As a small business owner, you know how important cash is. As much as we’d all like to close our eyes and hope for the best, it’s essential to have a plan in place to ensure you have the cash on hand to pay employees, make debt payments, and keep the lights on.

Simply hoping for a healthy cash flow isn’t enough. You need to manage your cash flow proactively and make sound financial decisions.

That’s why we’ve put together this step-by-step guide on creating a cash flow plan — so you can ensure the money keeps flowing!

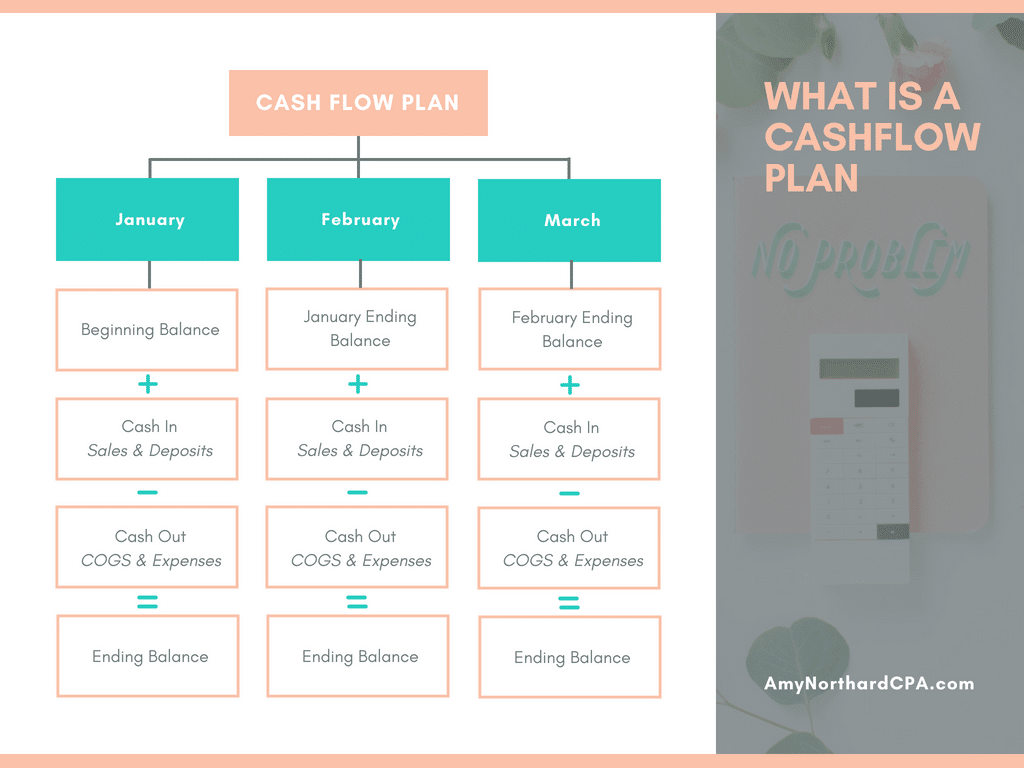

A cash flow plan is a crucial component of effective financial management for individuals and businesses It provides a detailed breakdown of expected cash inflows and outflows over a set period of time and helps identify potential cash flow problems or surpluses With proper cash flow planning, individuals and companies can better manage their finances, avoid potential pitfalls, and work towards important financial goals.

What is Cash Flow?

Before diving into cash flow plans, it’s important to understand exactly what cash flow means.

Cash flow refers to the net amount of cash moving into and out of a business or individual’s accounts over a given period of time. It represents the money available to cover expenses debts, and investments.

Positive cash flow means more money is coming in than going out, while negative cash flow means more money is going out than coming in. Maintaining proper cash flow is essential for financial health and stability.

The Elements of a Cash Flow Plan

A cash flow plan incorporates every expected source of income and expense over a set time period to provide a complete picture of cash inflows and outflows. While the specifics can vary, most cash flow plans include the following elements:

-

Income – All expected cash inflows like salary/wages, investment returns, sales revenue, and any other sources of cash.

-

Fixed Expenses – Expenses that remain relatively consistent like rent/mortgage, insurance premiums, loan payments, subscriptions, etc.

-

Variable Expenses – Expenses that fluctuate like utilities, groceries, gas, clothing, entertainment, etc.

-

Periodic Expenses – Expenses that only occur specific intervals like quarterly tax payments or annual insurance premiums.

-

Savings Goals – The amount you plan to save and invest each month.

-

Anticipated Extra Income – Any irregular income like bonuses, tax refunds, or gift money.

-

Anticipated Extra Expenses – Anticipated irregular expenses like car repairs, medical bills, home repairs, etc.

-

Time Frame – The period of time the cash flow plan covers – often monthly or annually.

Why Cash Flow Planning is Essential

Carefully planning and managing cash flow provides a variety of benefits that make it an essential practice for individuals and businesses alike.

Achieve Financial Goals

With a cash flow plan, you can align your spending with your savings goals. By detailing your income, fixed costs, and other expenses, you can determine how much you can realistically invest each month towards goals like an emergency fund, down payment savings, or retirement.

Prepare for the Unexpected

Even the most diligent budgeters face unexpected costs throughout the year. A cash flow plan allows you to anticipate irregular expenses like car repairs so you can be financially prepared when they arise.

Avoid Pitfalls

By detailing your inflows and outflows, a cash flow plan makes potential cash flow problems visible. You can proactively adjust spending if you identify upcoming periods where outflows will exceed inflows.

Manage Debt Repayment

If you have existing debts like student loans or credit cards, a cash flow plan can help ensure you allocate enough each month to maintain on-time payments. This helps avoid costly late fees and interest charges.

Smooth Seasonal Fluctuations

For businesses or individuals with seasonal income streams, planning cash flow is critical. You can ensure you save enough during peak seasons to sustain slower periods.

Optimize Use of Surpluses

A cash flow plan allows you to identify any anticipated surpluses and optimize their use. You might prepay some expenses, make extra debt payments, or increase savings.

How to Create a Cash Flow Plan

Creating a cash flow plan requires collecting all details of your income sources and expenses. Here are some tips for constructing your plan:

-

Use budgeting software or spreadsheets – This allows you to easily adjust and update your plan. Excel, Google Sheets, and Quicken are common options.

-

Track spending – Review 3-6 months of bank/credit card statements to identify average costs in each expense category.

-

Account for income fluctuations – Use a conservative estimate for inconsistent income like bonuses or commissions.

-

Plan annually – An annual plan allows you to incorporate periodic expenses and changes throughout the year.

-

Build in reserves – Add 10-15% buffers on expense and income estimates to account for unexpected changes.

-

Update regularly – Review and adjust your plan at least every 3-6 months as income and expenses evolve.

Cash Flow Planning for Individuals

Individuals and families should develop a household cash flow plan tailored to their unique financial lives and goals. Here are some tips for constructing a personal cash flow plan:

-

Use take-home pay, after taxes/deductions, as your income estimate. Be conservative on bonuses or side income.

-

Separate fixed and variable living expenses like mortgage versus groceries. Identify areas with flexibility to cut back if needed.

-

Factor in periodic expenses like car registration fees, HOA dues, etc. that only come a few times a year.

-

Build in reserves for irregular expenses like car repairs, medical bills, vet visits, etc. Review past years’ expenses to estimate averages.

-

Prioritize savings goals – retirement contributions, emergency fund, etc. Treat savings as a recurring expense.

-

Use monthly view – A month-by-month overview helps align variable paychecks with expenses.

-

Update with major life changes – Having a baby, changing jobs, buying a home all impact cash flow.

Cash Flow Planning for Businesses

For companies and entrepreneurs, cash flow planning is an essential practice for stability and success. Some tips for business cash flow plans:

-

Project using historical averages for income and costs. Don’t overly rely on best or worst case scenarios.

-

Factor in accounts receivable delays – Don’t assume sales immediately convert to cash.

-

Include reserve amounts for unexpected expenses like major equipment repairs.

-

Build seasonal forecasts – Map out cash surpluses and shortages month-by-month based on your industry cycles.

-

Update with growth plans like adding inventory, new hires, capital expenditures, etc. Model their cash flow impact.

-

Conservatively estimate income – Leave wiggle room versus the best case scenario.

-

Prioritize debt payments – Avoid late fees and high interest by aligning loan payments with cash inflows.

Optimizing Cash Flow

Once you’ve built your cash flow plan, here are some tips for optimizing your forecasted cash flow:

-

Reduce expenses where possible, particularly discretionary spending. Avoid lifestyle inflation as income grows.

-

Pay down high interest debts aggressively with any extra funds.

-

Build up emergency savings equal to 3-6 months of fixed expenses.

-

Shift expenses to align with income inflows if uneven. Move due dates or prepay expenses as possible.

-

Consider balance transfers to consolidate high interest credit card balances to lower rate cards.

-

Refine budgeting categories – identify where you can create more wiggle room in variable costs.

-

Boost income with OT, freelance work, monetizing skills/hobbies.

-

Communicate with vendors – discuss delays/payment plans if needed. Don’t let invoices pile up.

Cash Flow Forecasting Challenges

Creating accurate cash flow forecasts does present some challenges:

- Estimating irregular expenses and income requires reviewing past trends

- Changes in interest rates, economic conditions, your industry, etc. can alter projections

- It takes discipline to regularly update your cash flow plan as life evolves

- Balancing detail with flexibility – you can’t account for every single possibility

The key is to build comprehensive plans using your best estimates, then continually monitor cash flow and make adjustments. Having an adaptable outlook and focusing on optimizing areas you can control will lead to improved forecasting over time.

Final Thoughts on Cash Flow Plans

Monitoring cash flow is a critical component of personal finance and business management. By detailing your projected inflows and outflows over a set future period, you can minimize risk, spot potential problems ahead of time, and align spending with your financial goals.

While cash flow planning presents challenges, the process gets easier with practice. Start by building a simple plan using your current income and expenses over the next 3-6 months. Identify any tweaks needed with the benefit of hindsight, then gradually extend your plan further into the future. You’ll be able to create more accurate and detailed cash flow plans over time.

With proper diligence and discipline, cash flow planning provides tangible benefits and peace of mind that your financial footing is secure. It allows you to weather unexpected emergencies, work towards important goals, and prevent potential missteps that could lead to debt and financial distress. Incorporate cash flow planning as a regular component of your personal or business finances.

Plan for Cash Shortages

Many small businesses have cash flow shortages from time to time. Cash shortfalls can happen because customers are slow to pay their bills, due to seasonal declines in sales, or when an unexpected repair or other expense disrupts your plans.

Your cash flow plan can help you identify many of these potential cash shortfalls in advance (rather than looking back months later and wondering why you’re struggling to make payroll or cover invoices).

When you know when to expect negative cash flow, you can make necessary adjustments to ride it out, such as tapping a line of credit, infusing capital into the business, or getting serious about collecting outstanding receivables.

Step 3: List All Cash Outflows

Now, for the same month, list all the cash you’ll spend in the business. Cash outflows can come from:

- Purchasing inventory or raw materials

- Paying operating expenses, such as salaries and wages, marketing expenses, utilities, rent, subscriptions, etc.

- Making loan payments

- Paying accounts payable or tax liabilities

- Paying out dividends or distributions to shareholders

What is cashflow planning?

What is cash flow planning?

Cash flow planning is the process of creating a detailed budget and financial plan to manage income, expenses, and savings. It involves analyzing cash inflows and outflows, identifying areas of overspending, and creating a plan to improve financial stability. Why is cash flow planning important?

Why do businesses need a cash flow plan?

Businesses use a cash flow plan to predict how much cash flows in and out of the business each month. These plans can help companies understand how much incoming cash they need to cover their outgoing expenses. After building a robust cash flow plan, a company with cash management, budgets and other important financial aspects of the business.

Do you have a cash flow plan?

Those who don’t have an effective cash flow plan in place risk going into debt to cover their living expenses. Cash flow plans can help people figure out how to best allocate income between savings and spending. Assume the Smith Family has a monthly income of $6,000.

What is a cash flow plan in insurance?

Professionals in the insurance industry also use cash flow plans, but these plans have a specific purpose. Insurance cash flow plans help agents determine potential rates for clients’ insurance packages. While this is a useful tool, the general cash flow plan is more applicable to every type of business or organization. What’s in a cash flow plan?