |

| Operating Income | $40,000 |

| Other Expenses: ||

| Interest Expense | $5,000 |

| Income Before Tax | $35,000 |

| Income Tax | $7,000 |

| Net Income | $28,000 |

This illustrates the abbreviated structure, covering just the first quarter of the fiscal year. It includes key lines like revenue, operating profit, interest and tax expenses and bottom line net income. Comparing it quarter-over-quarter or year-over-year would show trends over time.

Uses and Limitations of Partial Income Statements

As a abbreviated snapshot of financial performance, partial income statements serve several purposes:

Benefits:

- Provide interim performance data more frequently

- Help identify positive or negative trends

- Support valuation models and investment decisions

- Satisfy regulatory reporting requirements

- Assist with internal performance monitoring

- Support loans, contracts and partnerships

Limitations:

- Volatility from seasonal or cyclical timing impacts

- May exclude non-recurring or infrequent items

- Harder to project full-year results accurately

- Lack of audited certification on unaudited reports

- Increased risk of accounting errors due to quick turnaround

Key Takeaways on Partial Income Statements

Here are some key points to remember about what partial income statements are and how they can be used:

-

Reports a company’s revenues, expenses and profits for an interim period shorter than a full fiscal year.

-

Typically prepared monthly, quarterly or semi-annually rather than just annually.

-

Helpful for monitoring trends and seasonal variations in performance.

-

Limitations include volatility, omission of some items and lack of audit assurance.

-

Used for regulatory compliance, financial modeling, investment analysis and internal management.

-

Include revenue, cost of goods sold, gross margin, operating expenses,

Importance of an Income Statement in Financial Analysis

An income statement is a crucial financial document that provides insights into a companyâs financial position during an accounting period. By analyzing a partial income statement, a company may get a detailed analysis of its income and expenses, including gross margin, interest income, and administrative expenses. This statement is prepared for the entire fiscal year or a certain line of business, creating a comprehensive guide to partial income statements. A single-step income statement can be prepared to show a summarized version of a companyâs financial performance. In contrast, a partial income statement reports information from specific aspects of the business. By using partial income statement examples, businesses can make informed decisions based on their financial standing and operational efficiency. Without a proper income statement, a company may not clearly understand its revenue, expenses, and overall profitability. By utilizing a partial income statement, companies can monitor their financial health and adjust their strategies to improve performance and achieve financial goals.

Why Companies Use Partial Income Statements?

Specific purposes for using partial income statements include analyzing the performance of a specific division or segment of the business, evaluating the impact of a recent marketing campaign, comparing the financial results of different product lines, and determining the profitability of a certain department within the organization.

Preparing Partial Income Statement with Discontinued Operations (Chance Co.)

What is a partial income statement?

A partial Income statement is generally prepared by the company when certain or uncertain changes affect the company’s financial performance and is reported for only part of the accounting period. Normally, we prepare an income statement for a single month or a year.

What is the difference between partial income statement and accounting period?

The partial Income statement reports only some portion of the income statement. Accounting Period Accounting Period refers to the period in which all financial transactions are recorded and financial statements are prepared.

Can a partial income statement be certified?

A partial income statement will never be certified by an , since it does not comprise a complete income statement. A partial income statement reports information for only part of a normal accounting period. This tends to be a special-purpose document that is only used once.

Why should a professional use a partial income statement?

Instead, professionals can use partial income statements to learn more about the company for which they work and share information easily with others. For example, a professional may want to know how much revenue the company made last month so they can estimate how much they can expect in the current month.